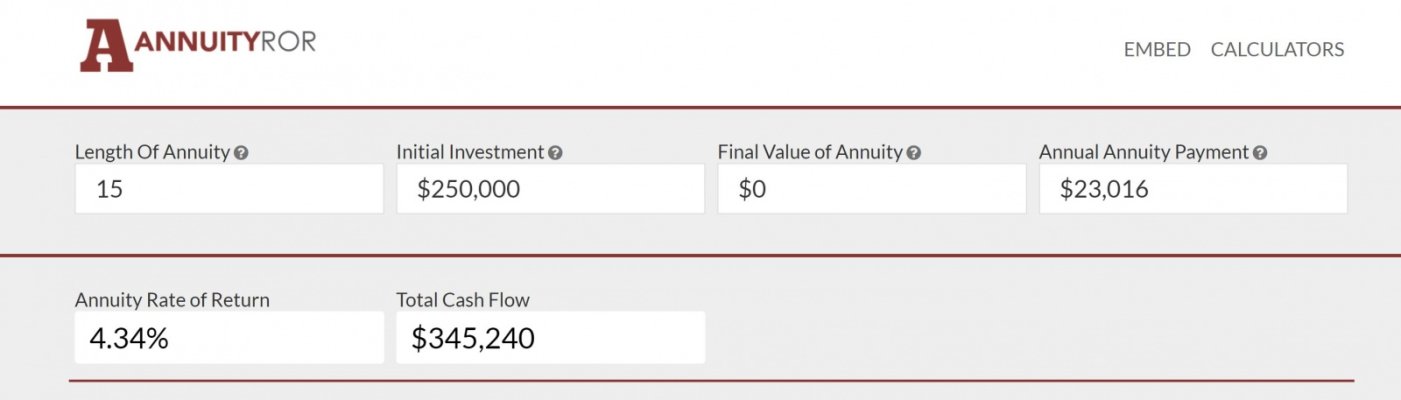

... My concern is DH after I'm gone. His extent of managing the money is howling for me to sell when the markets drop (I don't, and gently talk him off the ledge) and withdrawing money to spend. He will be a soft target for the kiddos and the overseas relatives when I'm not around to provide defense, so I want him to have a large, reliable monthly income. I am considering an annuity with a step up for DH (whose family lives forever) so he gets a larger amount which can go towards in-home care to the extent he needs it, dental, hearing aides, etc.

I agree with you, that is a

serious concern! One reason we went with a CFP firm is that I handle the investments and taxes. DH has zip, nada, no interest at all in the details. We talk regularly about various scenarios so he is aware

how his lifestyle will/can change, but that does not mean he has any interest in altering the asset allocations or realizing the tax consequences of changes. He needs a reliable, neutral sounding board that can also give professional recommendations.

Our using a CFP is a double back-up: not just for DH but when we both pass on or become

non compos mentis, our beneficiary is a relative: honest as the day is long but has NO familiarity with handling large sums of money or dealing with eldercare issues. She, too, will need advice but wouldn't know where to look for it, otherwise.

I can't help with your annuitizing difficulties, but I can totally sympathize with your need to give your DH a source of regular monthly income as a worry-free financial base.

When people are overwhelmed by grief it's almost impossible to properly grasp an unfamiliar and complex subject like financial investing, especially if they have poor instincts (which, sadly, is most people) about market ups and downs.

The easier you can make it for your DH to have some financial security that he won't have to worry about - no matter how you decide to do so - will be something he'll be grateful for, if the worst happens.

Good luck to you, and congrats for the courage in considering a 'worst case' scenario.