Currently, equities represent only about 43% of my portfolio. Including investment real estate, only about 25% of my assets are invested in stocks - almost exclusively good dividend-payers. So I am not selling. In fact, I am looking forward to invest more money in equities as they get cheaper.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sell in May

- Thread starter ripper1

- Start date

truenorth418

Full time employment: Posting here.

As someone who tracks his portfolio daily, the past few weeks have been a little depressing. But then I remember my reliance on dividend growth stocks, and I begin wishing for an even greater move to the downside. There still seems to be a lack of good bargains out there on high quality dividend stocks paying, say, >4%.

frayne

Thinks s/he gets paid by the post

Well, that sounds like the state of mind we'd all like to be in. Good for you. I'll just add that a little skepticism and worry is healthy too, instead of totally being in "set it and forget it" mode. The NASDAQ dot-com bubble of 10 years ago, where those prices never recovered, is an example of that.

To each his own, I set it and rebalance as needed but still don't worry about the state of the market. BTW, I am a pure indexer, fwiw.

BTW, I've seen my portfolio drop a cool $250K and again, didn't lose one iota of sleep as I am a true believer in mean reversion.

Last edited:

veremchuka

Thinks s/he gets paid by the post

I play with the S&P 500 fund in my 401k, I made some good purchases last summer. I got out a little early in March when the S&P 500 was at 1342 so I missed some of the up side to 1419 but I made a nice profit for the 7 months I was in. During that time I was 65/35 but that's too much in equities for me really. After exchanging back into the Stable Value fund I was at 35/65 and that's more to my liking even though it is really too conservative for my age and the fact I don't draw from investments. I've been waiting for a buy point. Yesterday I couldn't resist when the S&P 500 went below 1305 even though I wanted to wait longer and sure enough today was even a better buy but my crystal ball is cloudy. I'd like to get back up to 60/40 over the summer expecting the Nov-April time frame to perform.

There is something to the seasonality as mentioned by LizAnn Sonders. I read Sy Harding's 1st book and the stats are hard to argue with! It isn't always 100%, some unfavorable seasons are great and some favorable seasons are not, but typically it holds true. Look how much the DJIA, S&P 500 and Nasdaq were up in mid April and now look, just about all the gains for the year have been given back. Sy has tables showing the results of being in and out (when in you're in the DJIA or when you're out you're in Treasury bills) and the losses (give backs) in the unfavorable season really reduce your returns. This isn't pick dates to get in and out all during the year, the most simple form of this is go into equities on 10/1 and get out 4/30, btw your equity position is not 100% it is just what you'd normally invest in equities. He tweaks it with many indicators the most notable is the MACD so the date to go in and get out vary from year to year but the 10/1 and 4/30 work quite well.

I really hate trying to time the market because I know I'm lousy at it but I am always tempted to follow this seasonal strategy. The one summer I got out was 2009 and that year was definitely atypical! So if I follow it I would use my 401k funds, leaving the Vanguard equities invested during the unfavorable season.

If you look at the results from 1950 to in think it was 2000 in Sy's book it is impossible to argue this strategy was definitely a winner. But that was the past and we don't know if the same will hold true going forwards.....

There is something to the seasonality as mentioned by LizAnn Sonders. I read Sy Harding's 1st book and the stats are hard to argue with! It isn't always 100%, some unfavorable seasons are great and some favorable seasons are not, but typically it holds true. Look how much the DJIA, S&P 500 and Nasdaq were up in mid April and now look, just about all the gains for the year have been given back. Sy has tables showing the results of being in and out (when in you're in the DJIA or when you're out you're in Treasury bills) and the losses (give backs) in the unfavorable season really reduce your returns. This isn't pick dates to get in and out all during the year, the most simple form of this is go into equities on 10/1 and get out 4/30, btw your equity position is not 100% it is just what you'd normally invest in equities. He tweaks it with many indicators the most notable is the MACD so the date to go in and get out vary from year to year but the 10/1 and 4/30 work quite well.

I really hate trying to time the market because I know I'm lousy at it but I am always tempted to follow this seasonal strategy. The one summer I got out was 2009 and that year was definitely atypical! So if I follow it I would use my 401k funds, leaving the Vanguard equities invested during the unfavorable season.

If you look at the results from 1950 to in think it was 2000 in Sy's book it is impossible to argue this strategy was definitely a winner. But that was the past and we don't know if the same will hold true going forwards.....

steelyman

Moderator Emeritus

I'm amazed at the change in my attitude towards monitoring my investments, selling/buying etc., since I stopped working. I do a whole lot less these days!

Early this year, I decided I would try an experiment, specifically to set a "base level" for an investment, and then on a fixed time frame (for example, quarter's end) sell the amount over that base level. As a result of that, I sold at the end of March and transferred the proceeds to a stable value fund that will be waiting for me when I need it - but it's looking like I won't sell anything in June.

Close to the concept of rebalancing, but rather than reset your asset allocation, it's more like "take the money and run". I'm looking forward to spending it!

Maybe this approach means to wait for the market to tell you WHEE

Early this year, I decided I would try an experiment, specifically to set a "base level" for an investment, and then on a fixed time frame (for example, quarter's end) sell the amount over that base level. As a result of that, I sold at the end of March and transferred the proceeds to a stable value fund that will be waiting for me when I need it - but it's looking like I won't sell anything in June.

Close to the concept of rebalancing, but rather than reset your asset allocation, it's more like "take the money and run". I'm looking forward to spending it!

Maybe this approach means to wait for the market to tell you WHEE

Last edited:

almost there

Thinks s/he gets paid by the post

- Joined

- Sep 24, 2008

- Messages

- 1,012

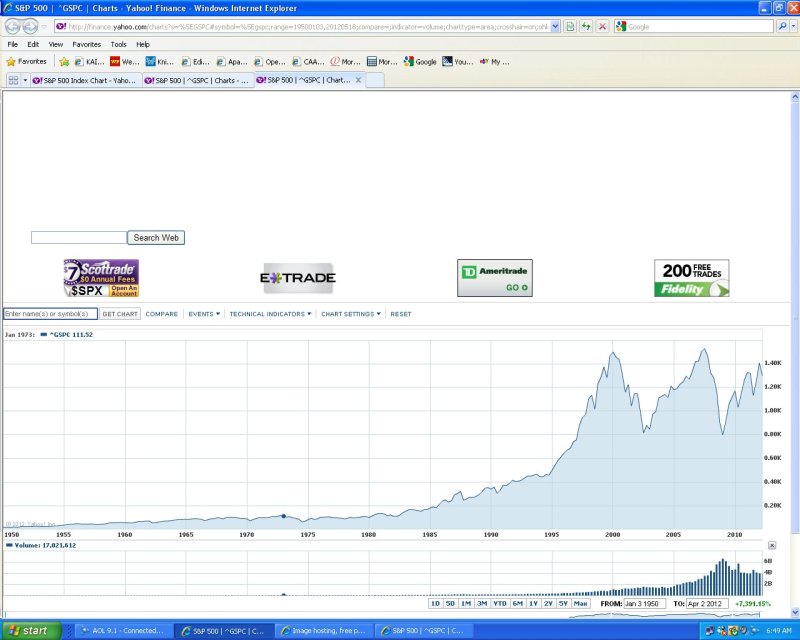

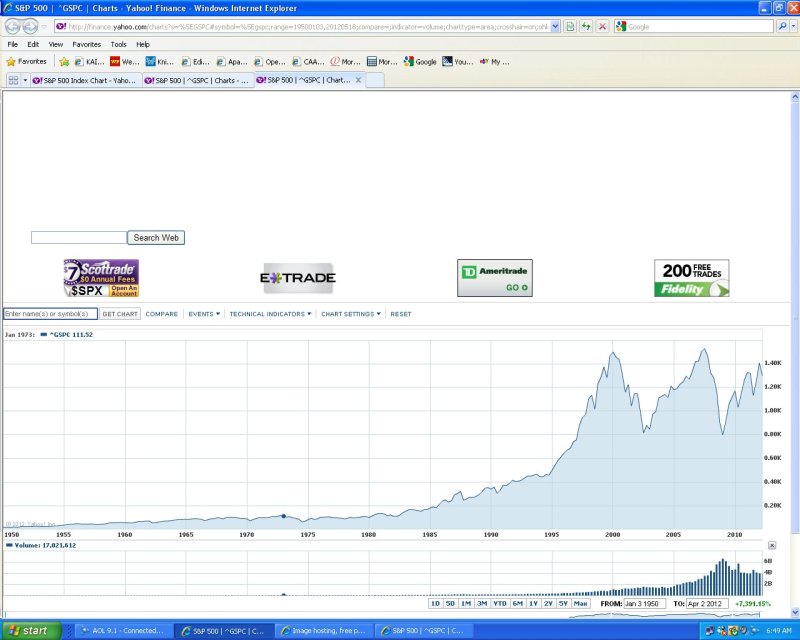

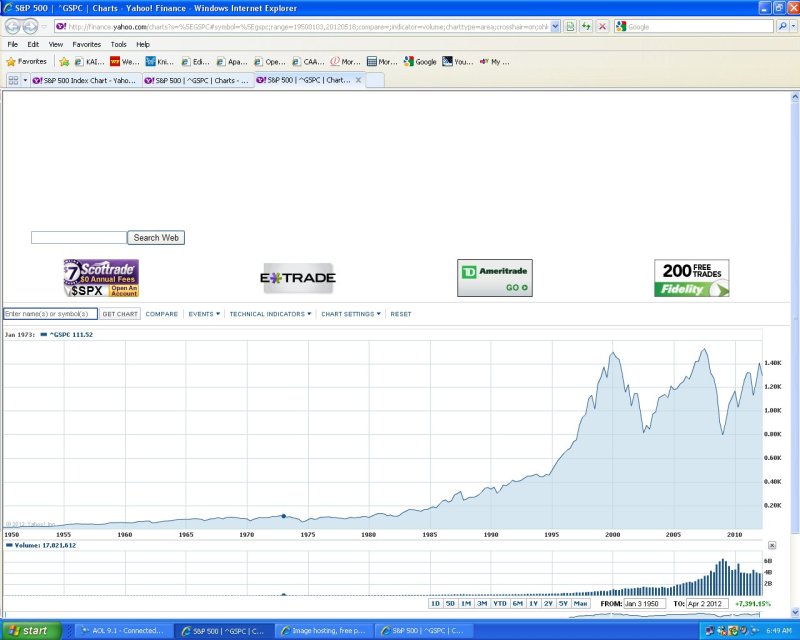

All one needs to do is look at an S&P 500 chart from 1950 to today.

Or 1960, 1970, 1980 to today. Its no wonder buy and hold scares most folks.

The chart looks like a capital M with an off shoot that started a new capital M that hit 1400. Again.......

Most of us have been whip sawed into oblivion over the past 20 years.

Some lucky, some not....... Most somewhere in the middle waiting for the next big move. Up or down..... Not a whole lot of fun........

Or 1960, 1970, 1980 to today. Its no wonder buy and hold scares most folks.

The chart looks like a capital M with an off shoot that started a new capital M that hit 1400. Again.......

Most of us have been whip sawed into oblivion over the past 20 years.

Some lucky, some not....... Most somewhere in the middle waiting for the next big move. Up or down..... Not a whole lot of fun........

W2R

Moderator Emeritus

All one needs to do is look at an S&P 500 chart from 1950 to today.

Or 1960, 1970, 1980 to today. Its no wonder buy and hold scares most folks.

