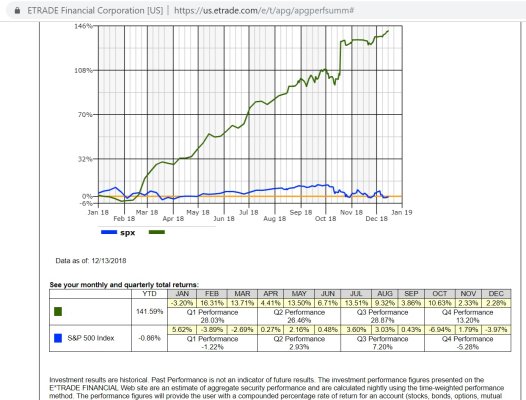

Turned negative for the second time in a couple months. Down $214 after contributions are subtracted for the year lol. That will update tomorrow morning down a bit more

Fun week, stocks went negative, work brought down the axe on c-suite and I said bye to a few good folks who did a lot of good work in IT, I hear bad things happen in threes, I better stay away from ladders and black cats.

Fun week, stocks went negative, work brought down the axe on c-suite and I said bye to a few good folks who did a lot of good work in IT, I hear bad things happen in threes, I better stay away from ladders and black cats.