exnavynuke

Thinks s/he gets paid by the post

There's nothing about my current strategy that would tend to make my few losses larger than my 89% gains. That's what happened but it's less likely to happen now. There was a time when I had more serious liquidation issues from doubling down but I don't do that any more. At least not as often.

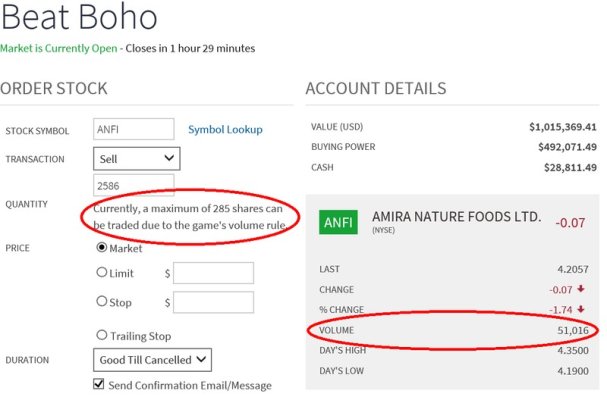

I'm Currently holding a big loser that I bought because I wasn't being careful. IRL, I'd be somewhat more careful. I don't want to make excuses so I won't say I'm certain I wouldn't have bought it IRL but I immediately had second thoughts and did more research (I think I tried Yahoo news instead of just Google and Fidelity) and I quickly found what I was afraid if. The cause of the drop was more serious than I had previously read. The order wasn't yet filled, I thought I could cancel, but I couldn't.

The above is different from something like a betting on red scenario.

As I mentioned before, you're largest problem is having no defined risk:reward strategy that anyone can possibly discern. If you're willing to wait until you have a 25% loss, you should be EXPECTING a gain at least double that much over in order to be operating under any "risk:reward" ratio I've ever heard of a successful trader using. Your "risk" tolerance, however, has been summed up as "whatever" and your "expected" gain seems to be "some", meaning you'll sell for a % gain a lot less than you'll sell a % loss on the same trade. Being willing to lose more than you think you'll gain if things go your way means that over time you will almost always lose out when your losers eat all your gains and then some (as has happened to you for the past year).

Until you change your trading style to control risk, you'll be net negative in the long run, even if you get lucky and go positive over any given time-frame. That's just how statistics work. In a more traditional market (with lower percentage "winners") you'd likely be doing much worse honestly.