The chart looks like a capital M with an off shoot that started a new capital M that hit 1400. Again.......

Most of us have been whip sawed into oblivion over the past 20 years.

Some lucky, some not....... Most somewhere in the middle waiting for the next big move. Up or down..... Not a whole lot of fun........

Well, this isn't the 1990's, that's for sure. Look at that steep upwards slope at that time! Beautiful.

I have only been investing heavily since 1999, but even so I am still [-]pleased[/-] ecstatic at how the market has treated me thus far. It sure beats putting my money in a savings account at the pitiful interest rates we have had lately.

Me, too. I think that before ER, a lot of that sort of thing was aimed at checking and refining my ER investment plan, making sure that it was going all right. Now that I am retired, I have everything in place and no reason to tweak or change my approach for now.I'm amazed at the change in my attitude towards monitoring my investments, selling/buying etc., since I stopped working. I do a whole lot less these days!

Last edited:

almost there

Thinks s/he gets paid by the post

- Joined

- Sep 24, 2008

- Messages

- 1,012

I guess it would make a difference investing for 15 yrs then getting cut in 1/2 in starting in 2000, rather than starting in 2000.

For long term folks the 2002 and 2009 bottoms really hurt.

If you look at the chart what do you think the S&P or Dow should be based on the past 50/100 yrs? Just curious.......

For long term folks the 2002 and 2009 bottoms really hurt.

If you look at the chart what do you think the S&P or Dow should be based on the past 50/100 yrs? Just curious.......

For long term folks the 2002 and 2009 bottoms really hurt.

Only if you sold at the bottom.

I'm a long term investor with periodic rebalancing once my 10% equity "bands" are exceeded. Started investing in January of 1987 only to see the world come to an end October of 1987 when the market dropped closed to 30% IN A SINGLE DAY!. Paralized by fear I did nothing and soon the 87 crash was a minor blip on the rearview mirror. Fast forward to 2000-2002 again the world is ending. Again did nothing and low and behold retired end of 2002 and world looked pretty good from that point to 2008. Another end of the world. Again did nothing. Guess what - world did not end.

Now retired for 10 years living off my investments and my pot is 60% higher than when I retired (No pension, no SS). Brilliant investing? not really just not panicking, rebalancing when called for and largely ignoring the gurrus.

