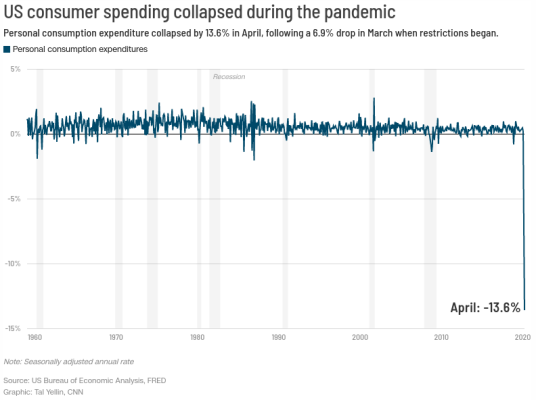

However, the pre-COVID economy was 70% consumer spending IIRC and we have 23 million people unemployed.

Many of whom are making more in unemployment than their normal pay.

Is the concern that people are quitting their jobs and collecting unemployment?

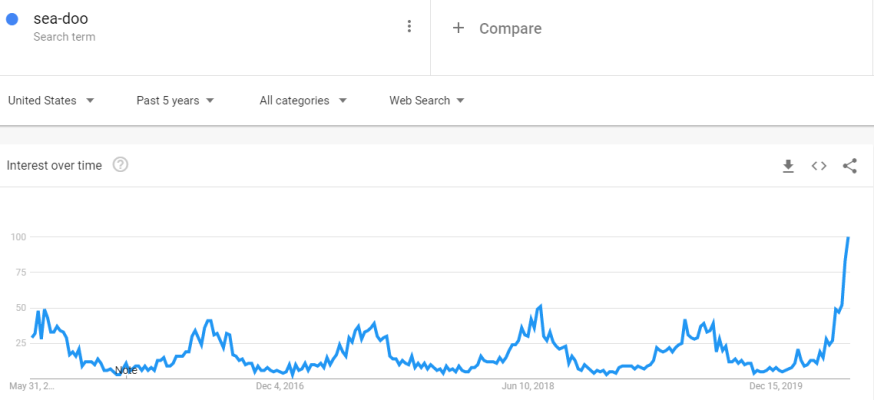

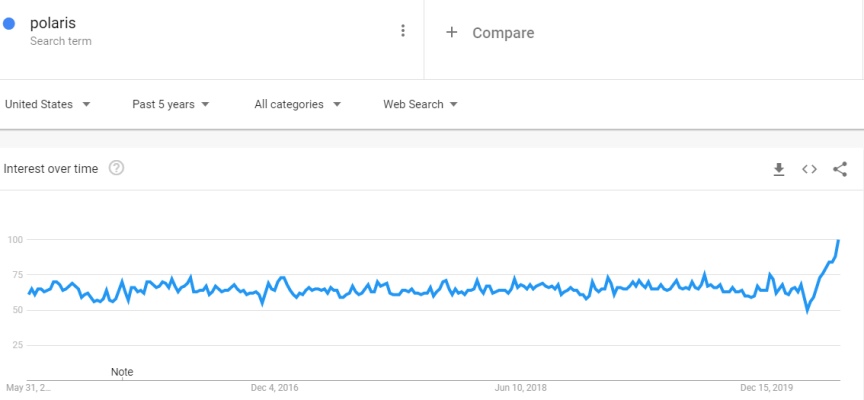

That was not my point. As pb4uski pointed out, the USA economy is heavily based on consumer spending. I interpret his post to meant that with consumer spending should be down because of the unemployment (and it largely has been). However, some (many?) are actually making more money due to the temporary unemployment as well as stimulus checks. For example, apparently sales of recreational water craft are through the roof.

When told you will make more money for the next few months, many people will spend it.