RetiredHappy

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2021

- Messages

- 1,589

Many of you have posted the reduced cost of managing your own investments. We have our investments managed since 2008. The fees are getting so large that it is hard to ignore even though we pay "only" 0.8%. The fees are enough to support a person's living expenses! Remember the advertisement, we make more when your investments grow more? Well, they have grown to a level that we no longer feel that we should continue to spend the money.

We have been thinking of moving to a lower cost investment management fee company like Vanguard. We also spent some time to research Vanguard ETFs which we are liking what we see.

We interviewed a Vanguard FA today and we definitely came away with why the hell do we want Vanguard FA to manage our portfolio. At this point we are leaning towards the self-directed route unless our current wealth management company comes back with much reduced fees.

Anyway, here is a rough investment strategy that we are thinking of going with. Our understanding of various ETFs is still very elementary at this point and hence the question.

Currently we have annuities which make up 18% of our investments. We consider those as part of fixed income. We need a total of about $100K of funds from our taxable investments to cover the next 7 years until all income streams kick in. Besides the $100K, our income needs will be met by SS, annuities and RMD.

We have equal amount of taxable investments and tax deferred investments, not counting the annuities. We are at the 22% to 24% tax bracket.

We are thinking of going with 85% to 90% equities for both taxable and tax deferred investments, with the remainder in a balanced fund like VBIAX and $100K in VTIP or something like that which acts like cash. We need help in understanding how VTIP works. We figure that $100K in VTIP in taxable account will cover the next 7 years, plus always funding it at about $100K to cover emergency needs. In tax deferred accounts, we will turn off dividend reinvesting and also keep another $100K in VTIP (2 to 3 years of withdrawal) to make up for the difference in RMD and dividends.

I need veterans here to help critique our strategy.

Thanks!

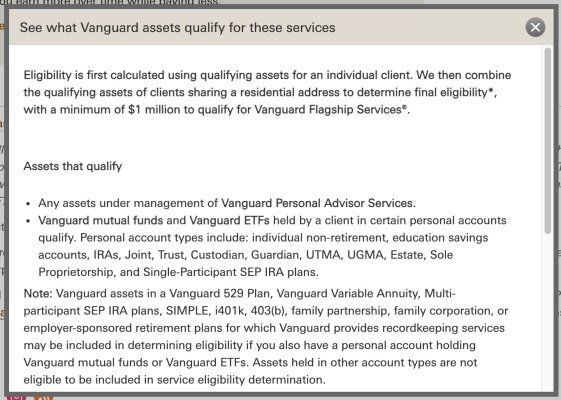

We have been thinking of moving to a lower cost investment management fee company like Vanguard. We also spent some time to research Vanguard ETFs which we are liking what we see.

We interviewed a Vanguard FA today and we definitely came away with why the hell do we want Vanguard FA to manage our portfolio. At this point we are leaning towards the self-directed route unless our current wealth management company comes back with much reduced fees.

Anyway, here is a rough investment strategy that we are thinking of going with. Our understanding of various ETFs is still very elementary at this point and hence the question.

Currently we have annuities which make up 18% of our investments. We consider those as part of fixed income. We need a total of about $100K of funds from our taxable investments to cover the next 7 years until all income streams kick in. Besides the $100K, our income needs will be met by SS, annuities and RMD.

We have equal amount of taxable investments and tax deferred investments, not counting the annuities. We are at the 22% to 24% tax bracket.

We are thinking of going with 85% to 90% equities for both taxable and tax deferred investments, with the remainder in a balanced fund like VBIAX and $100K in VTIP or something like that which acts like cash. We need help in understanding how VTIP works. We figure that $100K in VTIP in taxable account will cover the next 7 years, plus always funding it at about $100K to cover emergency needs. In tax deferred accounts, we will turn off dividend reinvesting and also keep another $100K in VTIP (2 to 3 years of withdrawal) to make up for the difference in RMD and dividends.

I need veterans here to help critique our strategy.

Thanks!

Last edited: