You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2023 Investment Performance Thread

- Thread starter audreyh1

- Start date

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

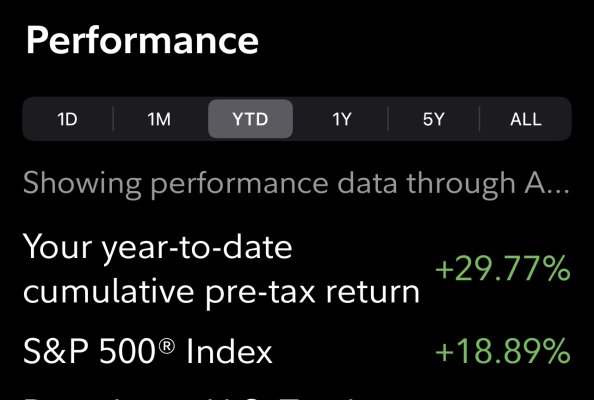

I’m up: +29.77% YTD on a 100% equities portfolio / asset allocation (excluding rentals and future SS).

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

i’m up: +29.77% ytd on a 100% equities portfolio / asset allocation (excluding rentals and future ss).

Duplicate

Attachments

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

One less account this month to track. That's a plus.

This is portfolio balance, not performance. The AA is 55/45.

Jan-23 +3.45%

Feb-23 -1.94%

Mar-23 +1.90%

Apr-23 +0.59%

May-23 -0.56%

Jun-23 +3.74%

Jul-23 +0.49%

Aug-23 -1.52%

2023 YTD +6.14%

A 50/50 balanced fund is +7.75, so our performance is near that number, but lagging.

This is portfolio balance, not performance. The AA is 55/45.

Jan-23 +3.45%

Feb-23 -1.94%

Mar-23 +1.90%

Apr-23 +0.59%

May-23 -0.56%

Jun-23 +3.74%

Jul-23 +0.49%

Aug-23 -1.52%

2023 YTD +6.14%

A 50/50 balanced fund is +7.75, so our performance is near that number, but lagging.

Andre1969

Thinks s/he gets paid by the post

Here's my latest...

1/31/2023: +7.08% YTD.

2/28/2023: +4.22% YTD.

3/31/2023: +7.18% YTD.

4/28/2023: +8.40% YTD.

5/31/2023: +8.96% YTD.

6/30/2023: +14.51% YTD.

7/31/2023: +17.96% YTD.

8/31/2023: +16.04% YTD.

August was starting to turn into a meh sort of month...as recently as 8/25 I was down to +13.29% YTD. But the end of the month was a pretty nice comeback.

1/31/2023: +7.08% YTD.

2/28/2023: +4.22% YTD.

3/31/2023: +7.18% YTD.

4/28/2023: +8.40% YTD.

5/31/2023: +8.96% YTD.

6/30/2023: +14.51% YTD.

7/31/2023: +17.96% YTD.

8/31/2023: +16.04% YTD.

August was starting to turn into a meh sort of month...as recently as 8/25 I was down to +13.29% YTD. But the end of the month was a pretty nice comeback.

15.7% on what is currently a 75% equity / 25% fixed asset allocation. My 2023 target is 70/30 but I see it's drifted due to a good market and my ever decreasing interest in monitoring finances. Have read as we get older, our interest and / or ability to manage our finances often decreases. I can see that in myself already at only 63 yrs old.

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

21.98% on my self managed money. A tiny account that's not in that # is up 153% this year. It's actually back to where it started 2 years ago.

copyright1997reloaded

Thinks s/he gets paid by the post

Traveling, so not a lot of time to update spreadsheets. Through 7/29:

July +1.0%

YTD +9.7%

YoY +6.4% (2022 July was +4.4%, one of the few up months last year)

Since high (12/31/21) -4.0%

Since 12/31/20 +7.3%

Since 12/31/19 +23.0%

Actual month end (July 23) would have been slightly higher (Monday 7/31/23 was an up market day).

Still under 40% equities, so not bad given allocation.

August -1.7%

YTD +7.9%

YoY +6.9%

Since high (12/31/21) -5.6%

Since 12/31/20 +5.7%

Since 12/31/19 +20.9%

I continue to "bleed" cash for house projects and other BTD which impact included in the above. Equity allocation similar to prior month.

Jan '23: +9.5% lol. I'll take it. Don't expect it to stick around though.

Feb '23: +7%.

Mar '23: +13% 99% Stocks, dividends included

Ooops, I realize I missed April, and May

Jun '23 +24.7%

Jul '23 +29% Losing to Nasdaq but on par with my A/A since I have about 42% of the portfolio in Small/Mid cap and the rest Mega. I should really stop farting around and just go all MegaCap MGK

Aug '23 +26%. Went backwards a tad.

Feb '23: +7%.

Mar '23: +13% 99% Stocks, dividends included

Ooops, I realize I missed April, and May

Jun '23 +24.7%

Jul '23 +29% Losing to Nasdaq but on par with my A/A since I have about 42% of the portfolio in Small/Mid cap and the rest Mega. I should really stop farting around and just go all MegaCap MGK

Aug '23 +26%. Went backwards a tad.

