You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thoughts on TESLA

- Thread starter frayne

- Start date

- Status

- Not open for further replies.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Musk just announced job cut of 7% of his work force.

For the last quarter, Tesla produced 86,555 cars with 45,000 employees. That's an annualized rate of 7.7 cars/employee.

Ford has 202,000 employees worldwide, producing 6,600,000 vehicles in 2017. That's 32.7 cars/employee.

Just a very ball park measure, FWIW.

Important to also note that Tesla/Musk has been pushing his employees really hard just to make the previous goals, so how is Musk going to make his increased production with fewer employees? And employees were told by working hard and long hours they would all share in the success of Tesla, there's 3150 employees now who won't. Got to think this is really deflating of what was already a low moral.

I think a serial hybrid of this type would be much more attractive to me than a pure plug-in. I'd like to be able to plug it in to run pure electric for my typical 40 mile daily use, but with the range extender so going farther is no problem.For cruising, the typical EV needs about 20 kW continuously from its battery. A range extender ICE driving a generator only needs to supply that. And 20 kW is about 30 HP, which can be provided by a small 0.5-liter engine (30 cubic in). That is the same as the engine of a mid-size motorcycle.

With the range extender ICE, the battery can be made smaller, and also lighter to make up for the small gasoline engine.

The little ICE extenders will be something to see. Point-optimized for a specific output, I'd guess they'll use simple turbos (no waste gate needed) to get the most out of every drop of fuel. Rather than being used to compress air for combustion, the turbo might be part of a turbocompounding setup to extract waste heat to drive the generator directly (some large piston aircraft engines did this). It will probably be simplest and cheapest to just let the turbo turn its own small generator to charge the battery, this eliminates all the gearing and clutches otherwise needed to allow it to contribute to turning the main engine crankshaft or a common generator.

Also, the "waste heat" from an ICE can come in handy for providing cabin heat for an otherwise electric car. It ain't waste heat if it is keeping your toes warm and the glass free of frost/condensation.

It will be interesting to see how they handle a situation where the battery "buffer" gets run down due to extended high power use (e.g. climbing a grade at 70 MPH for 30 minutes). If energy use exceeds the capacity of the ICE and slowly depletes the battery, at some point there's no reserve for additional acceleration. That's not a safe situation, drivers should be able to expect the same response every time they press the pedal. I'd expect some warnings as battery gets low, and maybe even a "pull over soon to allow battery recovery" warning if the situation grew serious.

Last edited:

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

... I highlighted the above keywords. This concept is not new, has been talked about for decades, but has not been carried out in a production vehicle.

For cruising, the typical EV needs about 20 kW continuously from its battery. A range extender ICE driving a generator only needs to supply that. And 20 kW is about 30 HP, which can be provided by a small 0.5-liter engine (30 cubic in). That is the same as the engine of a mid-size motorcycle.

With the range extender ICE, the battery can be made smaller, and also lighter to make up for the small gasoline engine.

I think a serial hybrid of this type would be much more attractive to me than a pure plug-in. I'd like to be able to plug it in to run pure electric for my typical 40 mile daily use, but with the range extender so going farther is no problem.

It will be interesting to see how they handle a situation where the battery "buffer" gets run down due to extended high power use (e.g. climbing a grade at 70 MPH for 30 minutes). If energy use exceeds the capacity of the ICE and slowly depletes the battery, at some point there's no reserve for additional acceleration. That's not a safe situation, drivers should be able to expect the same response every time they press the pedal. I'd expect some warnings as battery gets low, and maybe even a "pull over soon to allow battery recovery" warning if the situation grew serious.

Regarding a "serial hybrid", you are unlikely to see a "pure" serial hybrid, where the engine is strictly a generator for a buffer battery. The reason is, as you cruise down the highway, you are converting mechanical to electrical back to mechanical, and experiencing losses along the way. And additional losses in the battery for any buffering needed.

Because of that, they likely will also have a mechanical link from the engine to the wheels, to circumvent those losses. But since they can rely on the battery/motor for low speeds, and acceleration, and reverse, that mechanical link has the potential to be simplified. It would not need to handle the high torque of starting from a stop, or from hard acceleration. I think one of the new Hondas has a single speed connection between engine and wheels. Seems you could use a CVT to better match optimum engine speed, the main limitation with CVT is torque, and that torque can be carried by the battery/motor.

