CharlieZulu

Dryer sheet wannabe

- Joined

- Jul 14, 2021

- Messages

- 15

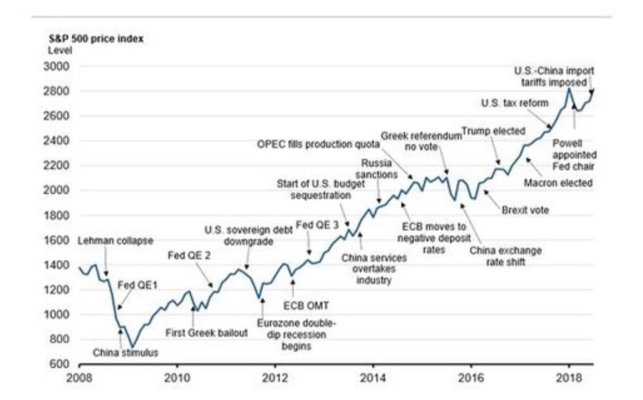

Charlie did you read my post, everyone has their own inflation number...

Remember no one complains when their stock doubles.

I like that perspective, “your own inflation number.” Makes sense. Your point about home ownership is also good. Except...no one complains about rising values in homes until they pay their property taxes.

That said, yes, Inflation is not evenly applied against all sectors of the economy, and so it totally depends on what you spend your money on. Absolutely on board. Right now, I imagine that those who want to travel are getting pummeled. , as an example.

Thanks!