W2R

Moderator Emeritus

I am still working and will be 61 when I retire in November. I think that my retirement activities at that time will fit within whatever I am capable of doing.

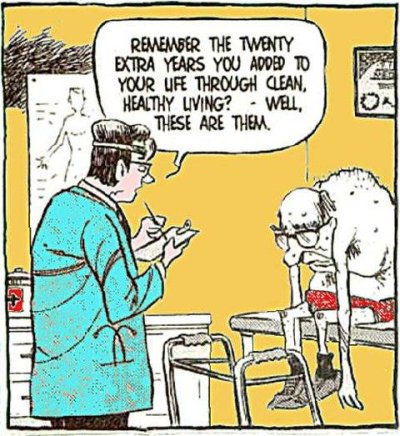

It would be very distressing to long for something that I am no longer capable of doing. I do feel the effects of aging. But for me, there is still a lot left to do in life. Glass half full, and all that.

It would be very distressing to long for something that I am no longer capable of doing. I do feel the effects of aging. But for me, there is still a lot left to do in life. Glass half full, and all that.