Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The P has regained to its prior value, but the E has yet to be updated to reflect the current economic condition.

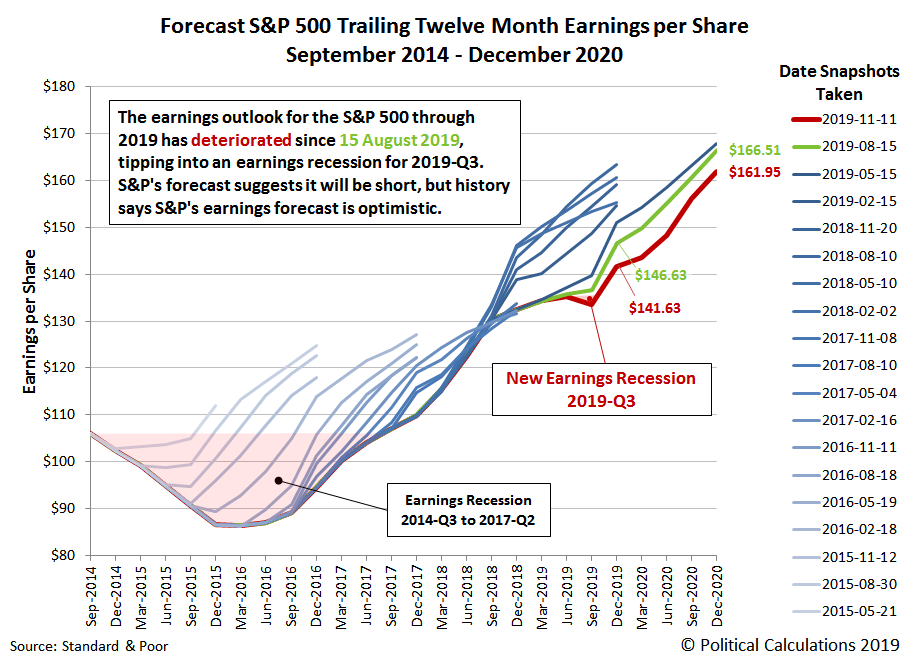

I looked and found this chart showing things were going great, i.e. the E was climbing, until this horrible virus hit.

PS. OOPS! The chart is old. Lemme go find a more current one.

The following chart was published in Nov 2019, and it showed what the expectation was for 2020 before the pandemic.

Didn't know that about the E. Wonder what the true Cape 10 is.