I'm wondering what number people here are using for their longevity (life expectancy) when doing calculations for drawing-down their portfolio during their retirement? (If you're married, you likely may be using the life expectancy of whichever person you expect to outlive the other.)

I early-retired in 2007 and used to use age 102 as my 'expiration date' for my portfolio calculations. This was based on something I'd read a while ago that said to calculate the average of the death ages of your parents and their siblings and then add 10 years to that number (to allow for the expected improvements in longevity due to healthcare advances). This is how I arrived at 102.

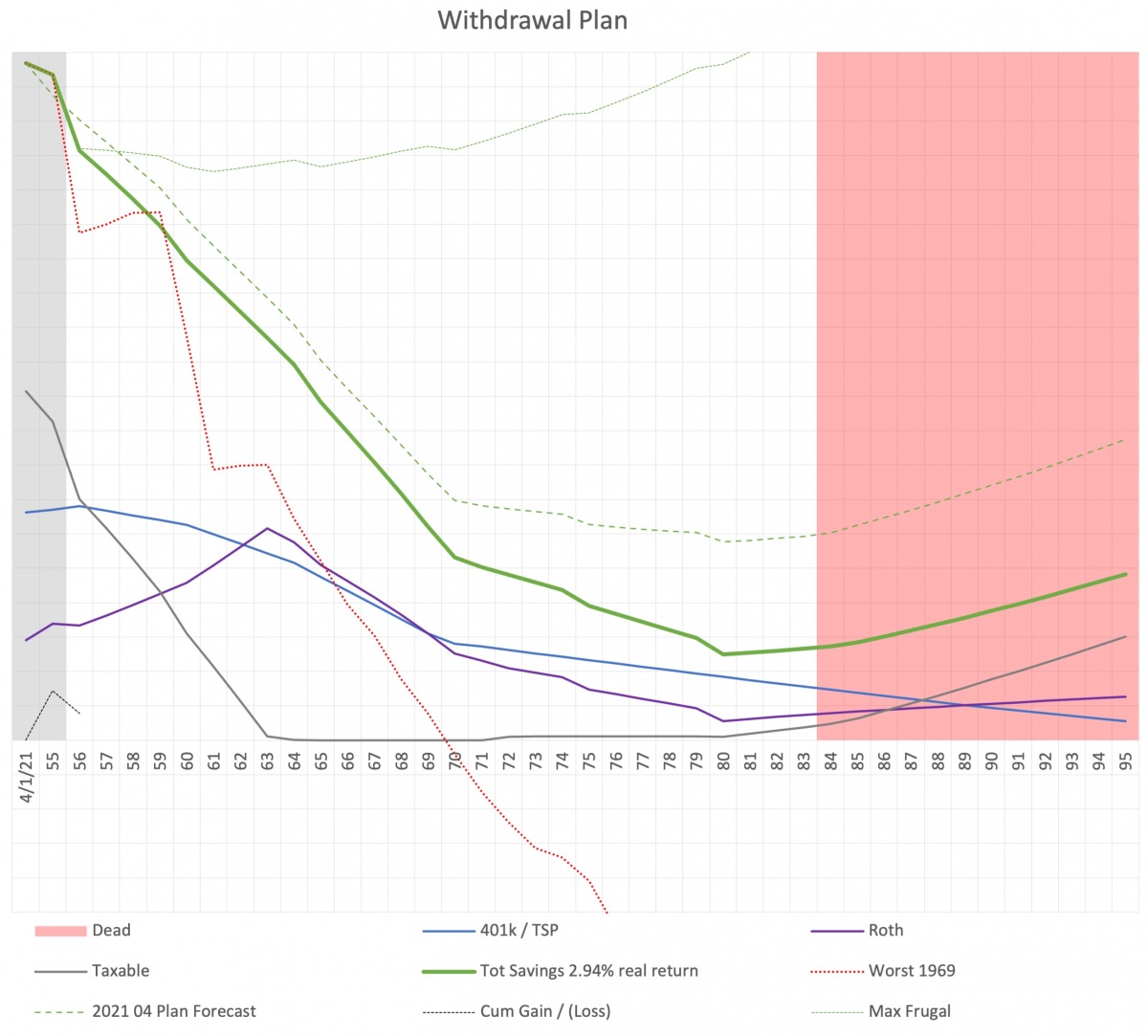

Now that I'm 'older and wiser' , I'm wondering if perhaps 102 is a bit overly-optimistic. Perhaps I should pick a lower number, which would allow for a much higher spend rate? I don't have a spouse nor any heirs to worry about, so leaving a large estate is not a major goal. Charities will be my beneficiaries. I'm wondering if perhaps I'd enjoy loosening-up the purse-strings a bit while still ensuring that I won't be destitute in my later years.

, I'm wondering if perhaps 102 is a bit overly-optimistic. Perhaps I should pick a lower number, which would allow for a much higher spend rate? I don't have a spouse nor any heirs to worry about, so leaving a large estate is not a major goal. Charities will be my beneficiaries. I'm wondering if perhaps I'd enjoy loosening-up the purse-strings a bit while still ensuring that I won't be destitute in my later years.

FWIW, a quick google search says current U.S. life expectancy is around 78.6 (76.1 for men and 81.1 for women). I know Covid resulted in a drop of a year or two which may not yet be factored-into this number.

omni

I early-retired in 2007 and used to use age 102 as my 'expiration date' for my portfolio calculations. This was based on something I'd read a while ago that said to calculate the average of the death ages of your parents and their siblings and then add 10 years to that number (to allow for the expected improvements in longevity due to healthcare advances). This is how I arrived at 102.

Now that I'm 'older and wiser'

FWIW, a quick google search says current U.S. life expectancy is around 78.6 (76.1 for men and 81.1 for women). I know Covid resulted in a drop of a year or two which may not yet be factored-into this number.

omni