You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Again Low Fee Index Funds Beat Active Managed

- Thread starter 38Chevy454

- Start date

Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,554

Which ones should we choose going forward? If you can do THAT, you need to start your own company.

Fidelity Blue Chip Growth. FBGRX.

It has outperformed the index since its inception and at almost any endpoints you care to choose. I'm going to assume it will continue to outperform the index.

And even if it has a down year, there is enough accumulated growth that even if the index beats it in any given year over the long haul it will outperform the index.

And I have started two companies in my lifetime.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OK, 90% of the time.

VanWinkle

Thinks s/he gets paid by the post

Fidelity Blue Chip Growth. FBGRX.

It has outperformed the index since its inception and at almost any endpoints you care to choose. I'm going to assume it will continue to outperform the index.

And even if it has a down year, there is enough accumulated growth that even if the index beats it in any given year over the long haul it will outperform the index.

And I have started two companies in my lifetime.

You were rewarded for taking more risk in a large cap growth fund. Try the same in a different 30 year period and it should work every time.......maybe.

I have a mix of mostly broad market index funds along with a few dividend index funds/ETFs and a few managed funds. There are several low expense managed funds from Vanguard (managed by Wellington and Primecap), T Rowe Price, American Funds, and Fidelity, which have great long-term records. Some retirees invest mainly in Wellesley. If that works for them, I doubt anyone could seriously argue that’s a bad choice.

Last edited:

Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,554

This is sensible to me. Why not have a mix of index and managed funds? This rigid adherence to *only* index funds, or worse yet, only *one* index fund is a deliberate plan to always accept market average returns.I have a mix of mostly broad market index funds along with a few dividend index funds/ETFs and a few managed funds. There are several low expense managed funds from Vanguard (managed by Wellington and Primecap), T Rowe Price, American Funds, and Fidelity, which have great long-term records. Some retirees invest mainly in Wellesley. If that works for them, I doubt anyone could seriously argue that’s a bad choice.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is sensible to me. Why not have a mix of index and managed funds? This rigid adherence to *only* index funds, or worse yet, only *one* index fund is a deliberate plan to always accept market average returns.

That's the point (minus small fees)!

Conversely, it is a deliberate plan to always achieve market average returns, and avoid under-performance, which is about (probably less than) a 50-50 proposition for active investing.

-ERD50

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

That's the point (minus small fees)!

Conversely, it is a deliberate plan to always achieve market average returns, and avoid under-performance, which is about (probably less than) a 50-50 proposition for active investing.

-ERD50

Agree 100%! I was with one of the largest wealth management companies in the world and their historical returns (net of fees) for the past 25+ years were lower than most low cost index funds. Sure, they occasionally had a good year but over the long term they have lost to most of the popular low-cost index funds.

ncbill

Thinks s/he gets paid by the post

Yep, just math. Going back 34 years to 1988 I put seed money of $10,000 in Vanguard S&P 500 Index fund and also in Fidelity Blue Chip Growth and Franklin Dynatech. No subsequent investments. All dividends reinvested.

This exercise was repeated every four years. Put $10,000 in each of these funds on January 1, 1992. Repeat for January 1, 1996, and so forth. In my example, the index fund beat the active funds one time out of eighteen tries, or 5.5%. The one time the index beat my active funds was putting $10,000 into each fund on Jan 1, 2020, but 18 months--that's not the long haul, is it?

Generally speaking, yes, index funds will beat the universe of active funds over the long haul. However, it's depends on which active funds you choose.

View attachment 43041

This is a huge problem I often see on this board.

You haven't accounted for risk.

The risk-adjusted return is what matters, not the absolute return.

The blue chip fund you're so enamored with is riskier than a market index, so sure, one'd expect a higher return.

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Love the progress.

Indexes always win...

well Indexes usually win.

Indexes sometimes win on a risk-adjusted basis.

Indexes always win...

well Indexes usually win.

Indexes sometimes win on a risk-adjusted basis.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Fidelity Blue Chip Growth. FBGRX.

It has outperformed the index since its inception and at almost any endpoints you care to choose. I'm going to assume it will continue to outperform the index.

And even if it has a down year, there is enough accumulated growth that even if the index beats it in any given year over the long haul it will outperform the index.

And I have started two companies in my lifetime.

So, it SHOULD work, right? Of course, it might well beat it's index going forward as well. Nice, but if the index is in the pits...

Oh, were your companies financial/banking/equity-bond companies? If not, maybe you should start one. Check back here in 30 years.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

True enough in an investment theory sort of context. The SPIVA reports for the last 20 years always have shown the vast majority of stock pickers to be losers just on a absolute return basis, though. No need for nuance, the evidence is so overwhelming. Then there is the analytical proof by he who shall not be named, which I have never seen challenged.... The risk-adjusted return is what matters, not the absolute return. ...

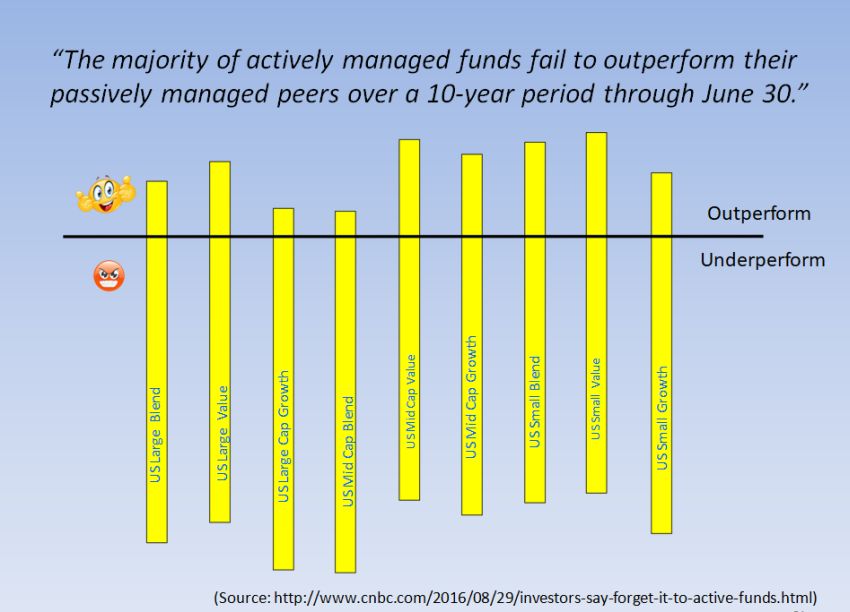

Here's a chart based on a SPIVA report from a few years back. I'll get around to freshening it up one of these days, but a new one will look about the same. They never change much.

Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,554

This is a huge problem I often see on this board.

You haven't accounted for risk.

The risk-adjusted return is what matters, not the absolute return.

The blue chip fund you're so enamored with is riskier than a market index, so sure, one'd expect a higher return.

Of course what you say is true, but here we are 59 posts into the subject matter and this is the first mention of risk. In other words, it wasn't a factor in the original comparison.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OldShooter, in post 41 said:True enough in an investment theory sort of context. The SPIVA reports for the last 20 years always have shown the vast majority of stock pickers to be losers just on a absolute return basis, though. No need for nuance, the evidence is so overwhelming. Then there is the analytical proof by he who shall not be named, which I have never seen challenged.

Here's a chart based on a SPIVA report from a few years back. I'll get around to freshening it up one of these days, but a new one will look about the same. They never change much.

"Until you can tell me what's wrong with it, I wont be responding here anymore."

ncbill

Thinks s/he gets paid by the post

OldShooter, in post 41 said:

"Until you can tell me what's wrong with it, I wont be responding here anymore."

VanWinkle

Thinks s/he gets paid by the post

Of course what you say is true, but here we are 59 posts into the subject matter and this is the first mention of risk. In other words, it wasn't a factor in the original comparison.

Then you didn't read all of the posts.

VanWinkle

Thinks s/he gets paid by the post

OldShooter, in post 41 said:

"Until you can tell me what's wrong with it, I wont be responding here anymore."

So let's poke fun at him...... wow, what a comeback that was.

arcyallen

Recycles dryer sheets

- Joined

- Apr 29, 2022

- Messages

- 212

Every time I see a thread like this, I cringe. There is good information presented that is then enhanced/exaggerated a bit so people can prove their "points". I see factual errors in statements like "No active fund can beat the index over long periods of time", but if I poke my head in and point out some exceptions, people will just dig their heels in and make assumptions/attacks that aren't based in facts specific to the examples I'm referring to. Everyone seems to have a closed mind an axe to grind. Me? I'm constantly and sincerely asking myself "How could I be wrong here?" and then mentally registering the times that I am so I can think better going forward.

If I found out that index funds beat ALL the actively managed funds over meaningfully long periods of time, I'd toss all those active funds out of my mind.

If I found out that there were active funds that beat their indexes/benchmarks over meaningfully long periods of time, I'd sincerely want to know more. But this never seems to happen, at least not in these threads.

I like discovering new facts without dismissing them offhandedly with prejudice. Does anyone else?

If I found out that index funds beat ALL the actively managed funds over meaningfully long periods of time, I'd toss all those active funds out of my mind.

If I found out that there were active funds that beat their indexes/benchmarks over meaningfully long periods of time, I'd sincerely want to know more. But this never seems to happen, at least not in these threads.

