I guess wild card is we enter recession (probably already in one) but inflation remains high and Fed continues to raise rates regardless. With such low unemployment GDP contracts but if most people are employed they won't notice a technical recession at the street level. Continued inflation though, they will notice.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Muni Bond (and Muni Bond Fund) Discussion

- Thread starter jazz4cash

- Start date

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

I guess wild card is we enter recession (probably already in one) but inflation remains high and Fed continues to raise rates regardless. With such low unemployment GDP contracts but if most people are employed they won't notice a technical recession at the street level. Continued inflation though, they will notice.

If that's the case, then we will go deeper into recession for a prolonged period rather than making progress to come out of it in short order. That brings a bunch of potentially dangerous outcomes. So, now they are acknowledging that there's likely no "soft landing". Will it just be a bumpy landing? Or a crash landing?

My platform, tear the bandaid off. Let's assume crash landing. Real estate continues to go down, unemployment up, stock falls further on disappointing GDP etc. This all keeps treasury yields lower despite what may become a further flight to safety as rates will not be raised further in this scenario?

Unless the inflation is thru roof and a Volker move is necessary. Trying to stay with theme of this thread and general fixed income commentary not necessarily arguing for a specific scenario per se.

Unless the inflation is thru roof and a Volker move is necessary. Trying to stay with theme of this thread and general fixed income commentary not necessarily arguing for a specific scenario per se.

Last edited:

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I used the last of my cash allocated to my ladder earlier this week. Bought 20, 2029, 4.4% double tax free muni’s.

I doubled the yield of my ladder since March. I have $25,000 maturing next month and about $130,000 more maturing into Fall. Yields might be higher then, but I sorta doubt it. I might be very happy with what I have, locking in some of these higher yields under 10 years.

I doubled the yield of my ladder since March. I have $25,000 maturing next month and about $130,000 more maturing into Fall. Yields might be higher then, but I sorta doubt it. I might be very happy with what I have, locking in some of these higher yields under 10 years.

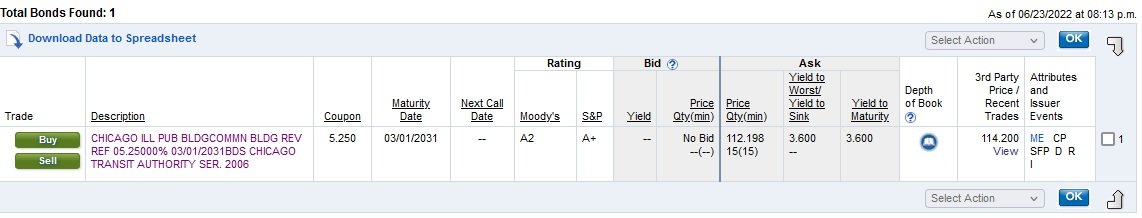

How does this one look?

CHICAGO ILL PUB BLDG COMMN BLDG REV REF BDS

CUSIP:

167664ZS3

5.250% 03/01/2031

Buy

Bond Calculator

TEY Calculator

Find Similar

Set Alert

S&P Research Report now available!

MASS/RAPID TRAN LEASE-RENT ALL BONDS Ser 2006, Non Callable

Bond Details

Bond Details

State

IL

Insurance

AMBAC

Type

N/A

Call Sched

N/A

Dated Date

10-25-2006

Tax Status

Tax Exempt

Delivery

EMMA Disclosure

EMMA Trade Activity

Book Entry

Ratings

A2/A+/---

S&P Report

S&P News

MuniPoints

Org. Maturity

03-01-2031

Maturity

03-01-2031

Material Events

MOODY RATING UPGRADE, EFF 05.04.2022 FROM A3 TO A2, 05-10-2022

Coupon & Yield

Coupon

5.250

Pay Months

Mar, Sep

Current Yield

4.675

Frequency

Semi-Annually

First Coupon

03-01-2007

Yield to Maturity

3.587

Yield to Worst

3.587

Depth of Market

Quantity (M) Min Inc MBR Price YTM YTW

15 15 5 10 112.298 3.587 3.587

CHICAGO ILL PUB BLDG COMMN BLDG REV REF BDS

CUSIP:

167664ZS3

5.250% 03/01/2031

Buy

Bond Calculator

TEY Calculator

Find Similar

Set Alert

S&P Research Report now available!

