Sam, would you mind telling us how you know this?

I mean, how do you know what "they" know and what "they" don't know?

All I've got is the reports I've read from people who check in here, at Bogleheads, etc. Often people (or their relatives) who believe in their FA and just want a second opinion--have been sold wildly inappropriate products, and have been told nothing about how best to convert to Roths, reduce taxes in the future, etc.

Examples of the services I want (as given by GregfromTexas):

- Tax avoidance in taxable investment accounts

- Selection of retirement accounts, when to fund with pre and post tax income (e.g. Roth vs. 401K)

- College savings strategies

- Tips on where to park cash. My FAs pointing out to me that I could get 1%+ on FDIC savings using an ebank paid for his fee entirely in 1 year.

- Education on the ins and outs of annuities and applicability to my financial circumstances.

- Thoughts on macro-timing (my term) - in other words the possibly validity of adjusting portfolio asset allocation based on medium (1-3 year) term expectations based on PE ratios and interest rates.

- Ways to improve my diversification beyond some popular funds getting a smidge closer to the efficient frontier for my risk tolerance

- Some thoughts about what "risk" really means and how I might think about it differently given my specific situation.

To this I would add:

-- Optimization of taxable income to maximize ACA subsidies/reduce taxes.

-- Legacy/inheritance considerations

-- Evaluation of LTC options

and a few others.

I can tell you right now that the kid from EJ who knocked on my door last month doesn't know how to do this stuff. He knows how to sell me products--especially ones that make money for EJ. No, thanks.

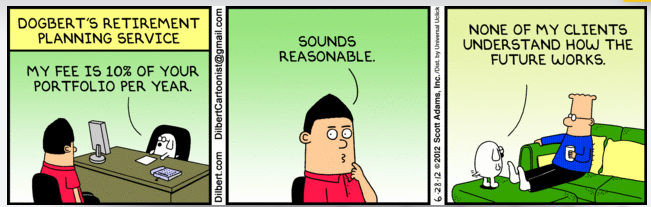

All of this will take the same amount of time/talent for an FA whether I've got $200K or $2million. So, I can't understand why they would price their services as a function of assets under management, or why anyone would use an advisor who prices their services in that way. >Even< if the price came out lower, the conflicts of interest would be enough to make me steer well clear. "Well, that inflation-adjusted pension of yours is okay, but you'd probably be much better served by cashing it out and buying this Equity Indexed Annuity. The market has beaten inflation over time, it's a great bet . . ."

To know if you've got a "real" worthwhile advisor or a huckster requires enough knowledge that, by then, you could do a pretty good yourself. My

impression is that, once you're that savvy you've exceeded the capability of a fair number of FAs, especially the AUM types.