audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

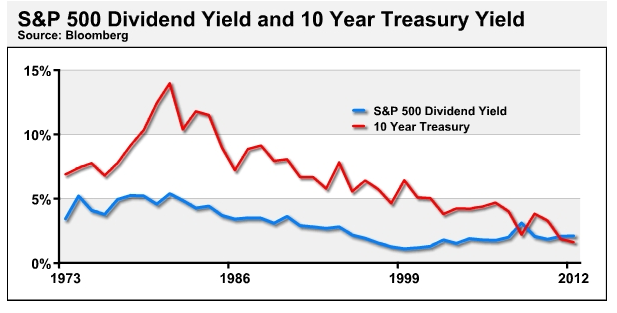

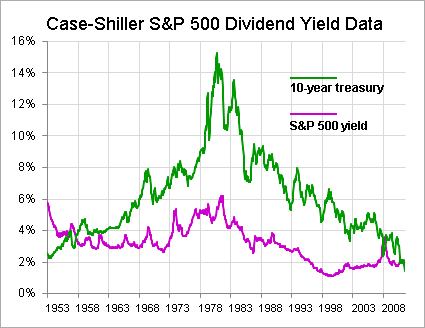

Fixed Income Continues to be "Highly Valued", and all indications are that this situation may persist for several more years.

In spite of all the warnings, etc., about imminently rising interest rates, fixed income asset classes continue to rise in value and the 10-year treasury recently burst through it's all time low from 1946. At 1.64%, it's still darn low historically.

According to folks who monitor future rate predictions, any tightening will be deferred until April 2015. This date has continued to move out over the past couple of years. Forward Rate Predictions: Radical Change - Morningstar

So what to do about fixed income asset classes that continue to be so "highly valued"? Well, I recently realized that I just don't have to worry about it. If that's the higher value section of my portfolio at the moment, that's the asset class I'll be spending down as I withdraw (per my AA). If the low-interest-rate situation continues to persist for several years, then I'll naturally continue to withdraw from this "appreciated" asset class. Eventually when things change and interest rates rise, and at least I will have "enjoyed" the fruits of the past situation, and perhaps some of my other asset classes will have a chance in the limelight.

Just another way to look at maintaining a balanced AA. Not only does it force you to "sell high" and "buy low" when you rebalance, but it also has you drawing down from the most appreciated asset classes. So when they inevitably turn (which can take a LOOOOONG time), you've already enjoyed some benefits.

Audrey

In spite of all the warnings, etc., about imminently rising interest rates, fixed income asset classes continue to rise in value and the 10-year treasury recently burst through it's all time low from 1946. At 1.64%, it's still darn low historically.

According to folks who monitor future rate predictions, any tightening will be deferred until April 2015. This date has continued to move out over the past couple of years. Forward Rate Predictions: Radical Change - Morningstar

So what to do about fixed income asset classes that continue to be so "highly valued"? Well, I recently realized that I just don't have to worry about it. If that's the higher value section of my portfolio at the moment, that's the asset class I'll be spending down as I withdraw (per my AA). If the low-interest-rate situation continues to persist for several years, then I'll naturally continue to withdraw from this "appreciated" asset class. Eventually when things change and interest rates rise, and at least I will have "enjoyed" the fruits of the past situation, and perhaps some of my other asset classes will have a chance in the limelight.

Just another way to look at maintaining a balanced AA. Not only does it force you to "sell high" and "buy low" when you rebalance, but it also has you drawing down from the most appreciated asset classes. So when they inevitably turn (which can take a LOOOOONG time), you've already enjoyed some benefits.

Audrey