MASS/RAPID TRAN LEASE-RENT ALL BONDS Ser 2006, Non Callable

Bond Details

Bond Details

State

IL

Insurance

AMBAC

Type

N/A

Call Sched

N/A

Dated Date

10-25-2006

Tax Status

Tax Exempt

Delivery

EMMA Disclosure

EMMA Trade Activity

Book Entry

Ratings

A2/A+/---

S&P Report

S&P News

MuniPoints

Org. Maturity

03-01-2031

Maturity

03-01-2031

Material Events

MOODY RATING UPGRADE, EFF 05.04.2022 FROM A3 TO A2, 05-10-2022

Coupon & Yield

Coupon

5.250

Pay Months

Mar, Sep

Current Yield

4.675

Frequency

Semi-Annually

First Coupon

03-01-2007

Yield to Maturity

3.587

Yield to Worst

3.587

Depth of Market

Quantity (M) Min Inc MBR Price YTM YTW

15 15 5 10 112.298 3.587 3.587

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

If you're happy with that tax free yield, then it's fine. Transportation systems are generally good, and this is an insured issue, so even better.

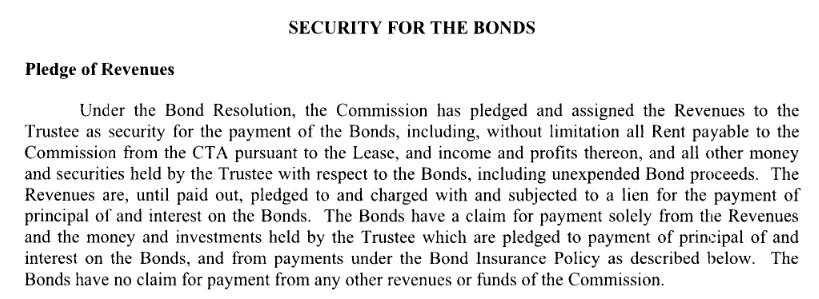

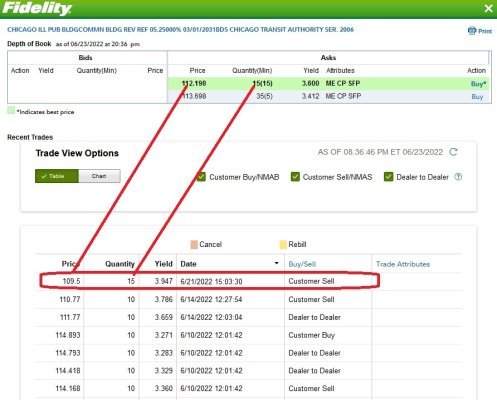

If you do go for it, and your broker provides for it, bid below the ask. You can see that the dealer offering 15 bonds for 112.198 paid 109.5 two days ago. I would bid 111.0 and let it sit out there for a while and see if he budges and lowers that ask...or interest rates rise during the day and he voluntarily lowers his ask.

With rent revenue bonds, you need to read through the offering statement and the section on Security for the Bonds. Though these types of bonds are generally strong, with the municipality/issuer paying the rent, it's usually appropriated annually as part of the budget. Many times there is some statement that there is not a requirement or obligation to appropriate the funds - it's a "moral obligation". I shy away from any bonds which contain clauses like that, no matter how highly rated they may be. Also, with rent revenue bonds, they usually say something that it's a lease that renews annually, and the municipality may not renew at any time if they don't want to...I won't buy any of those either. This one you've chosen is a good one, as it specifically says:

If you do go for it, and your broker provides for it, bid below the ask. You can see that the dealer offering 15 bonds for 112.198 paid 109.5 two days ago. I would bid 111.0 and let it sit out there for a while and see if he budges and lowers that ask...or interest rates rise during the day and he voluntarily lowers his ask.