I expect to see more advances in this area, maybe with opposed piston engines, HCCI mode, and other high efficiency techniques.

And yes, the power requirements do go up when you consider someone might expect to do 75 mph into a 20 mph headwind (effective 95 mph, and wind resistance would greatly increase power needs). We saw that Tesla range drop to about 100 miles with a trailer in the mountains. So yes, maybe 2x the HP needed in the ICE to handle the extremes? Still small.

-ERD50

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

This is the Bloomberg article https://finance.yahoo.com/news/tesla-cut-7-percent-jobs-103311804.html

The action is needed to survive. The products are high cost to mfg. and Tesla needs to concentrate on the high end of the market. Let the majors focus on lower end mass market.

The action is needed to survive. The products are high cost to mfg. and Tesla needs to concentrate on the high end of the market. Let the majors focus on lower end mass market.

The action is needed to survive. The products are high cost to mfg. and Tesla needs to concentrate on the high end of the market. Let the majors focus on lower end mass market.

Just the opposite. Musk said that the focus must shift to a lower cost Model 3 that will appeal to a larger market:

"In Q3 last year, we were able to make a 4% profit. While small by most standards, I would still consider this our first meaningful profit in the 15 years since we created Tesla. However, that was in part the result of preferentially selling higher priced Model 3 variants in North America. In Q4, preliminary, unaudited results indicate that we again made a GAAP profit, but less than Q3. This quarter, as with Q3, shipment of higher priced Model 3 variants (this time to Europe and Asia) will hopefully allow us, with great difficulty, effort and some luck, to target a tiny profit.

However, starting around May, we will need to deliver at least the mid-range Model 3 variant in all markets, as we need to reach more customers who can afford our vehicles. Moreover, we need to continue making progress towards lower priced variants of Model 3. Right now, our most affordable offering is the mid-range (264 mile) Model 3 with premium sound and interior at $44k. The need for a lower priced variants of Model 3 becomes even greater on July 1, when the US tax credit again drops in half, making our car $1,875 more expensive, and again at the end of the year when it goes away entirely."

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

Ok Tesla Haters , reserve your Audi E-Tron

https://www.audiontario.com/audi-et...MIwcDG1of43wIVj2l-Ch1AygI1EAEYASAAEgKWP_D_BwE

Don't care for the styling, especially the grille , lets see how it drives

https://www.audiontario.com/audi-et...MIwcDG1of43wIVj2l-Ch1AygI1EAEYASAAEgKWP_D_BwE

Don't care for the styling, especially the grille , lets see how it drives

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

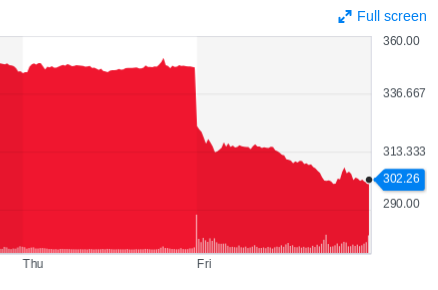

Looks like the market didn't like the news of Tesla cutting staff, down 13%/$45 and on a day that market is up over 1%.

Now, if stock can't get to $360 soon, those convertible shares coming due are going to cause more pain for Tesla's cash flow and the price will see another 10% drop or more.

Great opportunity for the Tesla fans to get in on the dip if they the kahoonies to weather the pending storm.

Now, if stock can't get to $360 soon, those convertible shares coming due are going to cause more pain for Tesla's cash flow and the price will see another 10% drop or more.

Great opportunity for the Tesla fans to get in on the dip if they the kahoonies to weather the pending storm.

Lakewood90712

Thinks s/he gets paid by the post

- Joined

- Jul 21, 2005

- Messages

- 2,223

Just the opposite. Musk said that the focus must shift to a lower cost Model 3 that will appeal to a larger market:

."

The price target for the mass market is sub $30,000 and no tax credits. Tesla manufactures luxury cars IMO, I consider many of the model 3 features as such. The company, and products are incomparable with true mass production. The mad rush to push out a thousand cars a day with present methods at the Fremont plant is not sustainable IMO ( we don't know if costs of the push are being hidden). The company would need radical re- structuring in all aspects to do that. And that would kill the good things of Tesla, IMO.

The only new auto manufacturer of any scale, selling in the US in the last 50 years that has survived is the Huyndai / Kia group. And that co. was privately owned with unlimited financial resources.

Rant done for today.

mpeirce

Thinks s/he gets paid by the post

Regarding a "serial hybrid", you are unlikely to see a "pure" serial hybrid, where the engine is strictly a generator for a buffer battery. The reason is, as you cruise down the highway, you are converting mechanical to electrical back to mechanical, and experiencing losses along the way. And additional losses in the battery for any buffering needed.

Is this basically how diesel-electric locomotives work? A diesel engine generating electricity that drives electric motors that turn the wheels? I suppose the trains don't have batteries, but still.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is this basically how diesel-electric locomotives work? A diesel engine generating electricity that drives electric motors that turn the wheels? I suppose the trains don't have batteries, but still.

Correct, and w/o batteries.

And I had wondered about that, since you would think trains would be very conscious of efficiency. Yes, they are already very efficient relative to trucks, but fuel is still a big expense.

But it turns out trains have some other requirements that make electric motor drive beneficial.

A) To get traction from steel wheels on steel rails, they need to get power to lots of wheels. That's complicated mechanically, but easy with a motor on each axle and big wires.

B) They benefit from the high torque at stall and low speeds of the electric motor. All they need is the electronic controller. A comparable transmission would be very complicated (and you still need to get the mechanical power to the wheels). Steam engines had a similar torque curve.

Now I'm curious if there were ever many diesels that were not electro-motive drive? I'll need to look that up.

-ERD50

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Regarding a "serial hybrid", you are unlikely to see a "pure" serial hybrid, where the engine is strictly a generator for a buffer battery. The reason is, as you cruise down the highway, you are converting mechanical to electrical back to mechanical, and experiencing losses along the way. And additional losses in the battery for any buffering needed.

Because of that, they likely will also have a mechanical link from the engine to the wheels, to circumvent those losses. But since they can rely on the battery/motor for low speeds, and acceleration, and reverse, that mechanical link has the potential to be simplified. It would not need to handle the high torque of starting from a stop, or from hard acceleration. I think one of the new Hondas has a single speed connection between engine and wheels. Seems you could use a CVT to better match optimum engine speed, the main limitation with CVT is torque, and that torque can be carried by the battery/motor.

I expect to see more advances in this area, maybe with opposed piston engines, HCCI mode, and other high efficiency techniques.

And yes, the power requirements do go up when you consider someone might expect to do 75 mph into a 20 mph headwind (effective 95 mph, and wind resistance would greatly increase power needs). We saw that Tesla range drop to about 100 miles with a trailer in the mountains. So yes, maybe 2x the HP needed in the ICE to handle the extremes? Still small.

-ERD50

But the new Nissan e-Power is a strictly serial hybrid. The ICE engine has no mechanical linkage to the wheels. One Web site says the ICE runs at a constant 2500 rpm when needed. Nissan has not revealed the horsepower of the ICE, nor the capacity of the battery.

Nissan says it is not a plug-in car, which means the battery may be quite small. This then means the ICE has to run quite often. Quite strange.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

He is actually giving a pre-warning that 2019 is not going to be profitable. They have forward pushed as many expensive cars as they could in order to give the incentives to the higher priced cars, as incentives are evaporating for Tesla, he actually has to compete on costs to produce and by the end of 2019 the dropped incentive equals a price increase on Tesla's equal to the entire profit rate of the company on high price models -- of which the backlog demand has been satisfied. So a $3,000+ price increase to the end user on the cheaper Tesla's that have never been produced (despite solemn vows by Elon when he took $1,000 deposits) because they cannot be made at a profit is an issue for him and he is cutting where he can. Despite Elon Musk claiming they are making 1,000 model 3 per day current Bloomberg estimate is 4,600 per week.Just the opposite. Musk said that the focus must shift to a lower cost Model 3 that will appeal to a larger market:

"In Q3 last year, we were able to make a 4% profit. While small by most standards, I would still consider this our first meaningful profit in the 15 years since we created Tesla. However, that was in part the result of preferentially selling higher priced Model 3 variants in North America. In Q4, preliminary, unaudited results indicate that we again made a GAAP profit, but less than Q3. This quarter, as with Q3, shipment of higher priced Model 3 variants (this time to Europe and Asia) will hopefully allow us, with great difficulty, effort and some luck, to target a tiny profit.

However, starting around May, we will need to deliver at least the mid-range Model 3 variant in all markets, as we need to reach more customers who can afford our vehicles. Moreover, we need to continue making progress towards lower priced variants of Model 3. Right now, our most affordable offering is the mid-range (264 mile) Model 3 with premium sound and interior at $44k. The need for a lower priced variants of Model 3 becomes even greater on July 1, when the US tax credit again drops in half, making our car $1,875 more expensive, and again at the end of the year when it goes away entirely."

With the 900 million due by March he is doing what he can to keep price over $360 a share otherwise he needs 900 million and most likely would be forced into an equity offering that would yield less than the $360 so have to dilute further with additional shares.

It will be interesting to see if the auditors go along with the decline in warranty expense per car that Tesla initiated in the 3rd quarter.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

But the new Nissan e-Power is a strictly serial hybrid. The ICE engine has no mechanical linkage to the wheels. One Web site says the ICE runs at a constant 2500 rpm when needed. Nissan has not revealed the horsepower of the ICE, nor the capacity of the battery.

Nissan says it is not a plug-in car, which means the battery may be quite small. This then means the ICE has to run quite often. Quite strange.

Interesting, I'll need to read up on that. I guess they decided the conversion losses were a reasonable trade-off (the definition of engineering!)?

Man, I'm glad I said "unlikely to see"! I'm sticking with my "never say never" creed!

-ERD50

The price target for the mass market is sub $30,000 and no tax credits. Tesla manufactures luxury cars IMO, I consider many of the model 3 features as such. The company, and products are incomparable with true mass production.

The mad rush to push out a thousand cars a day with present methods at the Fremont plant is not sustainable IMO ( we don't know if costs of the push are being hidden). The company would need radical re- structuring in all aspects to do that. And that would kill the good things of Tesla, IMO. The only new auto manufacturer of any scale, selling in the US in the last 50 years that has survived is the Huyndai / Kia group. And that co. was privately owned with unlimited financial resources.

Just under $30,000 is right where the Camry, Accord, Legacy, etc. buyers are at. Add the same types of options as the Model 3 and they will bump up into the low $30k range. If Tesla can get the Model 3 down to $35k without incentives, then they are going to be competitive with those cars (and similar ones)

I think the Tesla has a competitive advantage over these sedans with gas savings, performance, and technology. What is it worth to cut your gas bill in half or more? I think a $5,000 difference is not a show-stopper for those willing to spend $30k on a Camry. Of course, there will always be a market for the least expensive cars, but the majority of sedan buyers are in that 30-40k range (whether we call it luxury or not).

Not sure what you mean by no new big car manufacturers entering the US since 1969. The Japanese car makers nearly put Detroit out of business in the 80s. A superior product can sell. That is why Tesla is the 4th or 5th best selling sedan after being on the market just over 1 year.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just bought on the dip.

Well, you bought on a drop, we won't know if it was a dip until/if we see it recover enough for you to decide to sell at a profit.

Did you buy more - looks like it dropped another $10 since you bought.

Good Luck! -ERD50

Attachments

He is actually giving a pre-warning that 2019 is not going to be profitable. They have forward pushed as many expensive cars as they could in order to give the incentives to the higher priced cars, as incentives are evaporating for Tesla, he actually has to compete on costs to produce and by the end of 2019 the dropped incentive equals a price increase on Tesla's equal to the entire profit rate of the company on high price models -- of which the backlog demand has been satisfied. So a $3,000+ price increase to the end user on the cheaper Tesla's that have never been produced (despite solemn vows by Elon when he took $1,000 deposits) because they cannot be made at a profit is an issue for him and he is cutting where he can. Despite Elon Musk claiming they are making 1,000 model 3 per day current Bloomberg estimate is 4,600 per week.

