I keep re calculating firecalc.com with lower and lower portfolio values to see how we fare. We're safe but would leave "0" to beneficiaries and have to curb spending a lot at 50% less than what we have. But the market wild child just keeps going up so staying in at our current AA. Only sold a portion of International index fund and replaced with another stock index fund.Maybe it's just me, but I find those "ha ha, by selling then you already lost X percent" posts annoying.

It's all Monday morning armchair quarterbacking. The market could have kept going down then, and who's to say it still won't tumble in the not too distant future. Then, those that sold some stocks will look like a genius (for a period of time until the market recovers again).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

For the first time ever I sold all my stocks

- Thread starter harllee

- Start date

Count me as someone who truly doesn’t understand why the market is as high as it is right now. I admit that I don’t know a great deal about finance/investing. My success has been based on luck and inertia. I didn’t sell during the Great Recession because I felt that would be locking in losses. I have been holding a 60/40 AA. At the beginning of the year I was sitting at 62/38. I got nervous in February as COVID19 news was spreading and went to a 55/45 AA. I am now considering a 50/50. Since my funds are in a 401 K I can do this without tax consequences. Really thinking about it. Since I have a pension and DH has social security, we will be fine either way.

Like many have indicated our spending is way down. Planned trips have been canceled. The only area where we are spending more is groceries...no dining out and no hitting 2 and 3 local stores to cherry pick sale items. I have increased charitable donations, but as far as spending....way down.

Like many have indicated our spending is way down. Planned trips have been canceled. The only area where we are spending more is groceries...no dining out and no hitting 2 and 3 local stores to cherry pick sale items. I have increased charitable donations, but as far as spending....way down.

Markola

Thinks s/he gets paid by the post

Count me as someone who truly doesn’t understand why the market is as high as it is right now.

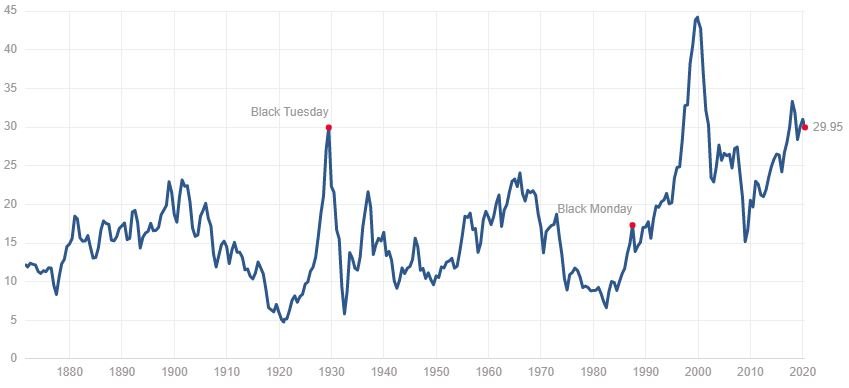

+1 and if it is already relatively highly valued in historic terms right now with a CAPE of 29.27, what will investors do once recent quarters’ earnings are factored in? Unless we’re in a La La Land where history no longer repeats, the denominator falls causing the P/E ratio to rise until the dumping of shares lowers the numerator and brings the P/E ratio back to something resembling attractive prices.

Shiller P/E 10 or “CAPE”. https://www.multpl.com/shiller-pe

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

+1 and if it is already relatively highly valued in historic terms right now with a CAPE of 29.27, what will investors do once recent quarters’ earnings are factored in? Unless we’re in a La La Land where history no longer repeats, the denominator falls causing the P/E ratio to rise until the dumping of shares lowers the numerator and brings the P/E ratio back to something resembling attractive prices.

Shiller P/E 10 or “CAPE”. https://www.multpl.com/shiller-pe

I read this morning that the s&p is trading at 26 times 2021 consensus earnings. What a bargain!

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I read this morning that the s&p is trading at 26 times 2021 consensus earnings. What a bargain!

I've been considering buying a put, since I missed out on most of the last great put buying (before covid-19 hit), and only got a little put in partway down.

I was thinking of a put at $130 (that was where I picked last time), but maybe a different strike price is better ?

I'm wondering do others feel the same way, that the market is going to collapse a lot, or is this a case of everything will remain around this level as the Fed will buy up everything/anything to keep it all happy. ?

Buying a Put is betting (gamble) that the market will go down, similar to selling lots of stock now is thinking the market may go down a lot.

Markola

Thinks s/he gets paid by the post

I read this morning that the s&p is trading at 26 times 2021 consensus earnings. What a bargain!

