audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

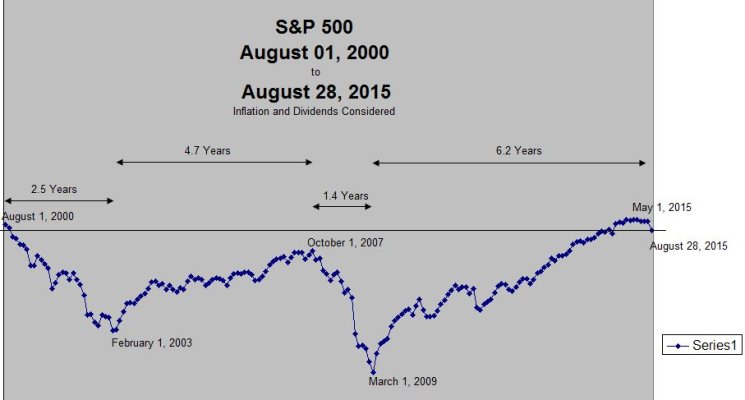

Those are the ones I'm insuring against by having 7 years to go without selling equities. When people say 2 years, I'm thinking "not nearly enough". Just looking at the S&P 500, with dividends, it looks like roughly 6.2 years from peak to above that old peak for the 2003, and 5.8 years peak to above that old peak for the 2008. And that doesn't count inflation. If you do, then it's 12.7 years from the 2000 peak to break-even. This is according to S&P 500 Return Calculator - Don't Quit Your Day Job... . I've almost talked myself into selling it all! Since August 2000 to May 2015, the return of the S&P 500 has been an inflation adjusted 2%! It's gone down 4.2% since May (only that figured does not including dividends). That's a lot of years to get back to "even". But the alternative was to lose buying power if you were in bonds instead.

I figure that as long as cash and fixed income cover 7 years of after-tax spending, I'm covered well enough. 4% x 7 years is 28% of portfolio in fixed income. And that case covers taxes too. My fixed income allocation is much higher than that, to that gives me room to buy stocks when down plus still have X years in living expenses not in stocks.

I do have a couple years cash outside the portfolio, but the other years are covered by cash plus bonds that is part of the portfolio AA.

As the portfolio appreciates and you rebalance, the fixed income portion increases in absolute terms. Then it's there for you when you have to make it through market down years.

If you rebalanced when the S&P was way down, you didn't have to wait as long for your portfolio to break even.