If Musk had claimed they would be making 4,500 per week currently, would you be praising him? Would you have predicted it a year ago?

Why do you care if he is aggressive in his estimates? Take a step back and try to recognize that what Tesla is doing to the auto industry is pretty amazing.

Last edited:

Well, you bought on a drop, we won't know if it was a dip until/if we see it recover enough for you to decide to sell at a profit. Did you buy more - looks like it dropped another $10 since you bought.

Good Luck! -ERD50

Let's just say I haven't sold, yet. I'm still calling it a dip.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

My understanding is by the terms of Tesla's ABL they were to hold aside, as of 1/1/19, the $920 million plus an additional $400 million (to ensure liquidity needs) in cash and equivalents.He is actually giving a pre-warning that 2019 is not going to be profitable. They have forward pushed as many expensive cars as they could in order to give the incentives to the higher priced cars, as incentives are evaporating for Tesla, he actually has to compete on costs to produce and by the end of 2019 the dropped incentive equals a price increase on Tesla's equal to the entire profit rate of the company on high price models -- of which the backlog demand has been satisfied. So a $3,000+ price increase to the end user on the cheaper Tesla's that have never been produced (despite solemn vows by Elon when he took $1,000 deposits) because they cannot be made at a profit is an issue for him and he is cutting where he can. Despite Elon Musk claiming they are making 1,000 model 3 per day current Bloomberg estimate is 4,600 per week.

With the 900 million due by March he is doing what he can to keep price over $360 a share otherwise he needs 900 million and most likely would be forced into an equity offering that would yield less than the $360 so have to dilute further with additional shares.

It will be interesting to see if the auditors go along with the decline in warranty expense per car that Tesla initiated in the 3rd quarter.

“Convertible Notes Maturity Default” shall mean the occurrence of any of the following events: (i) any of the Company’s 2018 Convertible Notes shall be outstanding on April 1, 2018 and the sum of Unrestricted and Available cash and Cash Equivalents of the Company and its Subsidiaries and Excess Availability as of such date is not in excess of the principal amount of 2018 Convertible Notes then outstanding plus $400,000,000 or (ii) any of the Company’s 2019 Convertible Notes are outstanding on January 1, 2019 and the sum of Unrestricted and Available cash and Cash Equivalents of the Company and its Subsidiaries and Excess Availability as of such date is not in excess of the principal amount of 2019 Convertible Notes then outstanding plus $400,000,000."

So Tesla should already be in a position to make the payout, but don't know what that means for the free cash going forward. It's getting real for Musk. I just continue to wonder how they Musk will work to pump up the stock based on today's decline. Just have to wonder how Musk was able to float almost a billion in the convertible at only 0.25%, guess it was thought this was going to be $500/sh stock at conversion day. Certainly if Tesla needs to secure funding post a payout it will cost them considerably more than 0.25%.

If I understand the terms correctly, the stock price for conversion is the product of the 20 trading days prior to the conversion date, so the clock will begin ticking later this month, so price needs to start to take a jump soon to avoid the payout.

https://www.sec.gov/Archives/edgar/data/1318605/000119312514077288/d678614d424b5.htm

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Well, you bought on a drop, we won't know if it was a dip until/if we see it recover enough for you to decide to sell at a profit.

Did you buy more - looks like it dropped another $10 since you bought.

Good Luck! -ERD50

Do you think Musk thought the email / release of employees would have resulted in stock drop of 13%? I'm thinking he thought this would be a good news story and move the stock higher. Interesting on the timing.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Do you think Musk thought the email / release of employees would have resulted in stock drop of 13%? I'm thinking he thought this would be a good news story and move the stock higher. Interesting on the timing.

Yes I believe he knew it would be bad for the stock, but he did not want it to come as a result of released financials that they did not meet targets he promised, so he can show he is proactive and has everything under control.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

If Musk had claimed they would be making 4,500 per week currently, would you be praising him? Would you have predicted it a year ago?

