njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

I wish I understood this. What is the actual interest one would get (anual interest) at the end of the period 6.1% or 4.5% divided by 8 months?

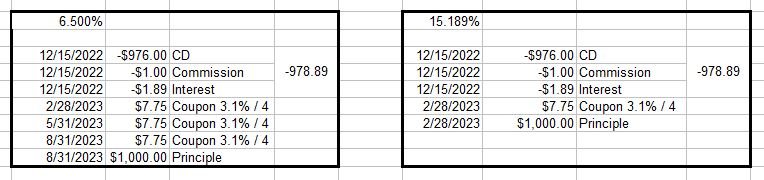

So there are two components when you are not buying new issue CDs:

1. Interest component

2. Premium or discount (capital loss or gain)

Obviously, if you pay above 100, you are paying a premium, and over the remaining life of the CD you will need to subtract this amount out of your total return. If you pay below 100, then it is a discount, and you will get this additional gain over the remaining life of the CD - since it will always be paid 100.0 at maturity.

So, in my case, the CD has 3.1% coupon, I collect that interest for 8 months - so 3.1/97.7 for that portion of the return. Additionally, I get the difference of 97.7 to 100 as a capital gain component. So, an extra 2.3 points over 8 months ($23/$1000 CD).

Now, if they do call in 2.5 months at the end of February, I still get that additional 2.3 points, but more quickly, 6 months early. Annualize that portion, and it's over 10% in the event of a call.

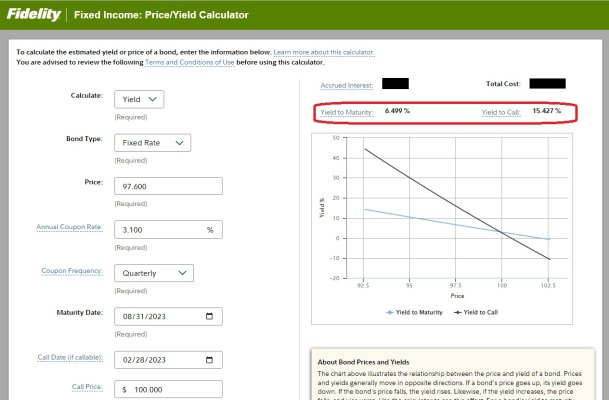

You can use Fidelity's price yield calculator to figure the exact returns.

Attachments

Last edited: