TheWizard

Thinks s/he gets paid by the post

Definitely letting the tax tail wag the dog here...

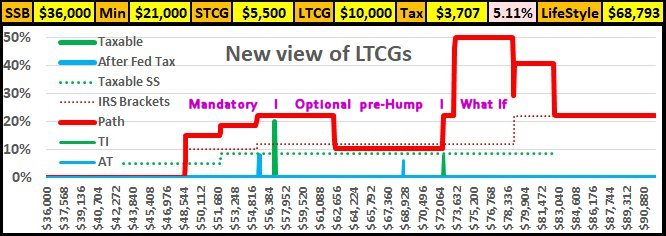

12% * 85% since each $1 of 0% LTCG causes 85c of SS to become taxable at 12%.

12% * 85% since each $1 of 0% LTCG causes 85c of SS to become taxable at 12%.

With the right combination of SS benefits, ordinary income, and capital gains, an additional $1000 of LTCG can incur no tax itself, but cause $850 of SS to become taxable, incurring $850 * 12% = $102 tax.Taxation of SS income goes from 0% to 50% to 85% taxable, not from 0% to 85% in one step.

There is a mistake here somewhere...

Definitely letting the tax tail wag the dog here...

Thanks to everyone for their advice, it has helped us make our final plans.

We will start our standard brokerage accounts as soon as possible and we will track our investment dates and amounts on a spreadsheet. Hopefully all of the investments will grow into capital gains, but we know that some will probably result in short term losses. Near the end of each year, we will generate the necessary short term gains to offset the losses, then take as many long term gains as we can while remaining below the point where those gains will become taxable. If we still have room for more pre 22% (40.1% marginal) income, we will withdraw what we can and move the cash into our standard account, and, if the market seems right, invest it.

Basically we are creating an account that is in the middle of an IRA and a Roth. Most of the assets in the account will be tax free return of capital while all of the matching short term gains and losses will be tax free transitions while almost all of the future growth will be limited to 10.2% Federal Taxes.

Is this something that was recommended to you or are you creating?

I've never heard of one that involves recognizing CG(L) routinely as a strategy. Is this something that was recommended to you or are you creating?

We will be making smaller and smaller 22.2% IRA withdrawals each year while creating larger and larger 10.2% LTCGs as our Tax Free (return of capital) investments grow.

T When she turns 70 her survivor SSB will almost double as her personal SSB and her Traditional IRA will be zero.

For many folks, it's a simple way to reduce the overall tax rate. "Optimizing" this aspect of federal taxation isn't easy, or even advisable, but taking advantage of at least some of the lower rate probably doesn't require doing anything that would have one deviating from their asset allocation targets. If things went up, you sell enough of the fund to generate the income to fill the need, and in the next minute you buy a similar fund. They're all very highly correlated. Not that hard, and doesn't change the investment profile.Definitely letting the tax tail wag the dog here...

For many folks, it's a simple way to reduce the overall tax rate. "Optimizing" this aspect of federal taxation isn't easy, or even advisable, but taking advantage of at least some of the lower rate probably doesn't require doing anything that would have one deviating from their asset allocation targets. If things went up, you sell enough of the fund to generate the income to fill the need, and in the next minute you buy a similar fund. They're all very highly correlated. Not that hard, and doesn't change the investment profile.

Why does this seem super ironic to me? Somebody is trying to reduce taxes by realizing gains to fill tax brackets requiring tax payments. After paying the tax, you have less to invest.

Why not just leave low basis assets invested? Unlike Charles Barkley, I hope to have assets remaining in my estate when I die. Wouldn't my lifetime effective tax rate be less if I deferred as much gain as possible to transfer tax free? When I need money now, one consideration I use is to consume financial assets that have a high basis to pay less tax now.

If I need money to pay bills, I would have that in a less risky asset.

This seems to suggest somebody is planning to pay tax on all their unrealized gains before the end of the game (death? running out of money?).

Cap gain harvesting relies on two things: the availability of the 0% cap gains bracket, and the premise / assumption / determination that one will be realizing that cap gain later.

If one can't use the 0% bracket (a high W-2 earner, for example), or does not expect to realize the cap gain later (a multimillionaire on hospice, for example), then cap gain harvesting would be unadvisable.

It's a tax strategy. Like most tax strategies, it works in some situations and not in others.

For many folks, it's a simple way to reduce the overall tax rate. "Optimizing" this aspect of federal taxation isn't easy, or even advisable, but taking advantage of at least some of the lower rate probably doesn't require doing anything that would have one deviating from their asset allocation targets. If things went up, you sell enough of the fund to generate the income to fill the need, and in the next minute you buy a similar fund. They're all very highly correlated. Not that hard, and doesn't change the investment profile.

I realized gains to pay living expenses not covered by other income. I just this week sold $31k in stocks with $18k in gains to pay my quarterly estimated Federal taxes for a Roth conversion. Those gains were offset by short term losses I took and reinvested into a different stock. There are lots of different strategies and I don’t know why you’d say it’s unadvisable.

We are going to pay off our mortgage this year, so, we are thinking about starting a standard brokerage account for the creation of LTCGs. As we understand it, LTCGs are tax free income as long as we are in the 12% Federal tax bracket.

Just a couple points:

1) The tax free thing is based on a $ amount, not a tax bracket. This may change in the future.

2) We sold $85K in stocks on 1/3/22. $83.5K was LTCG. I knew it was Fed Tax free but I completely forgot about state taxes. I grossly underpaid and will be receiving a bill from South Carolina with fines and fees at some point. Don't be dumb like I was...

The entire purpose is to create another Tax Free account and pay minimum taxes in doing so.

The first deposit of let’s say $10,000 will be made with 22.2% withdrawals from our IRA account.

Hopefully, year 1 will result in a 10% LTCG which will be withdrawn and taxed at only 10.2%. The Tax Free (return of capital) size of the account is now $11,000. Year 2 we might add another $9,000 of 22.2% IRA capital for a total of $20,000. Then, if we can create 10% LTCGs we will again only pay 10.2% tax on those gains bringing us to $22,000.

We will be making smaller and smaller 22.2% IRA withdrawals each year while creating larger and larger 10.2% LTCGs as our Tax Free (return of capital) investments grow.