Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

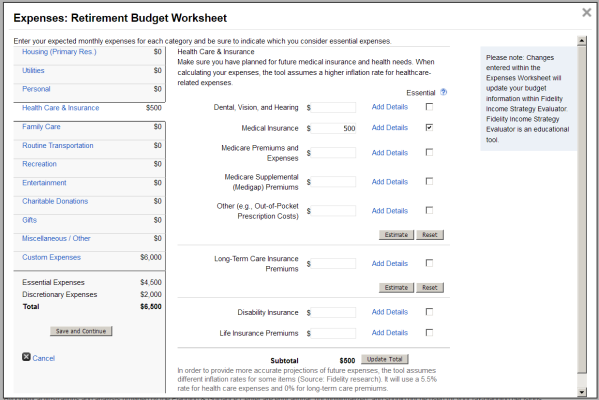

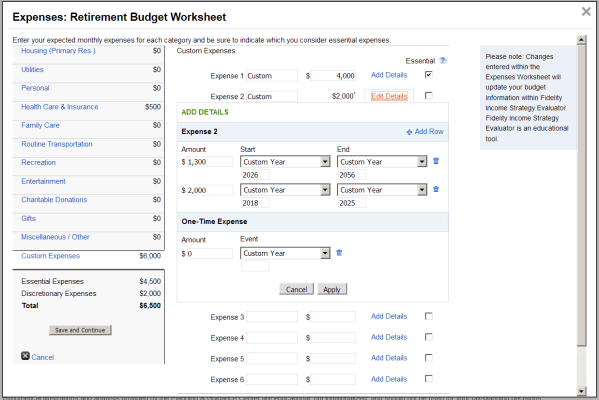

That is an interesting point that lindakoy raises. It would seem logical that Fidelity would/could apply some percentage of medical expenses from a total lump sum budget, but probably doesn't.

Perhaps lindakoy could input all the numbers in one example with the estimated medical vs. another example with no medical and apply the expected medical to another category. The total expenses would be the same, but the retirement number should be different.

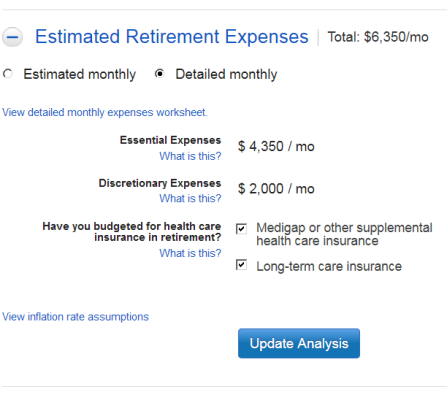

Okay, I tried my above scenario and my results went from 107 to 117, which would be in line with Lindakoy's results going from 102 to 93.