Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

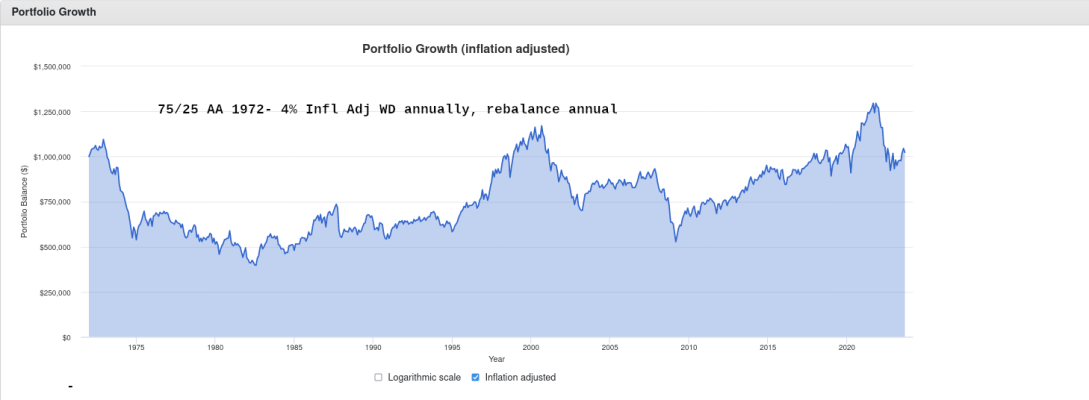

I never watch or listen to Dave Ramsey. Pretty unbelievable that he's recommending up to 10% withdrawal rate. What a way to set people up to fail. That's some pretty terrible advice, as the video above shows.

I've mentioned a co-w*rker (actually, a direct report.) He announced that he and his broker had decided he would retire in X months. He was gloating about how his broker had it all figured out (puts and calls for extra income as I recall) and that the broker had assured him he could draw 8% of the starting amount or more every single year.

Heh, heh, so 2 years into his ER, the guy was almost out of money and w*rking again - repositioning cars. I think he might have gotten $10/hour for doing the "hiring" of 2nd driver (like me - IIRC I got $0.15/mile) plus driving the other car. He made extra money if he ushered say 8 or 10 drivers to the car auction (maybe $5/car?) So, not a great life IMHO. But it w*rked for him - though not the life he had envisioned, I'm sure.

I was only doing the repositioning myself to help the guy out and to get a chance to drive some fairly nice cars (not to mention some really bad ones - to the auction.)