steelyman

Moderator Emeritus

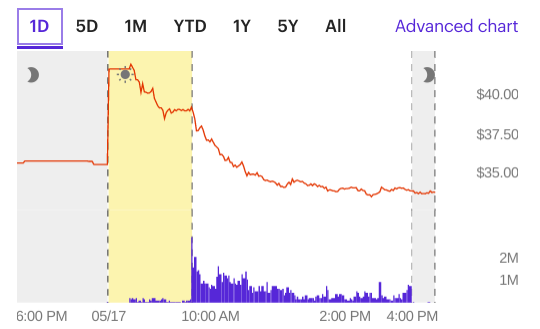

I hold a decent amount of T and so was interested to read today’s announcement of a merger with Discovery. There are also articles covering T and Warner and how that will be affected.

It sounds like a dividend cut is in store for T. I think it was pretty lofty and expect to continue holding T as everything shakes out over the next year or so.

It sounds like a dividend cut is in store for T. I think it was pretty lofty and expect to continue holding T as everything shakes out over the next year or so.