I'm not your typical market timer who thinks he can call the tops. I'm skeptical by training yet I'm optimistic by nature. I think that the economy is gearing up, that the stock market will rise over the next few years, that inflation will remain tame, that interest rates will rise to tame it, and that volatility will settle down a little.

But we might be getting a wee bit ahead of ourselves.

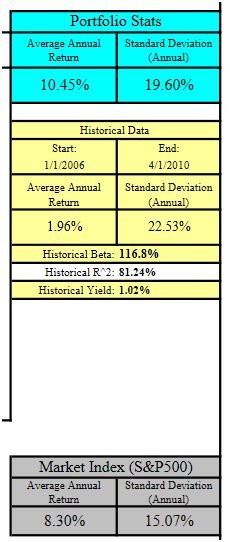

IJS isn't technically a stock-- it's a value index of the S&P600. In March 2009 it hit a low (along with everybody else) of $32.58. Yesterday, on Friday 23 April, it closed at $70.82. It's risen 117% in 13 months, and that doesn't include its dividend yield of 1-2%.

Its collective trailing 12-month revenue is less than zero, so its P/E is negative. However clearly someone expects positive future revenues, and they'd have to be a pretty big honkin' number to keep its forward P/E below 20.

It hit an all-time high of $82.57 in June 2007 and the last time it was above $70 was Sep 2008. Breaking $70 to me seems like an important psychological barrier.

I keep thinking this fund can't possibly get any higher, and I keep being proved wrong, but luckily we have a plan. This asset is perpetually bumping itself up against its upper limit of our allocation. We've sold off a few shares a half-dozen times in the last five months, and it looks like we're not done yet. I don't mind piling up to 10% cash for a few more weeks of "sell in May and go away"...

But we might be getting a wee bit ahead of ourselves.

IJS isn't technically a stock-- it's a value index of the S&P600. In March 2009 it hit a low (along with everybody else) of $32.58. Yesterday, on Friday 23 April, it closed at $70.82. It's risen 117% in 13 months, and that doesn't include its dividend yield of 1-2%.

Its collective trailing 12-month revenue is less than zero, so its P/E is negative. However clearly someone expects positive future revenues, and they'd have to be a pretty big honkin' number to keep its forward P/E below 20.

It hit an all-time high of $82.57 in June 2007 and the last time it was above $70 was Sep 2008. Breaking $70 to me seems like an important psychological barrier.

I keep thinking this fund can't possibly get any higher, and I keep being proved wrong, but luckily we have a plan. This asset is perpetually bumping itself up against its upper limit of our allocation. We've sold off a few shares a half-dozen times in the last five months, and it looks like we're not done yet. I don't mind piling up to 10% cash for a few more weeks of "sell in May and go away"...