I like discovering new facts without dismissing them offhandedly with prejudice. Does anyone else?

Markola

Thinks s/he gets paid by the post

^^^If you can name a fund whose manager has beaten their index for ten years and who is guaranteed to stay in place for the coming ten years and beat it again, inclusive of fees, then, yes, I will have learned something. Meanwhile, Vanguard’s fees are almost certain to stay low and its computers don’t even sleep, much less get sick, die or retire, or have a bad run vs. their indices.

frayne

Thinks s/he gets paid by the post

^^^If you can name a fund whose manager has beaten their index for ten years and who is guaranteed to stay in place for the coming ten years and beat it again, inclusive of fees, then, yes, I will have learned something. Meanwhile, Vanguard’s fees are almost certain to stay low and its computers don’t even sleep, much less get sick, die or retire, or have a bad run vs. their indices.

+1

Last edited:

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

When I was at Megacorp we had a profit sharing plan that did for most of the 29 years I was there. But let's talk about why and what can happen:^^^If you can name a fund whose manager has beaten their index for ten years and who is guaranteed to stay in place for the coming ten years and beat it again, inclusive of fees, then, yes, I will have learned something. Meanwhile, Vanguard’s fees are almost certain to stay low and its computers don’t even sleep, much less get sick, die or retire, or have a bad run vs. their indices.

The money was in a fund you or I could go buy today. Megacorp paid the 1% fee. The fund manager was one that historically did well, Buffet high lighted their abilities in an appendix to the Intelligent Investor as they were students of Graham. This fund allows corporate entities to modify the base investments and Megacorp's original CEO was a great stock picker. That was very clear to me by some of the investments the organization made in undervalued companies they acquired and later sold for large profits.

Great, for many years we enjoyed better than the average market returns, might have done that just by virtue of 0% ER. Then the founder retired and the new CEO took over the job of being the chief stock picker. Things were OK for 3 years and then the fund crashed, I bailed as planned when I turned 59.5. I lost a good 15% during the last 6 months but stopped the bleeding. Some of my peers didn't and lost 50% or more, to never recover. Many of these folks had little financial literacy and lost their ability to retire comfortably. Yeah there's lawsuits, breach of fiduciary duty, try and reclaim the lost assets; to date I've collected 10k back from the fund manager's insurance but now the attorneys for Megacorp have it tied up for several years. No thanks.

Last edited:

arcyallen

Recycles dryer sheets

- Joined

- Apr 29, 2022

- Messages

- 212

^^^If you can name a fund whose manager has beaten their index for ten years and who is guaranteed to stay in place for the coming ten years and beat it again

The first is easy. You and I both know the second - a guarantee of someone staying in place for ten years and a GUARANTEE of future results - is impossible. Literally. If your requirements are literal impossibilities, I can't help you there.

Last edited:

arcyallen

Recycles dryer sheets

- Joined

- Apr 29, 2022

- Messages

- 212

^^^If you can name a fund whose manager has beaten their index for ten years and who is guaranteed to stay in place for the coming ten years and beat it again, inclusive of fees, then, yes, I will have learned something. Meanwhile, Vanguard’s fees are almost certain to stay low and its computers don’t even sleep, much less get sick, die or retire, or have a bad run vs. their indices.

In order to promote an actual discussion (which I didn't do in my first reply), what -possible- things would it take to "convince you" there's more out there than just indexes? If the answer is "nothing, my mind is made up" I'll accept that. But if you're open to new ideas/views, I'm happy to talk.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In order to promote an actual discussion (which I didn't do in my first reply), what -possible- things would it take to "convince you" there's more out there than just indexes? If the answer is "nothing, my mind is made up" I'll accept that. But if you're open to new ideas/views, I'm happy to talk.

I'm sure you can find a fund that has beaten the indexes for 10 years (or whatever) but there is no way to know it will beat the indexes going forward. I think it's simple as that. The catch phrase "Past performance does not predoct future performance" is true.

I think on that basis, my mind is "made up" though, full disclosure, I DO use psssst. Wellesley fund. I learned about if from unclemick (who, IIRC no longer uses it) but it has relatively low fees and seems to smooth my particular portfolio. Perhaps is as simple as: I've grown accustomed to it's performance. In any case, I think we all have a bit of "superstition" in our portfolios even if we think we don't. YMMV

Similar threads

- Replies

- 19

- Views

- 1K

- Replies

- 48

- Views

- 5K

- Replies

- 14

- Views

- 2K

Latest posts

-

-

In Your City - What Are The Most Desirable Neighborhoods and Why?

- Latest: ShokWaveRider

-

-

-

-

-

-

-