fidler4

Recycles dryer sheets

- Joined

- Mar 31, 2013

- Messages

- 252

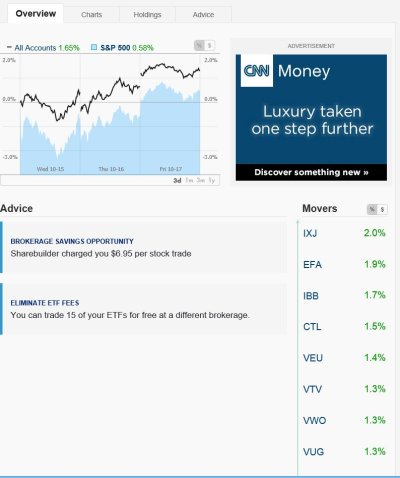

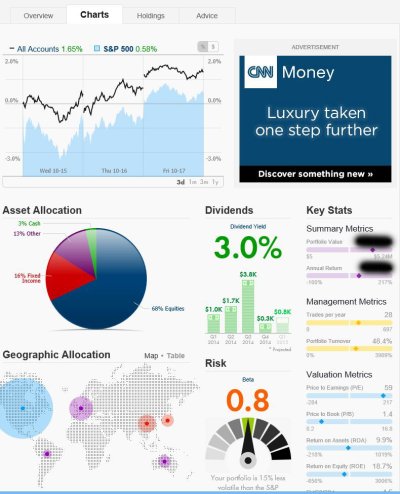

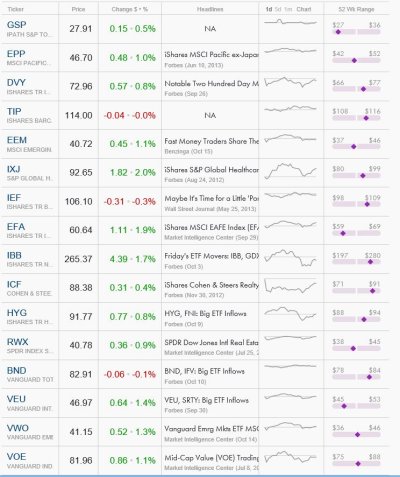

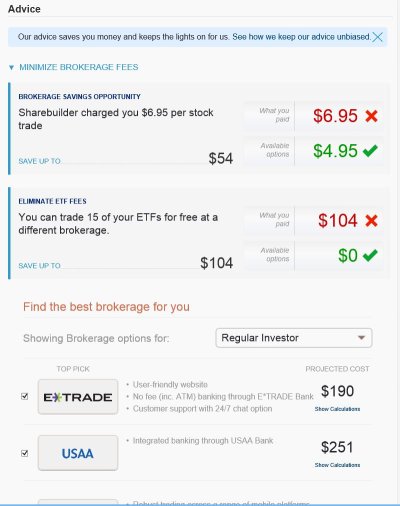

Can anyone recommend a web site or software that can bring together several retirement accounts to show what the total asset allocation is?

My wife and I have 3 separate retirement accounts each (Roth IRA, Traditional IRA & 457b). Each of the accounts is invested in various Vanguard Index Funds. All of the IRA's are Vanguard. What I currently do is put everything into Excel to determine what the overall AA is for the accounts. I list each account, the funds then whether its a Bond ,Dom Stock, or Intl Stock.

Is there a site someone could recommend where I can input the various funds and have it give me an asset allocation?

Thanks

Sent from my iPad using Early Retirement Forum

My wife and I have 3 separate retirement accounts each (Roth IRA, Traditional IRA & 457b). Each of the accounts is invested in various Vanguard Index Funds. All of the IRA's are Vanguard. What I currently do is put everything into Excel to determine what the overall AA is for the accounts. I list each account, the funds then whether its a Bond ,Dom Stock, or Intl Stock.

Is there a site someone could recommend where I can input the various funds and have it give me an asset allocation?

Thanks

Sent from my iPad using Early Retirement Forum