NYEXPAT

Thinks s/he gets paid by the post

I fully expected the S&P to be around 700 by now and posted that sometime last year. I am still waiting, but am very happy collecting 8.5% in CD's plus another 6% in currency exchange.I guess it would make a difference investing for 15 yrs then getting cut in 1/2 in starting in 2000, rather than starting in 2000.

For long term folks the 2002 and 2009 bottoms really hurt.

If you look at the chart what do you think the S&P or Dow should be based on the past 50/100 yrs? Just curious.......

urn2bfree

Full time employment: Posting here.

- Joined

- Feb 14, 2011

- Messages

- 852

Getting out means paying taxes on gains, some short term if getting in and out every May to ? Whatever- missing out on dividends which are the main source of gain in the market anyway. It is still market timing and as such is unlikely to work in the long run or most significant runs. Patience discipline balance and rebalance - it does not rhyme like Sell ln May and go away, but for me it makes better sense even not rhyming.

Love those Whee periods on our roller coaster ride, and I am looking forward to the next one

In my 401K I never got in the mkt last time to make a profit. But you better believe I'll get in it this time.

My IRA's I sold half my MSFT and bought some ZNGA(bad move!!)Left everyghing else as is because they are all div paying stocks.

Moscyn

Full time employment: Posting here.

- Joined

- Mar 14, 2009

- Messages

- 728

Right now I'm more interested in the second part of - "Sell in May, BUY BACK IN  ?" . Again, I am usually on vacation beginning Sept, so maybe I should buy back in end August?

?" . Again, I am usually on vacation beginning Sept, so maybe I should buy back in end August?

eatingmywords

Dryer sheet wannabe

- Joined

- May 2, 2010

- Messages

- 23

May has worked well for long term treasury entries for the last 3 years.

I recently entered TMF (3x leverage) and am up 12%. This returned about 100% last go around.

I recently entered TMF (3x leverage) and am up 12%. This returned about 100% last go around.

Last edited:

Again, I am usually on vacation beginning Sept, so maybe I should buy back in end August?

Take your laptop with you and go to the fast food restaurants that have wi-fi and check the mkt once a day...along with news. I love watching the mkt and have to check at least once a day and make changes if needed.

Sirka

Recycles dryer sheets

+1I have a feeling we are gonna see more carnage this summer....but who knows.

I worry about Greeks taking us down big time this summer.

I sold in early March to lock in some gains and raised cash from 8% to 15%. Kept on selling in April, so I got up to 27% cash - the highest ever.

Right now I'm more interested in the second part of - "Sell in May, BUY BACK IN?" . Again, I am usually on vacation beginning Sept, so maybe I should buy back in end August?

"Always remember to buy in September"

We all wonder about that. Now is an extrememly difficult time to make any predections. Sooo many things going on now.

First....Will Big Ben give us another QE? If yes, the mkt will rebound but who knows how long because:

Second...If Greece breaks out of EU, will Spain and Italy follow? If so, the whole globe will be affected.

Third....Who will win the presidential election? You know businesses are carefully watching this.

I'll be waiting and watching carefully before I make any moves and buy again.

First....Will Big Ben give us another QE? If yes, the mkt will rebound but who knows how long because:

Second...If Greece breaks out of EU, will Spain and Italy follow? If so, the whole globe will be affected.

Third....Who will win the presidential election? You know businesses are carefully watching this.

I'll be waiting and watching carefully before I make any moves and buy again.

almost there

Thinks s/he gets paid by the post

- Joined

- Sep 24, 2008

- Messages

- 1,012

Agree with most of the above.

Sold twice in March 3/19 & 3/26 was 100% out.

Started back in last week, still 70% cash.

In the 401 my PCRA allows me to place orders, so I have the next 6 buy orders in pace. How many will make it? Who knows.......

Mainly SCHX 1000 and 2000 lots $1.00 apart from 31 to $26.00

Got the $32 covered 20% of my port, now to catch a falling knife.

Worst case, we have a huge rally back to 1410 on the S&P and I can re-enter even. But it sure does not look that way to me........

Re entered 50% in the Roth IRA's last week. Sold in may @ 13.44 new ave 12.80. Plan to add more VTTVX next week.

Looking forward to quiet times in the future where you can just let it gently glide upwards.........

Sold twice in March 3/19 & 3/26 was 100% out.

Started back in last week, still 70% cash.

In the 401 my PCRA allows me to place orders, so I have the next 6 buy orders in pace. How many will make it? Who knows.......

Mainly SCHX 1000 and 2000 lots $1.00 apart from 31 to $26.00

Got the $32 covered 20% of my port, now to catch a falling knife.