Gonna assume you’re kidding [emoji3]. I wonder how “they” can even have informed consensus given all of the companies that have suspended earnings guidance?

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I read this morning that the s&p is trading at 26 times 2021 consensus earnings. What a bargain!

Agree. lol

IMO, I believe the forward earnings multiplier is somewhat more indicative than the Cape 10 ratio as to whether securities are fairly valued.

At more extreme levels as to the year 2000 and Japan from 1989, the Cape 10 levels eventually have more predictive powers.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Gonna assume you’re kidding [emoji3]. I wonder how “they” can even have informed consensus given all of the companies that have suspended earnings guidance?

I wish I were. If you are a halfway competent analyst, you are supposed to build your own model for earnings for each firm you cover. Suspension of guidance just means the model is not informed by whatever management says.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well I'll never be one to praise analysts, but the price of a stock is supposed to be the present value of all future cash flows. So if you believe that this virus thing is a temporary hit to earnings, then just looking at P/E during the hit, you'd expect some high multiples.I read this morning that the s&p is trading at 26 times 2021 consensus earnings. What a bargain!

Further, if the NPV calculation uses something like the current crazy-low interest rates, the cash flow in the out-years post-2021 is not discounted so much and provides some extra heft to value.

So that's an analytical view. Do I believe that this kind of thing actually drives prices? Not so much.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Whatever lies you tell yourself to make the voices quiet down are fine with me.Well I'll never be one to praise analysts, but the price of a stock is supposed to be the present value of all future cash flows. So if you believe that this virus thing is a temporary hit to earnings, then just looking at P/E during the hit, you'd expect some high multiples.

Further, if the NPV calculation uses something like the current crazy-low interest rates, the cash flow in the out-years post-2021 is not discounted so much and provides some extra heft to value.

So that's an analytical view. Do I believe that this kind of thing actually drives prices? Not so much.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Agree. lol

IMO, I believe the forward earnings multiplier is somewhat more indicative than the Cape 10 ratio as to whether securities are fairly valued.

At more extreme levels as to the year 2000 and Japan from 1989, the Cape 10 levels eventually have more predictive powers.

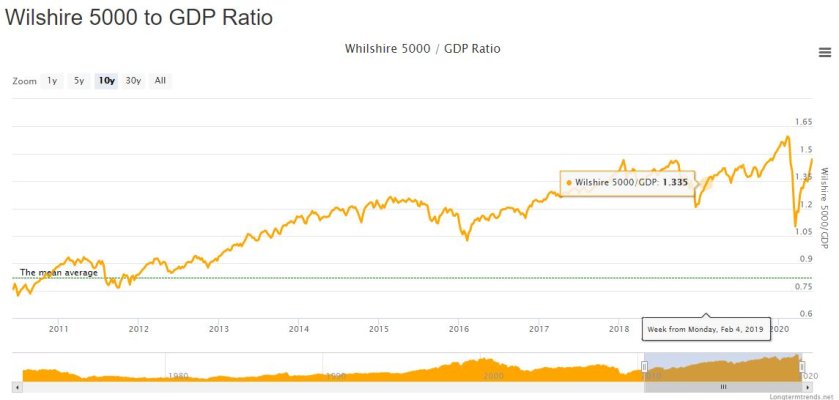

Wilshire 5000 total value to us gdp is now above the dotcom peak as well.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Oh, no problem. No voices. I've been going through these things since 1987 and, so far at least, they have all been temporary so I'm betting on temporary again.Whatever lies you tell yourself to make the voices quiet down are fine with me.

There are probably ten or more analyists for every single tradeable stock in the US. They do their thing: looking for market "inefficiencies." and I do mine: nothing.

VanWinkle

Thinks s/he gets paid by the post

Back to the original topic, here's my confession:

When the markets were in freefall, I held out for as long as I could - kept thinking of the cautionary comments on this site & all the times in previous crises when I panicked & sold stocks. One day, though, my anxiety got the better of me & I sold some VTSMX - not much, less than 5% my stock portfolio - & it felt good. It was my usual rationale: if stocks continue to drop, I'll feel a little bit better; if they rise, I'll still feel better because I still own a lot of stocks.

I didn't sell at the bottom, but close. In retrospect, not a wise move (& please, it's not necessary to point out how much that cost me). But I'm congratulating myself for behaving much better than during prior crises, & maybe the tiny amount of relief I felt at the time was worth it. See how well I can rationalize!

