Longevity is key, there isn’t a single right answer - so I dismiss anyone with a generic answer. My parents lived to 93 and 96, DW’s Mom lived to 88 despite a decidedly unhealthy lifestyle. We’ve both lived healthier lifestyles than our parents.

We’re fortunate to have “won the game” long ago.

Taking Soc Sec earlier would have reduced with our Roth conversions.

I am not suggesting everyone should wait until age 70 to claim Soc Sec…

Just casually assuming 8% return for 8 years isn’t a given. Do all retirees target an AA with that kind of projected return?

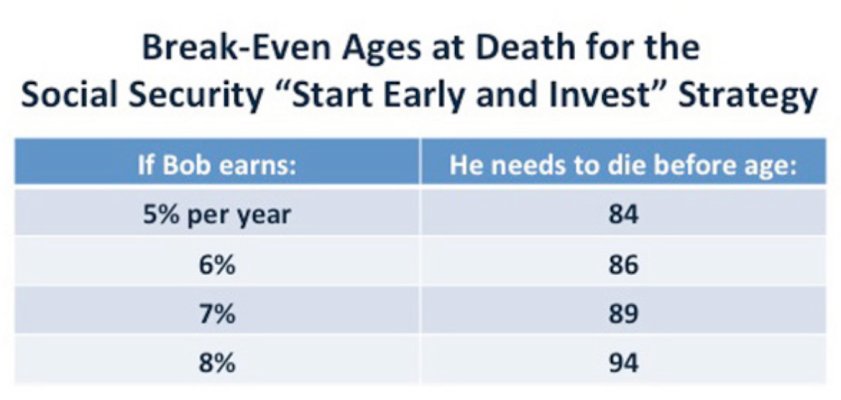

And many academics have studied the take early and invest vs wait proposition, this isn’t some new idea. Maybe read a couple instead of putting cocktail napkin calcs out there for people to make crucial decisions?

https://www.cbsnews.com/news/should-you-start-social-security-early-and-invest-your-benefit/

Below shows assuming Soc Sec 2% annual COLA.