With rent revenue bonds, you need to read through the offering statement and the section on Security for the Bonds. Though these types of bonds are generally strong, with the municipality/issuer paying the rent, it's usually appropriated annually as part of the budget. Many times there is some statement that there is not a requirement or obligation to appropriate the funds - it's a "moral obligation". I shy away from any bonds which contain clauses like that, no matter how highly rated they may be. Also, with rent revenue bonds, they usually say something that it's a lease that renews annually, and the municipality may not renew at any time if they don't want to...I won't buy any of those either. This one you've chosen is a good one, as it specifically says:

This is about as strong a statement/covenant as you can get. The word "unconditional" is what you like to see, and it is here.As long as any of the Bonds, the Series 2003 Bonds or any Additional Bonds are outstanding, the Lease is noncancellable by the CTA and the Commission. Payments shall be made by the CTA on a net basis without deduction, abatement or setoff for any reason or cause whatsoever. The obligation of the CTA to make Lease Payments is unconditional, and is a general obligation of the CTA payable from any lawfully available funds of the CTA. The CTA covenants in the Lease to annually budget and program for the payment of Rent. The CTA will remain obligated to make all Lease Payments regardless of whether the Leased Property is acquired, constructed, improved and rehabilitated and regardless of whether the Leased Property is damaged or destroyed or otherwise not useful for CTA purpose.

Attachments

Last edited:

Been buying small chunks of brokered CD's. I don't have a long history with them but see my first "STEP" available.

Cusip 46593LCG2, 5 year. Matures 7/2027, callable.

Date Coupon

07/15/2022 3.35

07/15/2024 3.75

07/15/2026 4.25

So I assume you get the rate above until change date. So 3.35% till 7/24, then 2 years at 3.75, and for final year 7/26 - 7/27 4.25%.

Just thought it was interesting.

Cusip 46593LCG2, 5 year. Matures 7/2027, callable.

Date Coupon

07/15/2022 3.35

07/15/2024 3.75

07/15/2026 4.25

So I assume you get the rate above until change date. So 3.35% till 7/24, then 2 years at 3.75, and for final year 7/26 - 7/27 4.25%.

Just thought it was interesting.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

Step CDs are really just marketing tools, concocted to reduce the risk of the issuing bank! (and entice the buyer with the potential of higher rates in the future)

Minimally they are callable on the step dates. On those dates, if interest rates have risen, they'll let the CD continue. If however, rates have dropped, they are going to call. So, in that respect, the Step CD is is on par with a callable CD, because it is callable, and also locks you in to a low future interest rate at the bank's option. It's analogous to other floating rate products.

With your Step CD, it is callable every 6 months in addition to the step dates.

I've owned a few Step CDs over the years, and they were all called...except for two where HSBC botched the calls. They wanted to call on the step date, but somehow didn't give notice far enough in advance (part of the CD terms). Within days of calling and giving me back my principal, it was reversed, CDs given back to me and cash taken back out of my account. One of them stepped up to 4.125% and will mature in September 2024. They only had the single call date, and since that was no longer there, they are stuck paying it to term.

40434ANG0 - you can look it up.

Minimally they are callable on the step dates. On those dates, if interest rates have risen, they'll let the CD continue. If however, rates have dropped, they are going to call. So, in that respect, the Step CD is is on par with a callable CD, because it is callable, and also locks you in to a low future interest rate at the bank's option. It's analogous to other floating rate products.

With your Step CD, it is callable every 6 months in addition to the step dates.

I've owned a few Step CDs over the years, and they were all called...except for two where HSBC botched the calls. They wanted to call on the step date, but somehow didn't give notice far enough in advance (part of the CD terms). Within days of calling and giving me back my principal, it was reversed, CDs given back to me and cash taken back out of my account. One of them stepped up to 4.125% and will mature in September 2024. They only had the single call date, and since that was no longer there, they are stuck paying it to term.

40434ANG0 - you can look it up.

Last edited:

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Step CDs are really just marketing tools, concocted to reduce the risk of the issuing bank! (and entice the buyer with the potential of higher rates in the future)

.

I tend to agree but the ones I’ve seen are issued by a credit union and not callable. I assume your comments are primarily for brokered products?

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

I tend to agree but the ones I’ve seen are issued by a credit union and not callable. I assume your comments are primarily for brokered products?

Yes

If you have access to non-callable step CDs, that is a better product in my view.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

