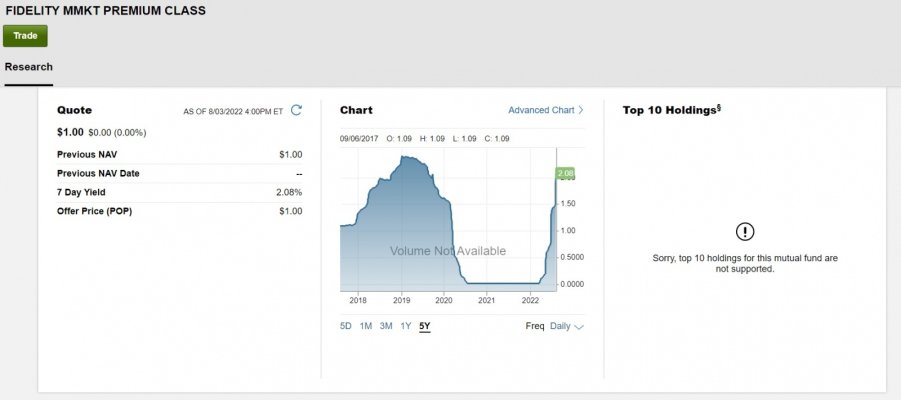

The research pages are behind. I have the fund and it reports the yield daily. As of this morning it says 2.08%.

Edit, if you click on your link, it also says 2.08%.

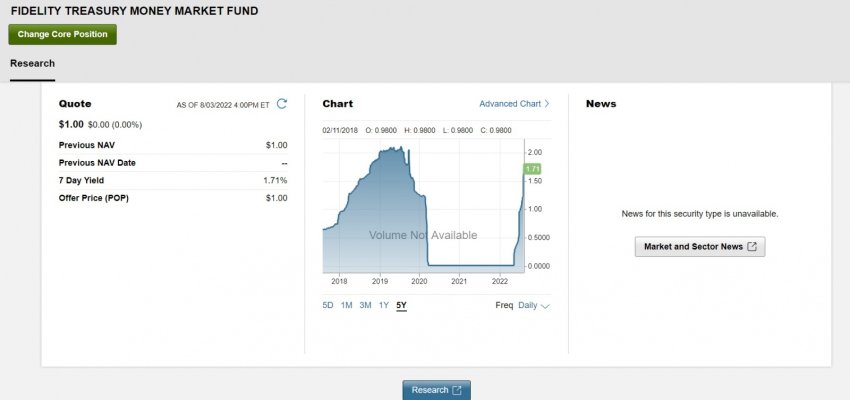

Is there another Fidelity MM fund earning similar thats open to new investors and has lover minimum investment? This one shows closed on my account and the other shows $100k min