Sounds like your plan worked for you, congrats!!

It's not being weak, its doing what you need to do to get by another day.

Best to you,

VW

gayl

Thinks s/he gets paid by the post

I know approximately how much it cost me (6%). But I also knew what I stood to lose as my 'plan' is to self insure aging in place leaving a small legacy account intact. Money is just a tool to fund my life plan

FWIW I'm back to my original AA. Up 34% since getting back in.

FWIW I'm back to my original AA. Up 34% since getting back in.

Last edited:

Okay, I still think this market is crazy. Anyway, expect a bit of a rally again next week, because I moved toward my 50% AA. With the jump today, I just couldn’t stay on the sidelines and went ahead and moved some money out of stocks.

Then, those that sold some stocks will look like a genius (for a period of time until the market recovers again).

That's me

Almost.

Almost.I bought back in just a few days after the bottom, 3/28. I got lucky there was no knowledge about it. I just got scared, sold a little, then got scared that I'm miss out on a market rise. It was only 17%, but it helped.

Vanguard hasn't posted yet but, I'm probably still about 2% from my peak.

It was an anomaly for me, I'm a buy and hold investor.

Just taking out what we need to live on.

Markola

Thinks s/he gets paid by the post

Sounds like your plan worked for you, congrats!!

It's not being weak, its doing what you need to do to get by another day.

Best to you,

VW

+1. The day I meet a wealthy, experienced investor who says they have not made a lot of mistakes on the way there, well, I probably won’t believe them.

Major Tom

Thinks s/he gets paid by the post

I just misread this thread title as, "For the first time ever, I sold all my socks".

Seems like a valid retirement subject. My oldest brother, who has been retired for a few years now, owns only one pair of socks. They are a pair of black ones, for weddings and funerals.

Seems like a valid retirement subject. My oldest brother, who has been retired for a few years now, owns only one pair of socks. They are a pair of black ones, for weddings and funerals.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just misread this thread title as, "For the first time ever, I sold all my socks".

Seems like a valid retirement subject. My oldest brother, who has been retired for a few years now, owns only one pair of socks. They are a pair of black ones, for weddings and funerals.

haha I guess he doesn't work out.

tmm99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 15, 2008

- Messages

- 5,232

I just misread this thread title as, "For the first time ever, I sold all my socks".

Seems like a valid retirement subject. My oldest brother, who has been retired for a few years now, owns only one pair of socks. They are a pair of black ones, for weddings and funerals.

I don't think anyone would want to buy my socks...

aja8888

Moderator Emeritus

What are socks?

The Buffet Ratio says US Equity Market VERY Overvalued

This is why Buffet is hoarding cash.

Market Cap to GDP is a long-term valuation indicator for stocks. Warren Buffett says "it is probably the best single measure of where valuations stand at any given moment."

This is why Buffet is hoarding cash.

Market Cap to GDP is a long-term valuation indicator for stocks. Warren Buffett says "it is probably the best single measure of where valuations stand at any given moment."

Attachments

Current Shiller PE Ratio: 29.95 as of Fri Jun 5

Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), or Shiller PE Ratio.

Shiller wrote the book "Irrational Exuberance"

Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), or Shiller PE Ratio.

Shiller wrote the book "Irrational Exuberance"

Attachments

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This is why Buffet is hoarding cash.

Market Cap to GDP is a long-term valuation indicator for stocks. Warren Buffett says "it is probably the best single measure of where valuations stand at any given moment."

Just don’t bring up the airlines he sold and then they bounced.

Last edited:

Hee. 3rd week of March I bought back half of some positions in mutual funds I had sold in Jan & Feb and bought a couple stocks (PPL, PRU) that have paid off well.

On the other hand, I blew about 5k on a limit order for Vanguard Total Stock that I screwed up the price bid, about 25% above the market price! Might as well have put the money in a pile and burned it!

(That doesn't mean I'm a wealthy, experienced investor, though.)

On the other hand, I blew about 5k on a limit order for Vanguard Total Stock that I screwed up the price bid, about 25% above the market price! Might as well have put the money in a pile and burned it!

(That doesn't mean I'm a wealthy, experienced investor, though.)

+1. The day I meet a wealthy, experienced investor who says they have not made a lot of mistakes on the way there, well, I probably won’t believe them.

Similar threads

- Replies

- 5

- Views

- 660

- Replies

- 4

- Views

- 435

- Replies

- 69

- Views

- 5K

- Replies

- 13

- Views

- 1K

- Replies

- 19

- Views

- 582