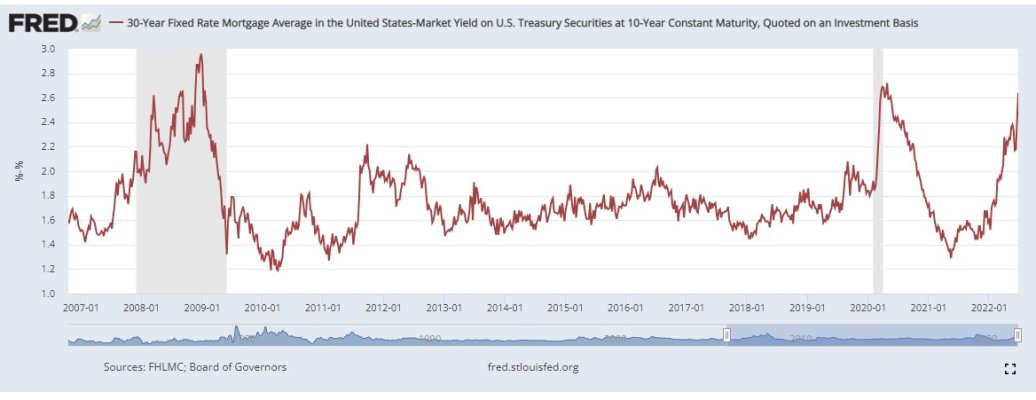

10-year treasury now below 3.0% again.

10-year treasury now below 3.0% again.

Head scratcher. the 30 year mortgage/10 Yr Treasury gap has to be the widest its been in some time.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Head scratcher. the 30 year mortgage/10 Yr Treasury gap has to be the widest its been in some time.

You think? I haven’t followed that relationship, but they seemed to rise simultaneously.

You think? I haven’t followed that relationship, but they seemed to rise simultaneously.

only 3 times in the last 20 years has it crossed ~2.2%, 2 out of 3 were recessions.

Attachments

10-year treasury now below 3.0% again.

Non callable brokered CD payable monthly 3.75%, Celtic Bank Utah.

Non callable brokered CD payable monthly 3.75%, Celtic Bank Utah.

If I am looking at same on Fido, above issue is a 9 year issue. Celtic also offer 3.65 at 7 yr.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

only 3 times in the last 20 years has it crossed ~2.2%, 2 out of 3 were recessions.

Very interesting.

If I am looking at same on Fido, above issue is a 9 year issue. Celtic also offer 3.65 at 7 yr.

Ooops, yes, 9 yr. 3.75% 7 yr. 3.65%, 5 year 3.35%. All payable monthly and not callable.

Of that bunch seems the 7 year is a sweet spot. But all together not bad for 7 and 10 year. Depending on your tax situation it is above 3% net of tax.

For me at least makes me think about longer term for money not needed until then. I get the idea of going shorter but if in two years when a shorter term CD comes due these rates are long gone, well...you know..of course we don't know.

Ooops, yes, 9 yr. 3.75% 7 yr. 3.65%, 5 year 3.35%. All payable monthly and not callable.

Of that bunch seems the 7 year is a sweet spot. But all together not bad for 7 and 10 year. Depending on your tax situation it is above 3% net of tax.

For me at least makes me think about longer term for money not needed until then. I get the idea of going shorter but if in two years when a shorter term CD comes due these rates are long gone, well...you know..of course we don't know.

Personally, given extraordinary uncertainties, I more inclined to stay under 3 years for now. To add to your issues, I am more attracted to the 3.3% issues for two years for which Fido shows several including a USB with no call and monthly pay

Yeah I can see that side too. My basic thought process depending on which way the wind blows is taking it all to three years say. 6 to 18 months, inflation tamed, fed lowers rates, we never see these rates again. My 2 and 3 years come due and I wish I had a bunch of longer term paying 3 to 4%.

I have some USB when they first hit 3%, same monthly. They were actually 30 month issue ending 11/24. Should probably sell and go for the 3.3%.

And all of this is tinkering with 20% of portfolio that is kept in cash/cd/muni/treasury. So it is the safest stuff I own and tweaking for a couple tenths but none of it will greatly change my life a few tenths one way or the other, unless I could have the entire 20% paying 10% in treasury or CD's ;-) Then I go from Kia Soul to Hyundai Santa Fe lavish life!

I have some USB when they first hit 3%, same monthly. They were actually 30 month issue ending 11/24. Should probably sell and go for the 3.3%.

And all of this is tinkering with 20% of portfolio that is kept in cash/cd/muni/treasury. So it is the safest stuff I own and tweaking for a couple tenths but none of it will greatly change my life a few tenths one way or the other, unless I could have the entire 20% paying 10% in treasury or CD's ;-) Then I go from Kia Soul to Hyundai Santa Fe lavish life!

Last edited:

Similar threads

- Replies

- 452

- Views

- 28K

- Replies

- 182

- Views

- 21K

- Replies

- 454

- Views

- 51K

- Replies

- 3K

- Views

- 370K