I'm doing the same job for my mom. I've got a ladder and one's maturing 8/1, so I'll be shopping.

When I looked up 130911XH8, it said "Fidelity is not currently offering this security." I wonder how many good deals are not being offered by Fidelity.

For maturities around the 6/2024 mark, most of the ones they offer have SFP. The one that doesn't has YTS -19%!! But the best rate is 3.75% YTM, so getting 5.05% (or likely 4.1%, I guess) is a pretty good deal.

Did you put in a lowball order that got picked-up, or did you just pay the ask?

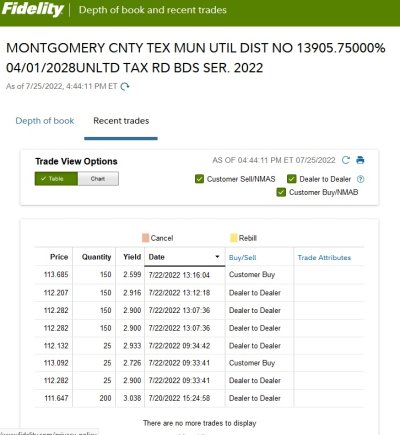

So, obviously at the time I purchased, the dealer was offering on Fidelity. I bought, and there were no other dealers offering, so that's why it says not currently offered by Fidelity. Also, sometimes dealers will leave their offers overnight or they will pull them before the close. My point is that what you see at this time may not be indicative of what is really available and will be reposted in the morning...generally sometime between the open at 8am, and around 9am. Also, if you look at the trade history on this one, it is extremely thinly traded.

When I saw this one, I just paid the ask, did not attempt to lowball because the yield was such that I figured if I didn't take it, soon enough someone else would. So not worth playing in this case, in my view.

As far as sinking fund, I don't pay too much attention to it. I will go and review the sinking fund schedule for ones that are a few years to maturity. If the yield to sink is low or even somewhat negative, I'll calculate the expected return based on the probability of mine coming up in the first sinking redemption. Earlier this week I did pick up some with sinking fund that if mine were redeemed on the first date, in about 6 months from now, my return would be a negative 10% (annualized). However, in the first year, only 2% of the outstanding bonds will be redeemed, so it's a very low likelihood that I will experience that YTW loss and if they get redeemed in year 2 or later, my yield works out significantly better.

I also picked up 346424Y40 for my own portfolio earlier today. I've built up a biggish position in the Forney, TX long-term zero coupon bonds. For this one, the call date is in one year. If called, I'll get 1.57% return for the one year hold. However, if not called, YTM is around 6.9% through 2041. I've built up this position in the Forney bonds because I began purchasing when they were undervalued...as I saw the financials and economy there strengthening, and then the ratings agencies upgraded a few months later confirming what I saw. Additionally, they are all insured. About half are taxable and the other half tax free. So, we'll see what happens. The first call date (for 346424U51) is coming up next month on 8/15, and they have not given notice, so it's looking good that they will not be calling. All the other Forney issues I hold have their first call dates on 8/15 in 2023 and 2024, with YTC of 1% to 3% and YTM of 5% to 7%.