I literally just had a discussion about living "paycheck to paycheck" with a longtime friend of mine, best man in my wedding. He came to MN to help his sister move her apartment and I offered up my truck, trailer and muscle to help get it done. As we were driving the topic came up and he said he and his girlfriend are living paycheck to paycheck. They have a household income of around $150k and live in California.

My wife and I have a household income over 250k so we don't wall in this category by any means...but I kind of explained that in terms of paycheck to paycheck we don't have much cash laying around if something did happen. The main reason being that we put so much into our 401k, IRA, HSA, and kids 529 and a little into broker. I said sure, if something dire happened I could take a 401k loan, or sell some equities in the broker account. He mentioned my definition and his were a bit different. He isn't saving much for the future and said for the first time in a loooong time he has about $2,000 in his checking, but it is more like $1,000 after all the bills are paid.

They never cook food. That was another topic that came up. He insisted on paying for a couple of things when he was visiting, mainly because I let him stay at our home. It was hard for me to accept anything knowing his situation, maybe guilt or shame on my end. He insisted. He donated $40 to my son's cub scouts activities, and filled up the tank of diesel insisting that when one man helps another man move, its just the right thing to do. It was hard for me to argue, but also I know our financial situation is much better and it wouldn't nearly make a dent in my budget compared to his.

He pays well over $5/gallon for gas, and I live in the midwest where gas has probably never been over $5/gallon. On top of that, I rarely drive these days so it wasn't a big deal to just use some gas to help someone move. BUT he insisted. I finally put an end to his generosity when he tried to pay for both my son and I's dinner the night we finished the move. His sister had given me $130 cash as a thank you for all my hard work (and I did do lots of hard work), so I felt that was fair. Then he tried to also pay for both our dinner's and I said "look, my son, he didn't do anything to help you...he is just here with us eating dinner and I threw down my card and said it's on me this time!"

He has never earned a lot comparatively, but his girlfriend does. At 40, he accepted a hand me down car from his folks. I keep trying to nudge him into the IT industry, but a guy is ultimately going to make his own choices.

One thing I noticed with him and even his sister is they have been very conservative with the risks they take compared to the risks I have taken in my life.

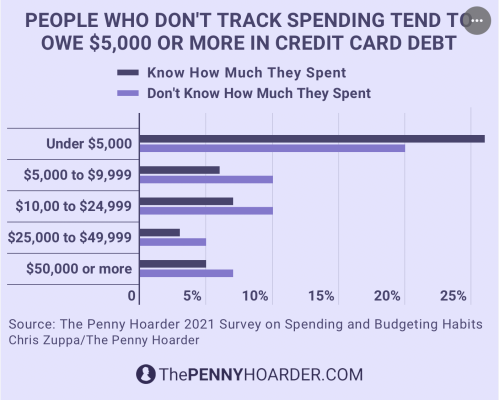

I guess, I am just super grateful I am in the smaller piece of this pie but do feel for the folks who are in the 64%. It's only getting harder with this rampant inflation which means less food, less activity and lesser quality of life.

I often wonder how many of these folks driving around these big expensive SUVs and really nice new sedan's are actually in that same 64% paycheck to paycheck group. It seems we as a society (likely not too many in this forum) tend to over leverage ourselves with interest bearing loans and unnecessary fees. I always enjoy when I get a deal on things and almost try to make a game of it. Never pay retail. Go without if I can. Repurpose things. I do borrow things from my folks like tools etc since they have already bought it, it doesn't make sense for me to buy something they can loan me. One of the perks to living close to ma and pa I guess. I just borrowed some moving sliders, straps and a dolly to help with the move so the friends wouldn't have to rent them. SO I guess in a sense I did earn my $130 which makes me feel slightly better.

Everything has gotten so much more expensive with inflation, its crazy.