Worst case, we have a huge rally back to 1410 on the S&P and I can re-enter even. But it sure does not look that way to me........

Re entered 50% in the Roth IRA's last week. Sold in may @ 13.44 new ave 12.80. Plan to add more VTTVX next week.

Looking forward to quiet times in the future where you can just let it gently glide upwards.........

Last edited:

Agree with most of the above.

Sold twice in March 3/19 & 3/26 was 100% out.

Started back in last week, still 70% cash.

In the 401 my PCRA allows me to place orders, so I have the next 6 buy orders in pace. How many will make it? Who knows.......

Mainly SCHX 1000 and 2000 lots $1.00 apart from 31 to $26.00

Got the $32 covered 20% of my port, now to catch a falling knife.

Worst case, we have a huge rally back to 1410 on the S&P and I can re-enter even. But it sure does not look that way to me........

Re entered 50% in the Roth IRA's last week. Sold in may @ 13.44 new ave 12.80. Plan to add more VTTVX next week.

Looking forward to quiet times in the future where you can just let it gently glide upwards.........

Sounds like you are having lots of fun. Some folks around here follow more of the cicada cycle which is 13 years so next time to wake up is 2024 if my math is correct...

almost there

Thinks s/he gets paid by the post

- Joined

- Sep 24, 2008

- Messages

- 1,012

Lots of ways to go. Some go public at 28 and are worth billions over night..

There is no right answer.......... As long as it works for you.

There is no right answer.......... As long as it works for you.

Moscyn

Full time employment: Posting here.

- Joined

- Mar 14, 2009

- Messages

- 728

Take your laptop with you and go to the fast food restaurants that have wi-fi and check the mkt once a day...along with news. I love watching the mkt and have to check at least once a day and make changes if needed.

Strangely, I completely do not think about the market when on holiday. The hotels have wi-fi but I tend to update my FB and not even check the market. I guess I have myself to blame if I can't get the best sells/buys.

eytonxav

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We all wonder about that. Now is an extrememly difficult time to make any predections. Sooo many things going on now.

First....Will Big Ben give us another QE? If yes, the mkt will rebound but who knows how long because:

Second...If Greece breaks out of EU, will Spain and Italy follow? If so, the whole globe will be affected.

Third....Who will win the presidential election? You know businesses are carefully watching this.

I'll be waiting and watching carefully before I make any moves and buy again.

Fourth..... Congressional grid lock II, which will most likely happen both before and after the election

. On your second point, the whole globe has already been affected, but yes it could get worse.

. On your second point, the whole globe has already been affected, but yes it could get worse.There are tremendous uncertainties right now for both businesses and investors, and thats one thing that wallstreet certainly doesn't like. Not sure how to best position for whats to come. Maybe short term bonds and div equites in consumer staples, utilities, and healthcare and cash.

Last edited:

EvrClrx311

Full time employment: Posting here.

- Joined

- Feb 8, 2012

- Messages

- 648

+1

I worry about Greeks taking us down big time this summer.

I sold in early March to lock in some gains and raised cash from 8% to 15%. Kept on selling in April, so I got up to 27% cash - the highest ever.

I often wonder how a country that has a smaller GDP than 14 of our states has any kind of impact on our economy. Ok, I get that its the Euro and people invest in Europe... but seriously, they are a drop in the lake compared to our entire GDP as a country (311B compared to 14.7T)

Crazy to think that billions of dollars in NYSE/NASDAQ equities can vanish overnight because a country with an economy smaller than Massachusetts made some bonehead mistakes.

I keep thinking it is just overreaction...

Gross Domestic Product

California - $1.9T

Texas - $1.2T

New York - $1.2T

Florida - $754B

Illinois - $644B

Pennsylvania - $575B

New Jersey - $497B

Ohio - $483B

Virginia - $427B

North Carolina - $407B

Georgia - $404B

Massachusetts - $377B

Michigan - $372B

Washington - $351B

GREECE - $311B

Maryland - $300B

...

Last edited:

Sirka

Recycles dryer sheets

+1I often wonder how a country that has a smaller GDP than 14 of our states has any kind of impact on our economy.

...

I keep thinking it is just overreaction...

It's because of the uncertainty. If Greece breaks out of EU, will Spain and Italy follow

Similar threads

- Replies

- 15

- Views

- 509

- Replies

- 92

- Views

- 5K

- Replies

- 20

- Views

- 1K

Latest posts

-

-

-

Best CD, MM Rates & Bank Special Deals Thread 2024 - Please post updates here

- Latest: ShokWaveRider

-

-

-

-

-