Thanks jazz4cash. Like Graybeard, I'm slowly dipping toes in these markets. I think it becomes simple for one who has done it. For a first time user, it can be perplexing. Kind of like driving a car with a manual transmission.

I have attached some relevant screen shots. If you don't mind, I'm going to pick apart your instructions and discuss them, referring to the picture, trying to do what Graybeard wants to do. Anyone, please correct me if I am wrong.

I think if you explore the VG bond pages you’ll find it easy to comprehend. Start with the yield table and look for the maturity closest to the one you just missed. Hover or click on it and a list of similar issues will pop up.

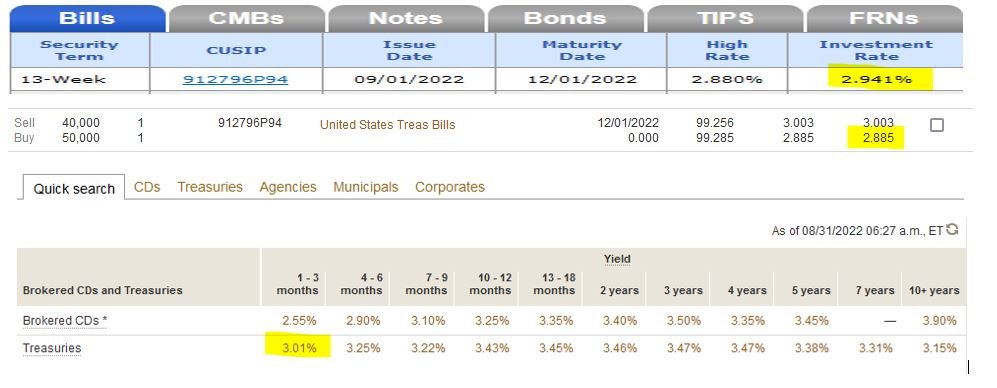

OK, the bottom of my screenshot is part of the yield table that comes up when using the "Quick Search" tab. I click the highlighted, in order to access the 3 month T-bill I just missed buying yesterday. A list of similar issues do pop up, including that 13 week that matures 12/1. So far, so good.

The price/yield will be very close to the auction result. Hover/click/ check the glossary of terms. Call VG or post specific questions here. No need to miss the opportunity just because you missed the auction. I use Fido but VG is similar.

I think this is where a lot of us lose it and grind the gears. We've gotta lot of numbers. Min/max buy/sell. Maturities. Coupon numbers (in this case, all 0.0000). And so on.

For the highlighted sections in my example, it appears I could buy a bond for 99.285 that has an effective yield of 2.885. Right? Above this you see the auction result which is 2.941%. Close, but not the same as a result of the "extra hands" in the secondary market effectively taking their cut, right?

Speaking of which, the "bid/ask" which is really sell/buy adds confusion for the novice. When buying, I really only care about ask, right? And this spread is a consequence of the extra hands in the market, in this case the market maker, getting their cut of the pie for enabling this transaction, right?

----

I think for zero coupon treasuries this mostly makes sense. But some is still confusing, so check my following statements: You buy in increments of $1000, but the price displayed is per $100. Confusing.

Corporates use the same $100 quote, right? I think looking at corporates or treasuries with coupons adds another dynamic because the "yield to maturity," especially for high coupon items with very short maturities, can be negative. I assume this is because a coupon payment is about to drop? Confusing...