Can we stop on this CD versus treasury minutiae and get back to the bubble?

Thank you. I'm the OP. From what I've read of responses, people seem to feel:

1. Bonds are no better, and likely worse, so stocks look good by comparison especially when comparing the dividend yield to treasury coupons.

2. That timing is a fool's errand because you need to get it right twice with the sell and with the buy.

My thoughts:

I never suggested that bonds were any great bargain. There's also the option of sitting on boring cash (and yes CDs or FDIC insurance online savings accounts are a reasonable option IMO) and patiently waiting for a better entry point.

Furthermore, regarding the timing, if you look at past bubbles, there were many opportunities to exit and re-enter later that, while not exactly nailing the peak upon exit, nor catching the exact low upon re-entry, still yielded better results with significantly less volatility than simply holding. (For instance, you could have exited the market in 1998, about two years after Greenspan's irrational exuberance comments, missed the incredible gains that followed in 1999 and early 2000, and re-entered anytime between 2002 - 2003 and done better than simply holding the whole time, while earning interest during the out-of-the-market period. Similar story for the up and down around the Great Financial Crisis.) Point is: It's like horse shoes; close enough is good enough.

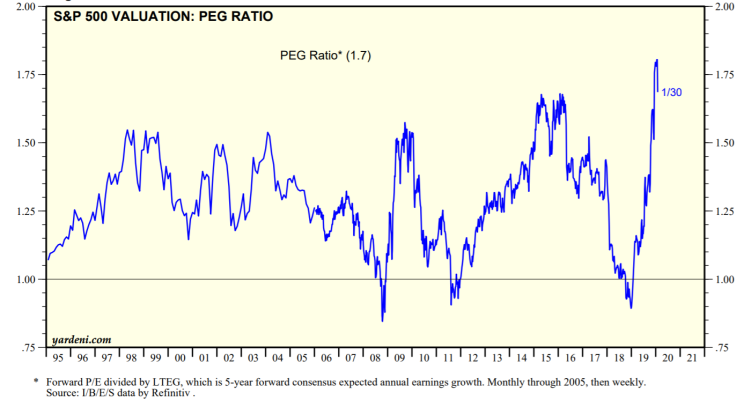

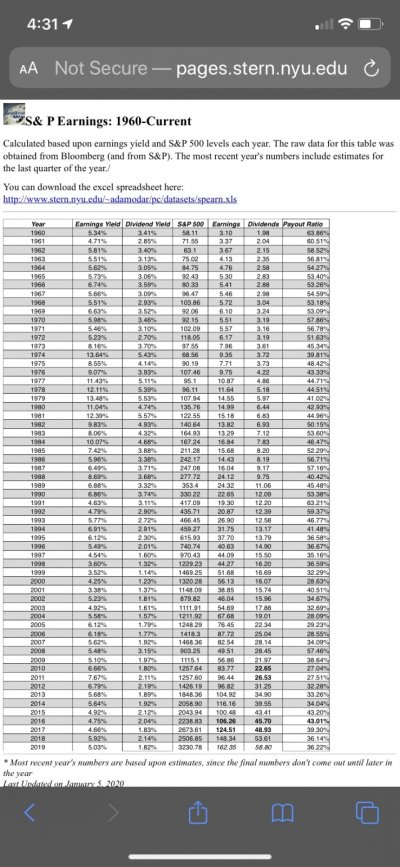

SO....does anyone disagree with my original thesis that aggregate profits have been flat for 7+ years, and interest rates are no lower now than then, and therefore the 2x+ jump in stock prices is unjustified? Does someone have an argument disproving the data points, or a point of view that I'm totally missing regarding overvaluation?