Why do you care if he is aggressive in his estimates? Take a step back and try to recognize that what Tesla is doing to the auto industry is pretty amazing.

I believe any CEO, especially one who is viewed as a prototype for future CEO's should quote facts and not hopes, especially if he already has already been charged with fraud. CEO's that tend to blow smoke to promote themselves in the end usually only hurt their companies. If what he is doing is truly that amazing he would not try and provide the facade that production is 33% higher than it actually is. What you are saying is almost verbatim the same things said about Theranos when people questioned actual facts about the company. Car companies have been known and proven over the years to hide truth in order to prop up stock prices. A good CEO would not be one that basically is an example of lying is ok if it helps the stock price and makes the company look better - since cars are instrumental in keeping people safe production targets and problems should not be lied about in an aim to help the stock price.

That Elon Musk has gotten excellent electric cars in the hands of wealthy individuals through massive tax breaks while paying workers 40 percent less than the competition is truly amazing I must admit.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Do you think Musk thought the email / release of employees would have resulted in stock drop of 13%? I'm thinking he thought this would be a good news story and move the stock higher. Interesting on the timing.

Don't know what Musk thought. Sometimes a stock does go up on this sort of news, anticipating lower costs, but it could be as Running_Man says, he just had to get it out there and be proactive.

Lots of things in play right now. That convertible debt. For the near future, can they keep selling $44K+ Model 3's, or will those with the reservations and others be looking for the $35K car many expected (that gets more expensive as the tax credits fade out). Will that be offset by new sales overseas?

For sub $44K cars, can they maintain margins? No doubt costs will come down as they streamline production, suppliers will become more efficient, but will they come down enough?

While some companies are successful with only premium priced models, it does seem that Tesla's goal is to reach down into the mid-lower-mid range.

Lots of challenges. I have no crystal ball, not enough insight to know if they can succeed or not, I'll just have to watch as time goes on.

-ERD50

aja8888

Moderator Emeritus

When I ran a manufacturing plant back in the day, we didn't fire/layoff workers unless we were absolutely positive work was drying up. My "gut" feeling is that now that the incentives are drying up and the BACKLOG of Model 3's is worked off, the forward sales pipeline looks thin.

We also used to make some product ahead of the layoffs that was commonly bought by customers just to keep it in stock in case we cut back too far and raw materials were thinned too slim. Maybe he's got an inventory of Tesla's that are available in a short notice to give the impression he can deliver even though the layoffs occurred.

We also used to make some product ahead of the layoffs that was commonly bought by customers just to keep it in stock in case we cut back too far and raw materials were thinned too slim. Maybe he's got an inventory of Tesla's that are available in a short notice to give the impression he can deliver even though the layoffs occurred.

I believe any CEO, especially one who is viewed as a prototype for future CEO's should quote facts and not hopes, especially if he already has already been charged with fraud. CEO's that tend to blow smoke to promote themselves in the end usually only hurt their companies. If what he is doing is truly that amazing he would not try and provide the facade that production is 33% higher than it actually is. What you are saying is almost verbatim the same things said about Theranos when people questioned actual facts about the company. Car companies have been known and proven over the years to hide truth in order to prop up stock prices. A good CEO would not be one that basically is an example of lying is ok if it helps the stock price and makes the company look better - since cars are instrumental in keeping people safe production targets and problems should not be lied about in an aim to help the stock price.

Is it not possible that he is just an optimist? Theranos was an outright fraud that sold a product which could not do what was claimed. It is more than a little bit of hyperbole (the same thing you accuse Musk of) to say that a Tesla Model 3 is a fraudulent product. Last time I checked it gets the mileage claimed, is relatively safe, and customers rave about it (with the exception of the occasional manufacturing defect).

That Elon Musk has gotten excellent electric cars in the hands of wealthy individuals through massive tax breaks while paying workers 40 percent less than the competition is truly amazing I must admit.

God forbid! You do know that they are trying to build cheaper ones and that the tax breaks will end soon. Unemployment rate is at historic lows, so I think his employees have options. Cheer up.

- Status

- Not open for further replies.

Similar threads

- Replies

- 2

- Views

- 252

- Replies

- 4

- Views

- 292

- Replies

- 10

- Views

- 411