A lot of this topic depends on your personal perspective of retirement. What income level do YOU need to provide YOU with the lifestyle YOU want for the rest of YOUR life.

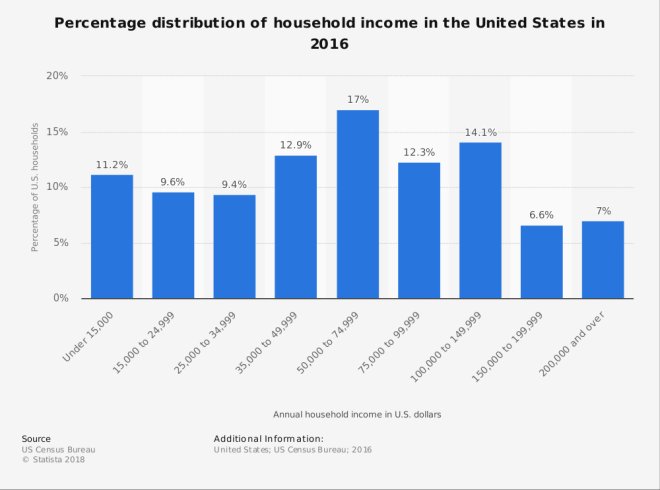

The tallest 4 bars in the middle of this graph show that more than 56% of the households in the US earn between $35,000 and $150,000, and many of them could be facing the excessive marginal tax rates shown in section C of the following graphic.

Section C generally starts when you enter the 22% Federal Bracket while your Social Security benefits are being taxed at an 85% level. 185% of 22% results in a marginal tax rate of 40.7%. The 49.95% marginal rate only exists if your also have LTCG or Dividend income.

| SS | ordinary | Taxability | Taxable | AGI - | Taxes | Gross | After | Tax | | | |

| Benefit | Income | Basis | SSB | $12,000 | Paid | Income | Tax | Rate | | | |

| $35,000 | $32,554 | $50,054 | $18,146 | $38,700 | $4,454 | $67,554 | $63,101 | 6.59% | | | |

| $25,000 | $34,852 | $47,352 | $15,849 | $38,700 | $4,454 | $59,852 | $55,398 | 7.44% | Extra | At | Tax |

| $25,000 | $41,206 | $53,706 | $21,250 | $50,456 | $7,040 | $66,206 | $59,166 | 10.63% | $6,355 | 40.7% | $2,586 |

| $25,000 | $46,251 | Over Max | $21,250 | $55,501 | $8,150 | $71,251 | $63,101 | 11.44% | $5,045 | 22% | $1,110 |

If you are an individual who desires a $63,101 after federal tax lifestyle, the taxable AGI minus standard deduction column of line 1 indicates that you can achieve that lifestyle with a $35,000 SSB without entering the 22% Federal bracket.

If your SSB is only $25,000, one way to look at the overall changes from line 1 to line 4 is that you had to withdraw an extra $13,696 from your IRA to get over the 40.7% Tax Hump to get the extra $7,703 needed to reach your lifestyle goal on the lower SSB level.

- Line 3: some of the extra cash was taxed at the 40.7% marginal level.

- Line 4: some was taxed at the standard 22% federal bracket.

- Some was just plain taxed at normal levels!

- $16,854 of your $35,000 SSB was tax free on line 1.

- Only $3,750 of your $25,000 SSB was tax free on line 4.

- You lost $13,104 of tax free income!

The end result is that the extra $13,696 that was withdrawn from your IRA only raised your standard of living by $7,703. The remaining $5,993, 43.76%, went somewhere else!

Bottom line: There is no simple answer! You have to do your own personal math. What lifestyle do you want? What will it cost? Where will that money come from? And most of all, act as if you are already there and calculate your after tax income for if I do it this way and if I do it that way. Finally, make your own personal decision!