RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

There are some great returns from you folks. I don't believe I ever been greater than the teens in percentages.

Great job!!

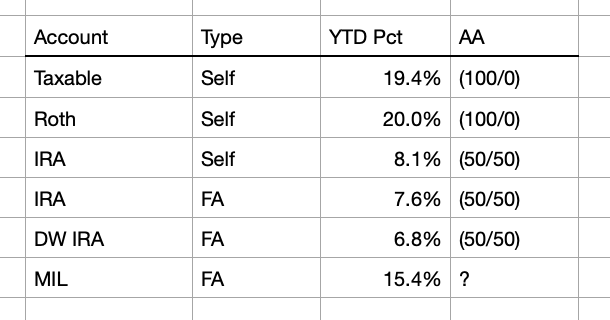

The reason why my YTD performance is so good is that my AA = 100% equities (excluding rentals). Additionally, while the majority of my portfolio is in VOO and VTI, I also have have QQQ and some individual stocks. Personally, I had hoped to be 100% in VOO, VTI, and QQQ but I wasn't able to convert the individual stocks to ETF's during the 2022 bear because I didn't want to take a tax hit.

Last edited: