DD's taxes were just filed using H&R Block tax SW. There have been quite a few questions about how HRB compares with TT, so I thought I'd share a few observations and my general impression.

The bottom line is this was simpler than last year's effort using TT (for DD). Fewer clicks, and the questions were easy to answer. My recollection of TT is many clicks, and even with simple returns some questions are more complex than necessary. For the most part, a breeze to complete.

Three irritations. First, to create a PDF copy of the filed return I had to install a 3rd party program (pdf995) supplied by HRB. I'll remove it when all the returns have been filed, but I prefer to keep this type of SW off my machine.

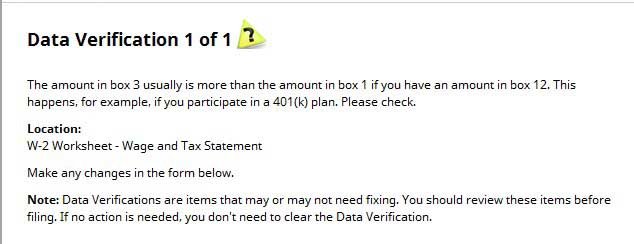

Second bug - after completing the return, during the review stage, it reports a "needs verification" item (Roth 401(k) contribution), in this case, incorrectly. (I'm attaching a screenshot).

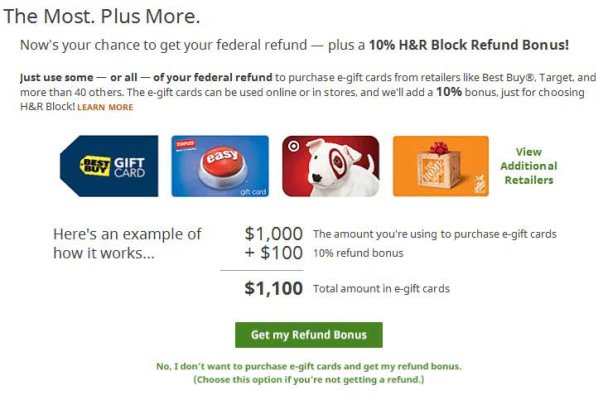

Finally, when setting up the refund, it offers an option for gift cards with an additional 10%, in lieu of cash. To reject this option and have the cash refunded one must click on a line that reads "Choose this option if you're not getting a refund". That was a real disappointment. (also attaching screenshot)

DD's return is easy, we'll see how it goes with others that have lots more input. Anyone else switch from TT to HRB this year?

.

.

The bottom line is this was simpler than last year's effort using TT (for DD). Fewer clicks, and the questions were easy to answer. My recollection of TT is many clicks, and even with simple returns some questions are more complex than necessary. For the most part, a breeze to complete.

Three irritations. First, to create a PDF copy of the filed return I had to install a 3rd party program (pdf995) supplied by HRB. I'll remove it when all the returns have been filed, but I prefer to keep this type of SW off my machine.

Second bug - after completing the return, during the review stage, it reports a "needs verification" item (Roth 401(k) contribution), in this case, incorrectly. (I'm attaching a screenshot).

Finally, when setting up the refund, it offers an option for gift cards with an additional 10%, in lieu of cash. To reject this option and have the cash refunded one must click on a line that reads "Choose this option if you're not getting a refund". That was a real disappointment. (also attaching screenshot)

DD's return is easy, we'll see how it goes with others that have lots more input. Anyone else switch from TT to HRB this year?

.

.