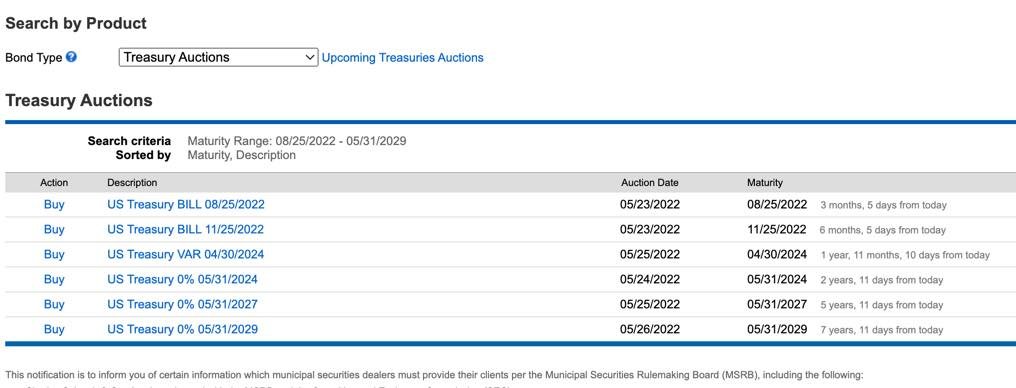

For those of you who may be laddering money out for 5 - 10 years, are you currently buying anything beyond 2 - 3 year maturities knowing the Fed has made it clear they will be raising rates for the foreseeable future until inflation is "tamed". I changed up my fixed allocation strategy earlier this year moving 5 years of my bond funds into individual bonds (Treasuries), currently all set to expire between July - Jan. Plans were to redeploy once they mature and perhaps look a little further out, some up to 2 years, but curious as to what others are thinking regarding when to start committing to longer term maturities?