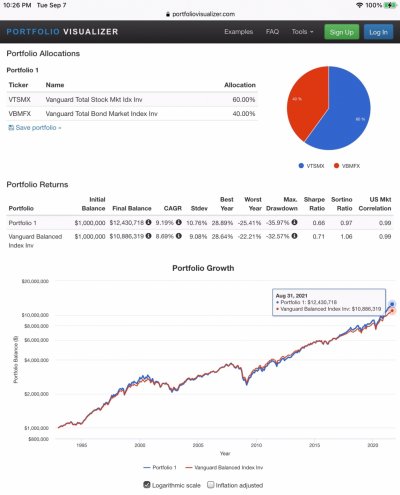

Well, It is not my choice for using a 60/40 portfolio for comparison, It was Markola's choice he used in his graph in post #80. When I mentioned my Fido analysis back in post #20, he used whatever AA I had at the time.

WRT either I do or I don't, I believe I have already addressed that in:

meaning I am not focused on AA. I did started out blindly years ago with some AA (probably 60/40) but thru years of not rebalancing I am way off that now. I'm perfectly OK with that. I know that goes against most conventional wisdom. For those with a target AA, I don't believe that everyone of them starts out with an AA and rebalance range and keeps that throughout their lives. Situations change as we get older, knowledge changes, perspective changes, goals change etc. I just have taken that to the extreme. To put it in the different terms, consider my plan is a 60% equities starting AA with a +/- 40% rebalance trigger.