Thanks. Most, perhaps even all, were sold at a small loss but they were all tax-deferred so any loss didn't bother me. I sort of kept an eye on the YTM of the sale and tried to invest in similar YTM for the buy side, and actually did a little better overall which helped increase the portfolio YTM a tad.

IOW, as an example, if I could sell a 2025 maturity at a 5.7% YTM and turnaround and buy a 2028 maturity at a 5.7% YTM then I am fine with that since I am maintaining yield but lengthening duration and balancing out my ladder better.

One other thing that I noticed and changed just this morning in my metrics is that I have a number of callables with coupons that are significantly below current rates for that CUSIP...like 1.35% (2030), 3.15% (2024), 3.00% (2029), 3.50% (2029), 3.60% (2024) and 3.78% (2028) that I think are unlikely to get called so I made a judgement call to categorize the CUSIP as non-callable for my metrics. In all cases they are over 200 bps below the current YTM for those issues.

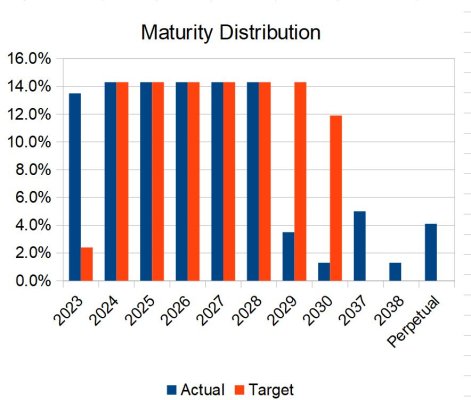

Below is my Maturity Distribution after this weeks trades. While I've explored sellinsome 2023 maturities to buy 2029 and later, the pricing is horrible so I'll just wait for them to mature. The Target is based on a 7-year ladder/3.5 year weighted average term to maturity and is 2/12 of 14.3% for 2023, 14.3% for 2024-2028 and 10/12 of 14.3% for 2029... but as a practical matter I include everything for 2030 and after and any perpetual preferreds in 2030 in the back of my mind.

Still learning and having fun.