ivinsfan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2007

- Messages

- 9,966

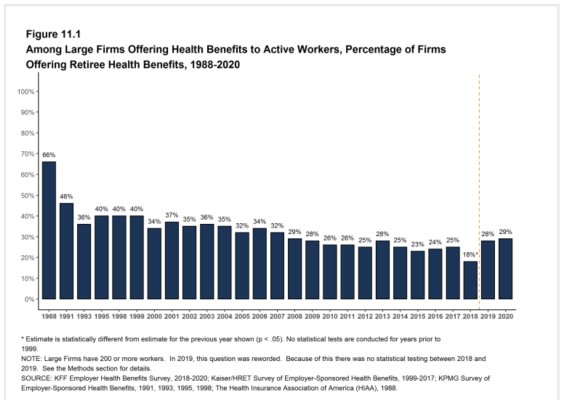

If it is disclosed up front you don't have to take a job that doesn't have the benefits you want. A retiree can't feasibly go back to work to get insurance. (Well okay some can but not all).

I was mostly wanting to make the point that those of you blessed with an ACA plan that doesn't suck are luckier than you may realize.

I certainly have no perfect answers, but if it was this ACA that was my only option I would probably move to another state. I really do believe it is THAT BAD.

I also ONLY still work for retiree health. 1.5 more years to qualify.

And I really hope that you can take advantage of that benefit but I'm sure deep down you know qualifying and actually getting the benefit isn't a sure thing.

I'm sure announcements like the one from VG cause you anxiety.