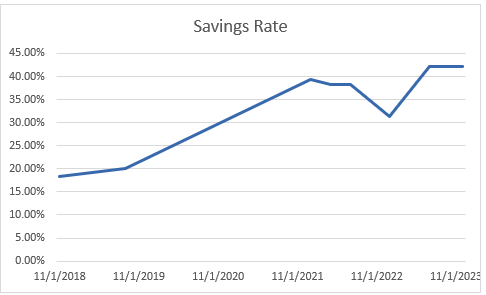

66% of income saved toward retirement

$100k saved total. This is the second-highest savings rate in 5 years (2020 COVID I saved a lot of money lol)

Notes:

In 2023 I got a big bonus for switching companies so that helped a lot, but I also had to unexpectedly buy a car.

2024 will be likely less, since I took a 10% pay cut for a much less stressful and much more stable job. (worth it)

What's your numbers?

$100k saved total. This is the second-highest savings rate in 5 years (2020 COVID I saved a lot of money lol)

Notes:

In 2023 I got a big bonus for switching companies so that helped a lot, but I also had to unexpectedly buy a car.

2024 will be likely less, since I took a 10% pay cut for a much less stressful and much more stable job. (worth it)

What's your numbers?

Hopefully, you're now in that magic season where your stash is making a lot more than you ever could by w*rking.

Hopefully, you're now in that magic season where your stash is making a lot more than you ever could by w*rking.