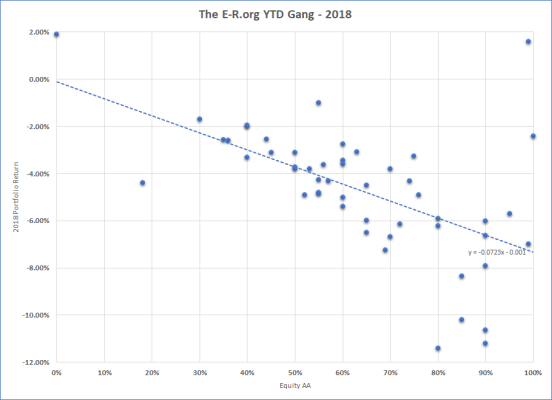

Good luck with trying to get everyone to adhere to a standard. It's a bit frustrating when some use the Beardstown Ladies method (including new investments as part of the return), but like polls here, I take the results as entertainment. I've seen that some of you track your return to a benchmark of the same AA, which is a lot more useful than comparing to a few random people on the internet who are more or less your peers.

I'm not sure what to do with that information anyway. I'm going to stick with my mostly index funds with very low expenses. I'm already motivated to look for the best safe returns on my non-equities. Even with two people having 60/40 AAs, one may be taking on a lot more risk than the other. I suppose if I'm getting consistently lower returns as others with the same AA, I might look at why, but that would require knowing just what they are invested in.

For myself, I admit I don't use the standard method, though when I compared it to moneychimp, I was within a few hundredths, so it's close enough. That method is far from perfect, as you'd get very different results if you withdrew a full year on Jan 1 vs Dec 31.

Also, does the moneychimp method account for the fact that converting to a Roth at a 12% tax rate really isn't a 12% investment loss? It looks like it does, and really shouldn't.

In actuality, the Beardstown Ladies method may be of more interest to me now that I'm retired anyway. How much I spend is as important as how much I make on the investments, so an overall picture of my change from the beginning of the year to the end is good to know. That's of even less use to compare with others because aren't spending down now, or have pensions and SS that have them spending less from actual investments.