You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2022 Investment Performance Thread

- Thread starter sengsational

- Start date

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 892

FINALLY.....Got ahead of where I would have been if I had not spent almost a year in mostly cash like assets.... My non real estate assets are up over25% YTD. (Moved heavily into energy and related commodities in early 2021).

(I will scale back out into other industries / markets....energy has some room to run, still undervalued, but not as undervalued as it was last year).

(I will scale back out into other industries / markets....energy has some room to run, still undervalued, but not as undervalued as it was last year).

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

YTD, down 1% in equities, 4.5% in bonds. Good thing I have over 80% equities eh?

Bonds. Boring as usual and getting worse all the time.

Individual bonds are getting very interesting. 2.8% on 3 year bonds. I bonds paying 8%. Owning a bond fund is hurting right now, but owning individual bonds is not so bad. Matches up nicely with my 30 year 2.25% fixed rate mortgage.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,456

Individual bonds are getting very interesting. 2.8% on 3 year bonds. I bonds paying 8%. Owning a bond fund is hurting right now, but owning individual bonds is not so bad.

After holding on for 20+ years, I started slowly moving out of my bond fund (RPSIX) holdings about six months ago. Flat to negative total return and declining income.

gamboolman

Recycles dryer sheets

As of 12-Apr-22, our Portfolio is down <-5.88%> from 1-Jan-22

Our AA is 51% Equities, 40% Bonds and 9% Cash which is just about on target for us

We like keep 2 to 3 years Cash on hand for the normal Peaks and Valleys of the Market.

Our AA is 51% Equities, 40% Bonds and 9% Cash which is just about on target for us

We like keep 2 to 3 years Cash on hand for the normal Peaks and Valleys of the Market.

RobbieB

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 22, 2016

- Messages

- 8,968

Individual bonds are getting very interesting. 2.8% on 3 year bonds. I bonds paying 8%. Owning a bond fund is hurting right now, but owning individual bonds is not so bad. Matches up nicely with my 30 year 2.25% fixed rate mortgage.

I have the individual bonds and not planning on selling either. It's just declining value as interest rates rise. Nothing new of course.

wyecrabber1

Recycles dryer sheets

- Joined

- May 20, 2015

- Messages

- 148

Down 5.2% from end of 2021 excluding withdrawals for RMDs. AA; stock 85%, bonds 15%

- Joined

- Nov 27, 2014

- Messages

- 9,251

6% down as of today. AA to heavy in bonds, but it is what it is. Holding for now. Only thing I’m doing is not reinvesting any dividends and interest - increasing cash position. Not selling (locking in any losses).

I guess no one is rushing in to report April YTD results

April was a horrible month for me.

I went from -0.87% YTD at the end of March to -8.26% as of tonight. And that was with a relatively low equity exposure.

I had been trying to increase my equity exposure by shopping the "bargains" in the tech growth sector (a.k.a. falling knives). So despite the huge hit, my equity percentage actually went up by a little under 1%. I guess you could say that I am rebalancing

April was a horrible month for me.

I went from -0.87% YTD at the end of March to -8.26% as of tonight. And that was with a relatively low equity exposure.

I had been trying to increase my equity exposure by shopping the "bargains" in the tech growth sector (a.k.a. falling knives). So despite the huge hit, my equity percentage actually went up by a little under 1%. I guess you could say that I am rebalancing

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

YTD down -8.07% with AA = 100% equities.

Stay calm, carry on! With over a century worth of data and our 30+ year time horizon, this little dip will be long forgotten!

Stay calm, carry on! With over a century worth of data and our 30+ year time horizon, this little dip will be long forgotten!

gamboolman

Recycles dryer sheets

Will be starting May with the Portfolio down <-9.08%> since 1-Jan-22.

Current AA is 53.5% Equities, 43.3% Bonds & 3.2% Cash

Current AA is 53.5% Equities, 43.3% Bonds & 3.2% Cash

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Jan 31, YTD -4.18%, stock AA 78.0%

Feb 28, YTD -3.22%, stock AA 73.8%.

Mar 31, YTD -0.18%, stock AA 74.7%

Apr 30, YTD -7.57%, stock AA 74.6%

Feb 28, YTD -3.22%, stock AA 73.8%.

Mar 31, YTD -0.18%, stock AA 74.7%

Apr 30, YTD -7.57%, stock AA 74.6%

Mr. Tightwad

Thinks s/he gets paid by the post

Up 3.5% in 2022.

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

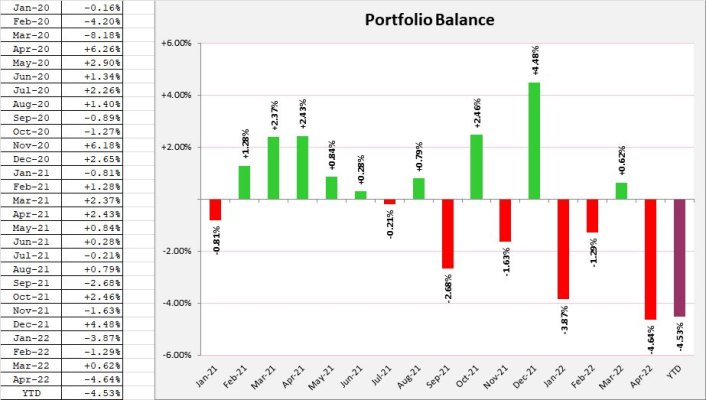

50/50 Portfolio BALANCE

Jan-22 -3.87% Feb-22 -1.29% Mar-22 +0.62% YTD -4.53

April-2022

Roughly speaking, our portfolio total is down about 5% from a year ago. YTD total is -4.64%. I don't measure performance, and just keep the AA of low-cost index funds on target.

For us, the 1-year time period includes significant transfer of wealth to the kids.

This page has a list of portfolios and performance for 1- and 10-years.

https://portfolioslab.com/lazy-portfolios

Attachments

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,567

Down 12.34 YTD invested 80/20 portfolio. I will just stay pat and hope that markets don't stay down for years.

Closet_Gamer

Thinks s/he gets paid by the post

I bled about 7% in April after yesterday's drubbing.

But interestingly, my AA is largely intact.

+/- 1% here and there but nothing that requires any changes.

But interestingly, my AA is largely intact.

+/- 1% here and there but nothing that requires any changes.

Lakedog

Full time employment: Posting here.

- Joined

- May 23, 2007

- Messages

- 984

Up 5.4% YTD due to high energy exposure. A couple of weeks ago was up over 9% YTD so even energy has taken a bit of a hit recently.

Similar threads

- Replies

- 145

- Views

- 6K

- Replies

- 15

- Views

- 532

- Replies

- 50

- Views

- 8K