Closet_Gamer

Thinks s/he gets paid by the post

Among a handful of other drivers, I think a lot comes down to Italy.

If they can really get the lid on it and restart their economy, then yes, I think we've put in a bottom. Its a leading indicator.

If they can't get it under control in the next 10 days, then we may take another down leg as there isn't a viable model for other western economies to follow.

I don't often quote myself, but its been on my mind since I wrote it....along with any number of other opinions I've hung out there since!

Italy has continued a steady downtrend since I wrote this but certainly didn't resolve it in 10 days. They're demonstrating the decline is much slower than the ramp. Still, just 16 days after I wrote this, most of Europe shows the virus rapidly coming under control.

Hence, we haven't returned to a big down leg.

We also have glimmers of encouraging news:

Germany has jumped to the front of the train and announced a partial re-opening plan. I believe we'll see similar moves in other European countries in the next week. Plus a few US states are taking off the parking break. China's economy is spinning back up.

There is more anecdotal evidence to suggest the virus is far more wide spread than thought implying lower mortality and higher immunity. Stanford just published a study where they went deep on testing in a single CA county. Result was the virus was 50x more prevalent than had already been diagnosed. (https://spectator.us/stanford-study-suggests-coronavirus-more-widespread-realized/)

The report on remdesivir is encouraging as well. Not only for its own potential utility but because it reminds us that the entire medical and pharmaceutical world has bent its will on this thing.

And, of course, governments continue to prop up businesses and families in an unprecedented way and healthcare systems the world over are ramping capacity to better manage future surges.

If some combination of these factors come true (less lethal, way closer to herd immunity, expanded healthcare capacity and an effective treatment), this thing fades far more quickly and into a backdrop of damaged but stabilized businesses. We'll all be wondering about how to clean up the wreckage, but the crisis will recede much sooner than if we have to wait for a vaccine.

The flip side:

-China closed two cities and is starting to admit they had a much bigger problem.

- Data coming out of nursing homes suggests we've been badly undercounting deaths among the elderly.

- Outbreaks continue to ramp in various US cities

- Russia & Japan are ramping

- No one knows what will happen in Africa, India, etc. but the living conditions and healthcare infrastructure point to something horrifying. Ecuador looks to be the leading indicator of what happens in a less developed country

Bottom line:

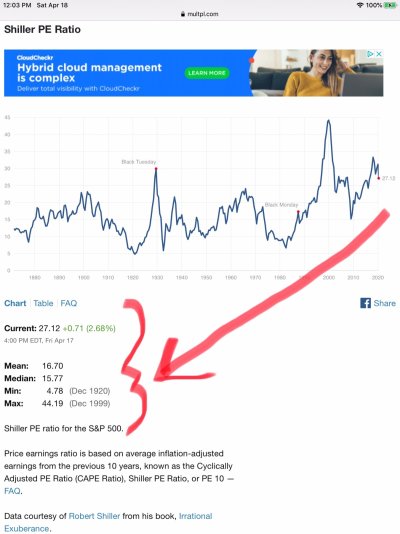

I think the market is spring loaded to the downside right now, but I don't think we will retest the lows in the next 6 weeks. (There, I said it!)

Too much good news is going to contend with the bad news.

A month from now we'll have a lot more real information to assess again, with the single most important piece of information being any level of scaled antibody testing among the general population. That's the missing puzzle piece.

(To ensure that we don't retest 18000, when the market was at 20K, I put in some buy orders for 10% down. My below market buy orders never trigger...so everyone is safe!