SloHan

Full time employment: Posting here.

- Joined

- Aug 13, 2017

- Messages

- 509

As of end of August 15.64% YTD.

wingfooted

Recycles dryer sheets

YTD investment return, time weighted inclusive of dividends, interest and mark to market gains / losses.

28.84 %

All equity portfolio, slightly levered.

The tech positions that were so strong in the first half were flat to down in Q3. AMZN, QQQ, AAPL, SMH.

Big winners in Q3 were the energy holdings - COP, OXY, FANG, HES and XOM.

I am very happy to be trouncing the returns of the SP 500 benchmark- which is up 13.0% YTD.

28.84 %

All equity portfolio, slightly levered.

The tech positions that were so strong in the first half were flat to down in Q3. AMZN, QQQ, AAPL, SMH.

Big winners in Q3 were the energy holdings - COP, OXY, FANG, HES and XOM.

I am very happy to be trouncing the returns of the SP 500 benchmark- which is up 13.0% YTD.

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,607

7.75% ytd.

steelyman

Moderator Emeritus

Retirement portfolio YTD return through Q3 2023 6.61% vs benchmark VTHRX (Vanguard Target 2030) 5.93%.

Stock/bond allocation follows VTHRX.

Stock/bond allocation follows VTHRX.

Markola

Thinks s/he gets paid by the post

7.02%. Returns often improve once September is out of the way, though I’m not complaining.

copyright1997reloaded

Thinks s/he gets paid by the post

August -1.7%

YTD +7.9%

YoY +6.9%

Since high (12/31/21) -5.6%

Since 12/31/20 +5.7%

Since 12/31/19 +20.9%

I continue to "bleed" cash for house projects and other BTD which impact included in the above. Equity allocation similar to prior month.

September Ugh results:

September -2.7%

YTD: + 4.9%

YoY: +12.2% (improved only because Sept 22 was so awful)

Since high [12/31/21] -8.2%

Since 12/31/20 +2.8%

Since 12/31/19 +17.6%

ATXFIRE2034

Recycles dryer sheets

End of Q3 Update:

- Up 41% across my portfolio YTD.

- Current AA (equities / bonds / cash) = 86% / 0% / 14%

- Overall NW is up 21% YTD.

- Reached 60% of my goal FI target.

- 42 with plan to retire at 55.

- ROTH performance YTD = +70% (Thanks NVDA! I do have a Stop Loss order in place to ensure I at least double my money in my position in the case of a crash which I would then invest in VOO at a presumed market low.)

- Up 41% across my portfolio YTD.

- Current AA (equities / bonds / cash) = 86% / 0% / 14%

- Overall NW is up 21% YTD.

- Reached 60% of my goal FI target.

- 42 with plan to retire at 55.

- ROTH performance YTD = +70% (Thanks NVDA! I do have a Stop Loss order in place to ensure I at least double my money in my position in the case of a crash which I would then invest in VOO at a presumed market low.)

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

Dropped back a bit to 10.7% gain. Rolled some maturing fixed income into 5.7% CDs. Thinking about tweaking the allocation a little but nahh, this 65/35 works for me.

GhostofTomJoad

Recycles dryer sheets

7.2% below all-time high at start of 2022.

34% in bonds, mostly junk. Still adding to taxable. In January, I customarily move a few thousand out of tIRA and it goes to keep my wonderful, fabulous, glorious in-laws in a foreign country afloat. Well, not ALL of it.

RMDs start in a bit over 2 years from now. Zero tax due on 1040.

34% in bonds, mostly junk. Still adding to taxable. In January, I customarily move a few thousand out of tIRA and it goes to keep my wonderful, fabulous, glorious in-laws in a foreign country afloat. Well, not ALL of it.

RMDs start in a bit over 2 years from now. Zero tax due on 1040.

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

AA = 100% equities (excluding rentals)

YTD = Up 22.11% (excluding rentals)

YTD = Up 22.11% (excluding rentals)

On our Schwab portfolio with an AA of 65.5/34.5 equity/fixed income we are..

YTD +4.89% ending January

YTD +3.34% ending February

YTD +5.50% ending March

YTD +6.18% ending April

YTD +6.34% ending May

YTD +11.06% ending June

YTD +14.64% ending July

YTD +13.07% ending Aug

YTD +10.20% ending Sep

YTD +4.89% ending January

YTD +3.34% ending February

YTD +5.50% ending March

YTD +6.18% ending April

YTD +6.34% ending May

YTD +11.06% ending June

YTD +14.64% ending July

YTD +13.07% ending Aug

YTD +10.20% ending Sep

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

10.6% AA about 70% Stock Index 30% CD/MM

Similar threads

- Replies

- 158

- Views

- 7K

- Replies

- 22

- Views

- 1K

Latest posts

-

-

-

-

-

-

-

Who FIREd the Earliest with the Lowest FIRE Score and Why You Did?

- Latest: upupandaway

-

-

-