Quiet and boring, some like it that way. Nowhere in FL is safe from hurricanes. A number of Tampa residents drove to Orlando during the multiple hurricanes in 2004 and the hurricane eye went up I- 4 right through Kissimmee and Orlando. The price gouging on contractors fixing your damaged homes at that time was out of control. The snakes and some gators came out of the lakes at that time.Ssssssshhhh...... Venice, Florida

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Another Florida Question - Retirement location

- Thread starter SunnyOne

- Start date

I can't imagine that avoiding hurricane country would not be the #1 criterion in picking a retirement area. I deployed with Red Cross for Hurricane Michael and could never have imagined the devastation I saw. Most striking were the 50+ year old trees knocked over like bowling pins. How many lesser hurricanes had they survived? How many stronger hurricanes are coming? How many more years after this one will they run out of hurricane names?

With respect, to fear the insurance cost more than the hurricane is, I think, due to not paying attention.

My point is that the entire state is hurricane country.... even as far from the coast as possible (if not swamp) you are within 60 miles of the coast which is not enough to weaken a storm if it's on the right path. Live in FL and you accept the risk. I absolutely do not recommend buying in flood zone unless the buyer is willing to view the house as "disposable" and price the possibility into their decision. After all, the barrier islands are simply above water sandbars....

WRT insurance, rates are crazy here and often it is hard to get insured (at least with a good carrier). A storm doesn't even need to hit your area/make a claim in order for your rates to dramatically rise. Flood insurance can even be more fun as the risk maps get reworked... I had coworkers have their renewals jump from $5k/yr to over $15K/yr a few years back for their flood policies! Google some old news articles and you'll see some sob stories....

Many carriers may not be not underwriting in your area due to risk exposure... doesn't seem to make sense how they draw the lines from the consumer perspective. For instance, in Feb 2019 I had a condo (1980's code) on Treasure Island under contract and USAA would underwrite that property... on the beach. I ended up buying in St Pete (post 2004 code, 70' elevation, off the beach/highest risk zone) and they wouldn't underwrite. Got "Podunk Insurance" to get through closing. If you have a preferred insurer, call regularly to see if they will underwrite you as they are constantly updating their maps/risk assessments/gaining/losing exposure. After living in this home for 3 months, I was calling USAA about my auto policy (auto is also very high in FL compared to a lot of the US) and had them transfer me to property just to check... low and behold, on that day they were willing to underwrite when they wouldn't 3 months prior. On other homes I owned, I was never able to get a preferred underwriter. I picked the best of the worst that would cover me after looking at their balance sheets (pretty much all were pretty bad but the catastrophic fund would eventually bail out the homeowner in a major event). I pay a bit more for USAA (glad they'll cover me as they never would my other house) but I've been with them a long time and am happy with their service and comfortable with their financial position.

I love living here but don't think anywhere is "safe" from tropical weather events!

FLSunFire

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Good Points made here, another important for consideration for insurance availability is being in an "X" flood zone. There are very few of those left in desirable beach locations. As a result the home prices reflect the good fortune.

Tower Hill just dropped a lot of beach communities after 25 years of covering them. Frontline still insures well built properties in "X" flood zones ...... don't ask me how I know.

Tower Hill just dropped a lot of beach communities after 25 years of covering them. Frontline still insures well built properties in "X" flood zones ...... don't ask me how I know.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can't imagine that avoiding hurricane country would not be the #1 criterion in picking a retirement area. I deployed with Red Cross for Hurricane Michael and could never have imagined the devastation I saw. Most striking were the 50+ year old trees knocked over like bowling pins. How many lesser hurricanes had they survived? How many stronger hurricanes are coming? How many more years after this one will they run out of hurricane names?

With respect, to fear the insurance cost more than the hurricane is, I think, due to not paying attention.

In my opinion, hurricane prone areas are worth avoiding. But hurricanes run in cycles. The last really busy hurricane year prior to last year was 2005. Over the next 11 years no major hurricanes hit the US mainland, a historic low point.

Forecasting future hurricanes based upon recent storm activity has not worked too well.

I do think the northeast coast of Florida, or even up into SE Georgia (St Simons, etc) have historically been less hurricane prone but actual results may vary

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

With Respect to the 55+ communities we have been to in our area. We have found that we really prefer Regular Gated Multi family communities with a good HOA and well managed finances. (The last 2 being the hardest to establish).

Here are some of our comments as to why we decided against the Area or the individual Community. This does not mean there are not a lot of positives, just what we found not to our liking, again YMMV. Our current community over the last 5 years has pleasantly become a good mix of families, still not overrun with small children, mostly all professional. I guess the Golf Club is an attraction for some, but not us. The HOA is still reasonable, but the finances are VERY good. BTW, we are VERY particular about the general Location, Area, and surrounding neighborhoods, and ease of access to a nice beach. That and we will never buy a Wood home in Florida, near the beach.

We reviewed, actually visited and toured the following:

Dell Web Pointe Vedra

While not far from the beach, because of the traffic, it takes a while to get there, and when one does the parking is restrictive.

Same for Shopping in PV. Traffic around Sawgrass is too much for our liking. But everything you want is available. But has very good access to Jacksonville if that's what turns your crank.

Homes are now being built of wood, and general quality seems not to be as good as the older properties. The older homes are concrete block and as a result reflect a premium. This is a BIG deal for us. Lot sizes are also getting smaller.

Nocatee is too close for our liking.

The Clubhouse seemed full of "Nearly Deads" (Not being derogatory, just to us everyone seemed VERY Old. We are in our Early and Mid 60's.)

Sweetwater

Did not like the location, called and cancelled the appointment once we were near the location.

Stillwater

Too far from the beach. Too Crowded. Close to Jacksonville, so it may appeal to some.

Del Webb Nocatee

Well it is Nocatee, to crowded and location not to our liking. similar to Del Web PV.

Villages of Seloy

Small Semi Detached Homes. (Too Small for us) We want a fully detached property.

Small Club House. No saving graces as far as we were concerned.

Various 55+ Developments in World Golf Village

The area is nice, but too far away from where we like to be.

Homes mostly wood. We are not fans of WGV.

Rivertown St. Johns

Did not like the home construction or Styles, seemed cheap. Again made of Wood.

Soooooo far from everything.

Once you get near shopping the traffic is ridiculous, Think Orange PArk and Blanding Boulevard.

Margaritaville in Daytona

Homes VERY Well Built.

Too Far from a decent beach, but they do have a clubhouse at the beach for residents.

Too Much Buffet everywhere, gets tedious even for the length of an averare Tour.

Once again we are particular, YMMV. For now we will stay put.

Here are some of our comments as to why we decided against the Area or the individual Community. This does not mean there are not a lot of positives, just what we found not to our liking, again YMMV. Our current community over the last 5 years has pleasantly become a good mix of families, still not overrun with small children, mostly all professional. I guess the Golf Club is an attraction for some, but not us. The HOA is still reasonable, but the finances are VERY good. BTW, we are VERY particular about the general Location, Area, and surrounding neighborhoods, and ease of access to a nice beach. That and we will never buy a Wood home in Florida, near the beach.

We reviewed, actually visited and toured the following:

Dell Web Pointe Vedra

While not far from the beach, because of the traffic, it takes a while to get there, and when one does the parking is restrictive.

Same for Shopping in PV. Traffic around Sawgrass is too much for our liking. But everything you want is available. But has very good access to Jacksonville if that's what turns your crank.

Homes are now being built of wood, and general quality seems not to be as good as the older properties. The older homes are concrete block and as a result reflect a premium. This is a BIG deal for us. Lot sizes are also getting smaller.

Nocatee is too close for our liking.

The Clubhouse seemed full of "Nearly Deads" (Not being derogatory, just to us everyone seemed VERY Old. We are in our Early and Mid 60's.)

Sweetwater

Did not like the location, called and cancelled the appointment once we were near the location.

Stillwater

Too far from the beach. Too Crowded. Close to Jacksonville, so it may appeal to some.

Del Webb Nocatee

Well it is Nocatee, to crowded and location not to our liking. similar to Del Web PV.

Villages of Seloy

Small Semi Detached Homes. (Too Small for us) We want a fully detached property.

Small Club House. No saving graces as far as we were concerned.

Various 55+ Developments in World Golf Village

The area is nice, but too far away from where we like to be.

Homes mostly wood. We are not fans of WGV.

Rivertown St. Johns

Did not like the home construction or Styles, seemed cheap. Again made of Wood.

Soooooo far from everything.

Once you get near shopping the traffic is ridiculous, Think Orange PArk and Blanding Boulevard.

Margaritaville in Daytona

Homes VERY Well Built.

Too Far from a decent beach, but they do have a clubhouse at the beach for residents.

Too Much Buffet everywhere, gets tedious even for the length of an averare Tour.

Once again we are particular, YMMV. For now we will stay put.

Last edited:

- Joined

- Nov 17, 2015

- Messages

- 13,982

The thing about Florida hurricanes, is they might not always hit, but they do disrupt. You can count on at least one near-miss in most parts of the state, most years.

That means a rush to stock up supplies, maybe put up shutters, clean off the patio, and at best ride out a messy tropical storm that puts your power/net out for a bit and wrecks your garden. Maybe takes down a favorite palm or part of your fence. Or it stays off coast, you've still done the prep and got almost nothing - good problem to have.

But whether or not they actually do damage you need to be ready for them every year. If you go away over the summer (June to November), you need a plan. It's just an extra thing you need to be concerned with. I'm sure many in the middle of the country have their earthquake plans, and those in fire country have their go bags.

It's just a factor.

That means a rush to stock up supplies, maybe put up shutters, clean off the patio, and at best ride out a messy tropical storm that puts your power/net out for a bit and wrecks your garden. Maybe takes down a favorite palm or part of your fence. Or it stays off coast, you've still done the prep and got almost nothing - good problem to have.

But whether or not they actually do damage you need to be ready for them every year. If you go away over the summer (June to November), you need a plan. It's just an extra thing you need to be concerned with. I'm sure many in the middle of the country have their earthquake plans, and those in fire country have their go bags.

It's just a factor.

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Good Points made here, another important for consideration for insurance availability is being in an "X" flood zone. There are very few of those left in desirable beach locations. As a result the home prices reflect the good fortune.

Tower Hill just dropped a lot of beach communities after 25 years of covering them. Frontline still insures well built properties in "X" flood zones ...... don't ask me how I know.

That's true. We just got notified that the company that has insured us for the last 8 years isn't going to renew our coverage. Never made a claim, but the area did get hit pretty hard when Irma came through a few years ago. Our new company is called Typ Tap. Sounds more like an app than an insurance company. I've been tempted to self insure, since our house is small and would be cheap to replace. Also it's been there for almost 40 years, and made it through many a hurricane. But I'm just a bit too conservative for that. When they drop us and I have to go with Joe's Insurance, I'll reconsider.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Tampa fits most of your requirements, with Clearwater and St. Pete nearby. If you want lower cost of living and less hurricane disruption you could live in Lakeland (we did for 3 years). That would also give you access to arts & culture in Tampa/St. Pete and Orlando. Many other choices all along I4 between Tampa and Orlando. 55 plus communities are everywhere in FL - but diversity and progressives may be (very) scarce in most.

Last edited:

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yup. Mine too. No way would I move to anywhere in Florida or, really, to any coastal Atlantic or Gulf area, this based solely on hurricane risk. Working Michael with the Red Cross made a huge impression on me.My point is that the entire state is hurricane country....

Agreed. Forecasting pretty much anything from recent data doesn't usually work too well.... Forecasting future hurricanes based upon recent storm activity has not worked too well. ...

The difference here (Yes, "This time it's different.") is the recent history of increasing frequency of severe weather events (fact, not debatable) blamed on global warming (probably, but hard to know absolutely for sure.) I would also avoid places with risk of wildfires, places that rely on getting water from somewhere else, flood plains, etc. I would also avoid at least the most dangerous of the earthquake-prone areas like most of the left coast. I don't think there's any reason to expect earthquake probabilities to be increasing, but "the big one" would be such a high-impact event for retirees that I just wouldn't take the risk. The New Madrid Fault? I don't know.

This morning's WaPo has a story about a new FEMA report that is very germane to the OP's question: "The Federal Emergency Management Agency has calculated the risk for every county in America for 18 types of natural disasters, such as earthquakes, hurricanes, tornadoes, floods, volcanoes and even tsunamis. ... National Risk Index" https://www.washingtonpost.com/heal...4230a2-4d0c-11eb-97b6-4eb9f72ff46b_story.html (sorry to say it may be behind a paywall, but a FEMA search should find it.)

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Nice find. Is this it? https://hazards.geoplatform.gov/por...x.html?appid=ddf915a24fb24dc8863eed96bc3345f8This morning's WaPo has a story about a new FEMA report that is very germane to the OP's question: "The Federal Emergency Management Agency has calculated the risk for every county in America for 18 types of natural disasters, such as earthquakes, hurricanes, tornadoes, floods, volcanoes and even tsunamis. ... National Risk Index" https://www.washingtonpost.com/heal...4230a2-4d0c-11eb-97b6-4eb9f72ff46b_story.html (sorry to say it may be behind a paywall, but a FEMA search should find it.)

Or this? Choose state then county. https://www.fema.gov/data-visualization/disaster-declarations-states-and-counties

Last edited:

Out-to-Lunch

Thinks s/he gets paid by the post

This morning's WaPo has a story about a new FEMA report that is very germane to the OP's question: "The Federal Emergency Management Agency has calculated the risk for every county in America for 18 types of natural disasters, such as earthquakes, hurricanes, tornadoes, floods, volcanoes and even tsunamis. ... National Risk Index" https://www.washingtonpost.com/heal...4230a2-4d0c-11eb-97b6-4eb9f72ff46b_story.html (sorry to say it may be behind a paywall, but a FEMA search should find it.)

Nice find. Is this it? https://hazards.geoplatform.gov/por...x.html?appid=ddf915a24fb24dc8863eed96bc3345f8

Or this? Choose state then county. https://www.fema.gov/data-visualization/disaster-declarations-states-and-counties

I am also grateful for the FEMA reference from OS. However, I spent some time with it after he pointed it out, and I don't think the results of the NRI are that helpful to an individual.

As the WashPo article points out (and can be read in the 50-page NRI primer ), FEMA defines "risk" as (likelihood of happening) * (the total cost if it happens). Therefore, as the WashPo article points out, my home county of Philadelphia is one of the "riskiest" counties in the US for tornadoes, much riskier than Oklahoma City. Why? Because if a tornado wiped out Philly, it would cost much, much more than if a tornado wiped out OKC.

But I would argue that measures risk the to society, as is appropriate for FEMA. But that is not the risk to an individual. I as an individual am far more likely to be harmed by a tornado in OKC than in Philly.

Now, if you want to drill down on the likelihood of adverse events, I imagine you can find it in that report, but I found it difficult to get that info.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yeah. Agree. I used @Midpack's link and spent some time looking around. Interesting information and it probably has some value but it is not a magic bullet for individual decision making.... I don't think the results of the NRI are that helpful to an individual. ...

Speculator

Recycles dryer sheets

The thing to keep in mind is that moving to a "55+" place doesn't stop people from aging. And once people move in, they tend to stay until old age difficulties or death take them out.

I agree. I guess I didn't realize that in this particular community, everyone must have moved in around the same time and consequently, most younger folks who were considering moving there visited first and apparently most decided to move elsewhere. Unfortunately for me, I had not visited the community first and had relied on the descriptions of the community put out by the homeowners' association and realtors. I ended up being the only person in their 50's who lived in a community of people over 75 and did not have much in common with anyone else. That being said, it was an interesting experience and I learned quite a bit about the aging process, both emotionally and physically.

I agree. I guess I didn't realize that in this particular community, everyone must have moved in around the same time and consequently, most younger folks who were considering moving there visited first and apparently most decided to move elsewhere. Unfortunately for me, I had not visited the community first and had relied on the descriptions of the community put out by the homeowners' association and realtors. I ended up being the only person in their 50's who lived in a community of people over 75 and did not have much in common with anyone else. That being said, it was an interesting experience and I learned quite a bit about the aging process, both emotionally and physically.

Thank you to everyone who has taken the time to comment, a lot to consider here, for sure. Helpful comments. A big shout out to FLAGator - that type of information was exactly what I was hoping to receive. Capital areas and university towns do seem to fit my speed and interests.

Of course now I am thinking of other questions. Is anyone planning to leave Florida permanently on account of the predicted hurricane/storm risks? Do climate predictions impact real estate pricing in certain areas? Insurance I can see - what about local property taxes?

Of course now I am thinking of other questions. Is anyone planning to leave Florida permanently on account of the predicted hurricane/storm risks? Do climate predictions impact real estate pricing in certain areas? Insurance I can see - what about local property taxes?

Last edited:

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is anyone planning to leave Florida permanently on account of the predicted hurricane/storm risks? Do climate predications impact real estate pricing in certain areas? Insurance I can see - what about local property taxes?

No, and St. Johns County taxes are reasonable. We also live in a College Town. If one already owns Real Estate it is moot as Florida has Tax portability and homesteading.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not leaving now but we lived in FL for 3 years and wouldn’t go back. Hurricanes was one of the main reasons, but not the only one. We relocated from up north and choose NC. Could’ve picked anywhere and as much as we wanted to live on the coast, we live about 3 hours inland mostly because of hurricane risks. Even if insurance covered the damage (I doubt it would), the disruption wouldn’t be worth it to us. And to me all indications seem to suggest hurricanes will become more common.Thank you to everyone who has taken the time to comment, a lot to consider here, for sure. Helpful comments. A big shout out to FLAGator - that type of information was exactly what I was hoping to receive. Capital areas and university towns do seem to fit my speed and interests.

Of course now I am thinking of other questions. Is anyone planning to leave Florida permanently on account of the predicted hurricane/storm risks? Do climate predications impact real estate pricing in certain areas? Insurance I can see - what about local property taxes?

Last edited:

Moemg

Gone but not forgotten

I have lived in Florida for 25 years . To ensure you will be in a younger 55 community buy into one just being built . I have lived on Sarasota bay for 20 years and the only time we ever evacuated was Irma . We had minimal damage . . If you are liberal think twice before moving here or move to where liberals have moved .Take a look at Lakewood Ranch outside Sarasota and Bradenton. Lots of communities with tons of activities about 40 minutes to the beach . Quick trip to Sarasota or Tampa for art,culture and classes .Great health care !

Last edited:

I am not a liberal. I am an independent but prefer to be around people who are open and receptive to new ideas & information...so I use the word progressive for lack of a better term.

Thank you, I will check out Lakewood. I heard Mick Jagger just bought a house there lol.

Thank you, I will check out Lakewood. I heard Mick Jagger just bought a house there lol.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There’s no way around the hurricane risk in FL, and it won’t get better.

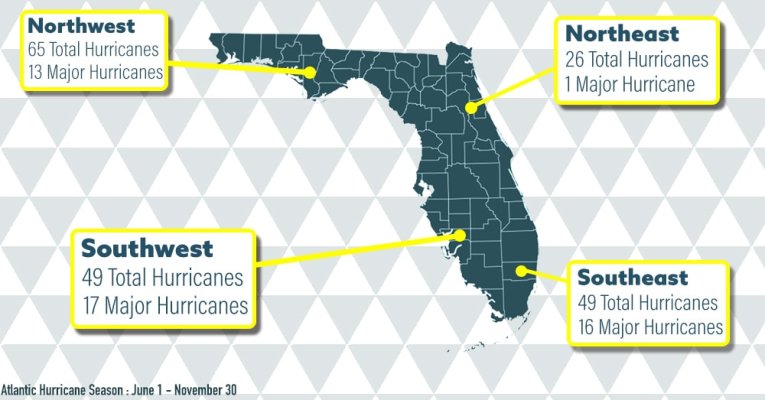

https://clovered.com/most-hurricane...0 Massachusetts: 12 (with 1 major hurricane)

https://clovered.com/most-hurricane...0 Massachusetts: 12 (with 1 major hurricane)

Attachments

Last edited:

Freedom56

Thinks s/he gets paid by the post

I received a letter from the Palm Beach County tax collector today. For 2021 taxes they are proposing installment payments starting July 2021 with the final payment March 2022. Are any other counties doing this? I plan to pay in full at the end of November as we do every year.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I received a letter from the Palm Beach County tax collector today. For 2021 taxes they are proposing installment payments starting July 2021 with the final payment March 2022. Are any other counties doing this? I plan to pay in full at the end of November as we do every year.

November for me for the 4% discount.

Badger

Thinks s/he gets paid by the post

- Joined

- Nov 2, 2008

- Messages

- 3,423

There’s no way around the hurricane risk in FL, and it won’t get better.

I agree that it won't get better but there are potential catastrophic drawbacks most anywhere you live. I get more nervous with earth quakes, forest fires, tornadoes, deep snow for months, and drought.

i live in a 1950s 1400 sq ft concrete block house 2 blocks from the ocean in NE Fl. The house may be old but we have ridden out all the hurricanes since 1975 in it. The house itself has survived all hurricanes coming through since the 50s. If I was to build or look for another house I would make sure it was NOT a stick frame. It would have to be reinforced concrete with a standing seam metal roof.

Cheers!

November for me for the 4% discount.

+4%!

Absolutely. I'm one of the weirdos that wish the bill would come sooner so I could lock it in! Never had escrow and like liquidating that liability ASAP.

There’s no way around the hurricane risk in FL, and it won’t get better.

https://clovered.com/most-hurricane-prone-areas-in-united-states/#:~:text=Through%20the%202020%20hurricane%20season%2C%20these%20are%20the,10%20Massachusetts%3A%2012%20%28with%201%20major%20hurricane%29%20

We went through Michael in Oct 2018. We had about $90k of damage to house and property. We went 3 days with the water we had saved in the tubs, 8 days without electricity, 10 weeks without cable, and over 3 months without cellphone service. I did get a phone from a AT&T whose service was working, and tethered that to my computer, so I had some internet service, this was a savior dealing with the insurance company. It took us about 14 months to be completely back to normal. The hurricane also demolished our small business, which we did not reopen, forcing my wife to retire, I had already cut my work time way back and was glad the business was done. It was an adventure! I don't recommend it more than once though. I'm staying here, but may go out of town for the next hurricane.

Last edited:

Thank you to everyone who has taken the time to comment, a lot to consider here, for sure. Helpful comments. A big shout out to FLAGator - that type of information was exactly what I was hoping to receive. Capital areas and university towns do seem to fit my speed and interests.

Of course now I am thinking of other questions. Is anyone planning to leave Florida permanently on account of the predicted hurricane/storm risks? Do climate predictions impact real estate pricing in certain areas? Insurance I can see - what about local property taxes?

Insurance is a crap shoot, in that there few competitors, and as far as I know, no recognizable national firms writing new policies. I'm insured by a company started after the 2004-05 cycle and the state encouraged new companies and the transfer of policies from the state-chartered Citizens. I haven't seen any stories about the new companies failing to pay out the last few years.

There are also strong incentives for the state to ensure a viable and financially strong, if limited, market for hurricane coverage. If the cost of hurricanes gets as bad as some here think it will, the dynamics will change. In the meantime, I continue to accept the risk and pay a reasonable price.

As to taxes, there is variability across the state. Urban areas with large indigent populations and greater social services will be higher. As a single data point, I pay the same in property taxes for a $500,000 house in the Panhandle (bought 2016) as I did in 2015 for a house sold for $350,000 in Broward County (bought for $170,000 in the late 90's).

Here's a link to estimate taxes:

Florida Property Taxes By County - 2021

Similar threads

- Replies

- 11

- Views

- 1K

- Replies

- 4

- Views

- 580