Sandy & Shirley

Recycles dryer sheets

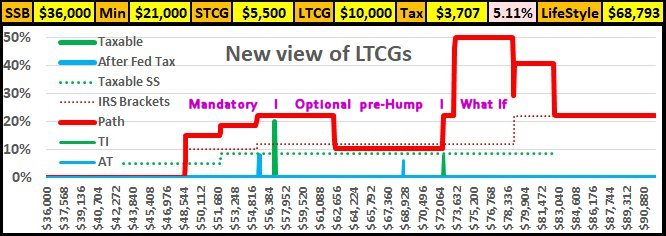

We are going to pay off our mortgage this year, so, we are thinking about starting a standard brokerage account for the creation of LTCGs. As we understand it, LTCGs are tax free income as long as we are in the 12% Federal tax bracket. Yes, we know that each dollar of our LTCGs gains will make 85 cents of SS taxable.

So, back to our question! Line 16 of Schedule D merely adds your long and short term gains together, then puts that number on your 1040SR form line 7.

What forms or instructions or … etc. are used to count the LTCGs for the taxation of your SSB, but not count the LTCGs for your Tax Due calculations, until your combined income is over $100 less than the top of the 12% bracket.

Also, and this is what we will eventually be aiming for, how do you fill out what forms when we have $15,000 of LTCGs and $5,000 of STCLs?

Thanks in advance for any feedback on this question.

So, back to our question! Line 16 of Schedule D merely adds your long and short term gains together, then puts that number on your 1040SR form line 7.

What forms or instructions or … etc. are used to count the LTCGs for the taxation of your SSB, but not count the LTCGs for your Tax Due calculations, until your combined income is over $100 less than the top of the 12% bracket.

Also, and this is what we will eventually be aiming for, how do you fill out what forms when we have $15,000 of LTCGs and $5,000 of STCLs?

Thanks in advance for any feedback on this question.