You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2023 Investment Performance Thread

- Thread starter audreyh1

- Start date

Markola

Thinks s/he gets paid by the post

Your higher beta bet on bitcoin really helped that ‘fairly conservative’ portfolio.

Your results are quite impressive too. Congrats. As for my strategy, yes, even a few points additional return from a small tech component helps a lot over time.

Last edited:

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I am getting too lazy to keep crunching these #s. The ROR column for 2022 was blank in my master spreadsheet so I must’ve forgot or blew it off.

In 2023 my ROR is 17.8%. I finished with 72% equities. I’m pretty happy with that since my FI assets are very safe.

In 2023 my ROR is 17.8%. I finished with 72% equities. I’m pretty happy with that since my FI assets are very safe.

KCGeezer

Thinks s/he gets paid by the post

- Joined

- Jan 2, 2015

- Messages

- 1,539

Seems to be respectable compared to others here. 15.5% on 60/35/5 AA

Retire2023

Recycles dryer sheets

- Joined

- Mar 10, 2019

- Messages

- 98

+19.59% for the year. Also managed to hit a new high investible net worth this year. Very happy with things this year. 84/8/8 allocation

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

60% Stocks / 40% Fixed/Cash, Hi-Yield MMF, etc.

Total Portfolio balance rose 11.24% for the year, and is not too far from the all-time high.

2023 IRR gathered from various institutions and weighted, gives a performance number of +12.47%.

We have a small Roth conversion to do, and that will reduce holdings by 1.

Total Portfolio balance rose 11.24% for the year, and is not too far from the all-time high.

2023 IRR gathered from various institutions and weighted, gives a performance number of +12.47%.

We have a small Roth conversion to do, and that will reduce holdings by 1.

Markola

Thinks s/he gets paid by the post

A little inspiration for the young dreamers, 10 yrs ago I had recently quit drinking after being a lifelong binge drinker and alcoholic. We began 2014 with just about $40,000 to our name. Today we are millionaires. IN less than 10 yrs we went from nothing, to something. If I can do it, anyone can.

Great story. Kudos for getting your life back on track.

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OK with the last bit of interest reported, it was 13.25% for 2023 on a 50/50 portfolio. Nice!

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

My self managed mone 75/25 was up 24.02% for the bulk of it. A little higher if I include the smaller Roth at 59.31%.

The Vanguard managed assets through PAS. They did 14.60% on a 50/50 split.

The Vanguard managed assets through PAS. They did 14.60% on a 50/50 split.

Ronstar

Moderator Emeritus

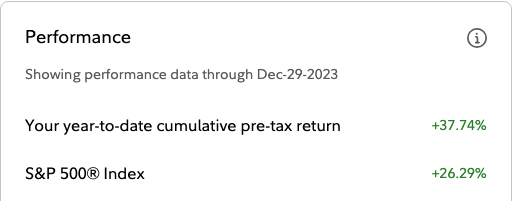

AA = 100% (excluding rental properties)

2023 Return = +37.74% (excluding rental properties)

That's a hell of a year. Congrats.

However, given you're I think all in tech names isn't your benchmark a tech index or the NASDAQ?

RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

That's a hell of a year. Congrats.

However, given you're I think all in tech names isn't your benchmark a tech index or the NASDAQ?

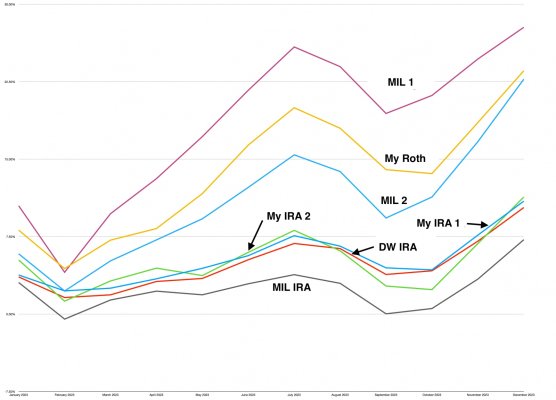

The majority of my portfolio is VOO, VTI, and QQQ so yes I have a tilt towards tech due to QQQ plus the fact that VOO/VTI is tech top heavy (at least currently). These figures do not include my day trading algos nor rental properties, both of which have done well.

The majority of my portfolio is VOO, VTI, and QQQ so yes I have a tilt towards tech due to QQQ plus the fact that VOO/VTI is tech top heavy (at least currently). These figures do not include my day trading algos nor rental properties, both of which have done well.

Gotcha. Regardless, that’s a damn nice number. My tech exposure is SCHG which trades similarly to QQQ. Like you also have SPY and VTI. And IWM for small cap exposure.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My best laid plans to lower my RMDs in 2024 went out the window with this past year's results - especially the vestiges of Megacorp stock that took off in 2023. What a great set of circumstances to complain about!

steelyman

Moderator Emeritus

Retirement portfolio 2023 return 18.52% vs benchmark VTHRX (Vanguard Target 2030) 15.99%.

Stock/bond allocation follows VTHRX (63/37).

2023 WR (withdrawal rate) 3.19%.

Stock/bond allocation follows VTHRX (63/37).

2023 WR (withdrawal rate) 3.19%.

Last edited:

yakers

Thinks s/he gets paid by the post

To get a really precise breakdown I would have to gather Vanguard accounts, Wells Fargo accounts, Federal TSP and figure it all out with weighted averages, its 8.8% in the TSP, 14 something at VG, various amounts at WF, but the number that really matters is the total portfolio is up 4.4% after spending and I'm happy. 2023 was big travel, 3 weeks in Portugal & Spain, a coupe weeks in NY and a very expensive trip to Norway (hired a private guide for a heritage tour) DW got a new car and gave younger son some $ to get a decent replacement car after an accident. I'm happy, really happy, for the numbers that mean the most to me. Now 73 (DW 75) retired 2008, time to BTD.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Turns out I actually did 13.35% for 2023 (50/50). Quicken had “lost” a few shares and I didn’t catch it until yesterday.

Last edited:

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’m losing it. I thought I posted mine earlier.

We did 16.8% with our liquid investments. About a 72/28 allocation to stocks/fixed income. I tend to take interest and invest that into stocks, but send the dividends from stocks to my checking account. Maturing fixed income assets are reinvested.

We did 16.8% with our liquid investments. About a 72/28 allocation to stocks/fixed income. I tend to take interest and invest that into stocks, but send the dividends from stocks to my checking account. Maturing fixed income assets are reinvested.

AA on 12/31/2023 was 86/11/3. 2023 performance was 19.2% per Fidelity. The Fidelity 85/15 market index was 20.3%. We have some high-dividend equity funds in taxable. I'd like to dump them, but I hang on due to very large embedded capital gains. I haven't checked yet, but I'm pretty sure that's the culprit. Still, great recovery from a dismal 2022.

Similar threads

- Replies

- 148

- Views

- 7K

- Replies

- 22

- Views

- 1K