You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

0% capital gains bracket

- Thread starter ripper1

- Start date

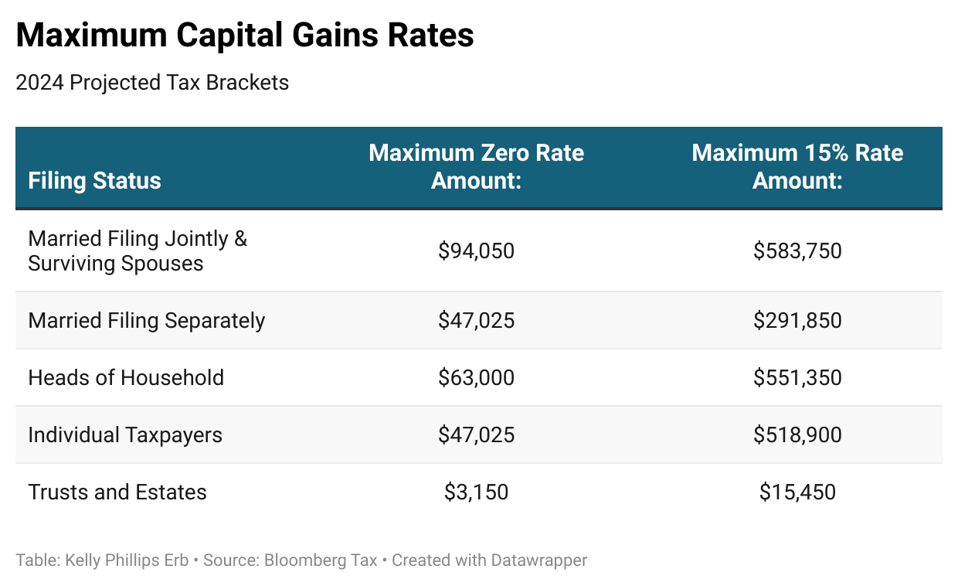

Am I correct that the 0% capitol gain bracket is going away in 2024? The married filling jointly threshold is a taxable income under 89250 and in 2024 goes to 94300 I believe.

I thought the 0% LTCG/QD bracket pre-dated TCJA. Wasn't it a Bush tax cut?

Last edited:

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

According to the article you posted, there will still be 0% CG.

Not according to The Financial Buff.

https://thefinancebuff.com/tax-brackets-standard-deduction-0-capital-gains.html

https://thefinancebuff.com/tax-brackets-standard-deduction-0-capital-gains.html

is the 0% LTCG rate going away as the OP suggested?

No

PaunchyPirate

Thinks s/he gets paid by the post

The bracket changes put in place by the TCJA legislation expire after the 2025 tax year. So other than the inflation adjustments, the brackets aren’t changing until 2026. I don’t recall if that will reset the 0% cap gains bracket or not, but certainly not until 2026 if it does.

The bracket changes put in place by the TCJA legislation expire after the 2025 tax year. So other than the inflation adjustments, the brackets aren’t changing until 2026. I don’t recall if that will reset the 0% cap gains bracket or not, but certainly not until 2026 if it does.

Even if the TCJA expires, the 0% cap gains bracket won't "go away". The limit would just change.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Am I correct that the 0% capitol gain bracket is going away in 2024? The married filling jointly threshold is a taxable income under 89250 and in 2024 goes to 94300 I believe.

You are incorrect. There is no capitol gains tax bracket and never was. Not sure if that qualifies as going away or not.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yep I deleted when I realized I couldn't read! I don't think I have done one single thing right today.

Keep that up and you'll have to change your screen name to badateverything.

dixonge

Thinks s/he gets paid by the post

do capital gains *add to* your 'taxable income' bottom line? In other words, if taxable income is just under the minimum for 0% capital gains, would a stock sale be *added to* your taxable income on your 1040? And would it push you *out of* the 0% rate spot?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,249

do capital gains *add to* your 'taxable income' bottom line? In other words, if taxable income is just under the minimum for 0% capital gains, would a stock sale be *added to* your taxable income on your 1040? And would it push you *out of* the 0% rate spot?

Yes and Yes. But only the part over the 0% range is taxed at CG rates.

do capital gains *add to* your 'taxable income' bottom line? In other words, if taxable income is just under the minimum for 0% capital gains, would a stock sale be *added to* your taxable income on your 1040? And would it push you *out of* the 0% rate spot?

This site does a nice job of visualizing tax brackets:

https://engaging-data.com/tax-brackets/

Keep that up and you'll have to change your screen name to badateverything.

Ha I just saw this and am thinking it might true.

Similar threads

- Replies

- 4

- Views

- 835

- Replies

- 12

- Views

- 1K

- Replies

- 13

- Views

- 1K