Perhaps another way of putting it, when did you really stop BTD?

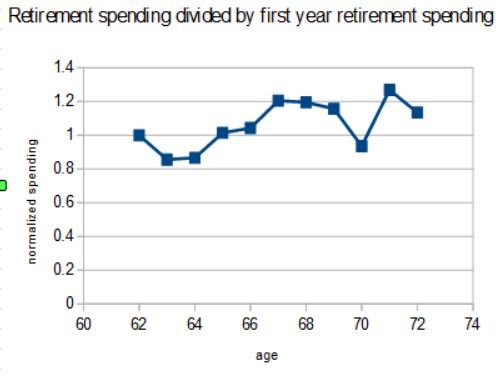

The science all seems to make sense... in ER you are in the honeymoon stage and excited to get after it and BTD on things such as travel, fun cars, fix up the house, buy some toys and then perhaps at sometime in the future (say in 70's), you get achy, health issues hit, maybe a little lazy, have a "been there done that" attitude to some things and pull back to a simpler less BTD lifestyle.

I'm in my last year of "part time work" and have taken off the governor on spending this year to really see how much I can/would BTD. The biggest items are travel this year, including 2 all expense paid trips with kids/G kids (9 of us) which can clearly run up the tab, along with some other trips with DW. Clearly, some of this extra travel is the result of Covid. Additionally, we have done some home renovation/new furniture and bought a few small toys. While I am not spending just to spend, I wonder how long I will really want to run at a serious BTD pace, regardless of my ability to fund it. Aside from any above normal gifting, I'm feeling like this could be my biggest spend year on BTD stuff.

When did you see your BTD trend line start to turn down (if it has)? What triggered the change? How much did your average annual spend drop?

This BTD stuff can be hard!

The science all seems to make sense... in ER you are in the honeymoon stage and excited to get after it and BTD on things such as travel, fun cars, fix up the house, buy some toys and then perhaps at sometime in the future (say in 70's), you get achy, health issues hit, maybe a little lazy, have a "been there done that" attitude to some things and pull back to a simpler less BTD lifestyle.

I'm in my last year of "part time work" and have taken off the governor on spending this year to really see how much I can/would BTD. The biggest items are travel this year, including 2 all expense paid trips with kids/G kids (9 of us) which can clearly run up the tab, along with some other trips with DW. Clearly, some of this extra travel is the result of Covid. Additionally, we have done some home renovation/new furniture and bought a few small toys. While I am not spending just to spend, I wonder how long I will really want to run at a serious BTD pace, regardless of my ability to fund it. Aside from any above normal gifting, I'm feeling like this could be my biggest spend year on BTD stuff.

When did you see your BTD trend line start to turn down (if it has)? What triggered the change? How much did your average annual spend drop?

This BTD stuff can be hard!