ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sorry if I offended anyone by not replying, probably because I still don,t know what to do , that's why its been five years . I,m at the point now that I have to start to withdraw from this acct to live. Maybe ive had my head in the sand, but again I apologize if ive offended anyone. ...

Not offended in any way, but I think you can understand a little frustration when you see the same person asking the same question several times over a period of years, with little in the way of updates/action.

Now I'm thinking about Vanquard and am going to call them I think it all stems to the fact I'm afraid to trust anyone!

I tend not to think in terms of 'trust' when it comes to financial decisions. I think in terms of - how and why could they screw me? What are their motivations?

For these retail FAs like EJ, they mostly have to spend their time getting customers, they do very little actual financial analysis. It's all cookie cutter, and mostly designed to make money for them, not you.

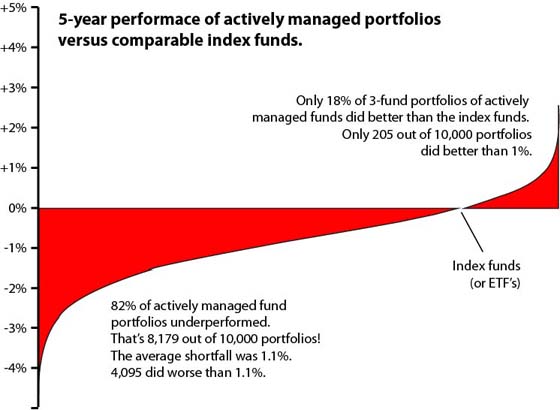

But the places that offer no-load, low cost funds (like Fidelity and Vanguard), they don't spend a lot on marketing to those types, and they seem to be doing well with the low expense ratios they charge. They attract people like on this forum, who just want a basic investment, and don't want to pay for anything beyond that. And the data shows that those low expense funds will generally outperform the higher cost funds that are pushed by the retail places. It is a win-win for those who see past the sales pitch.

So maybe this will be the year for you to take action?

-ERD50