And on the personal investing front:

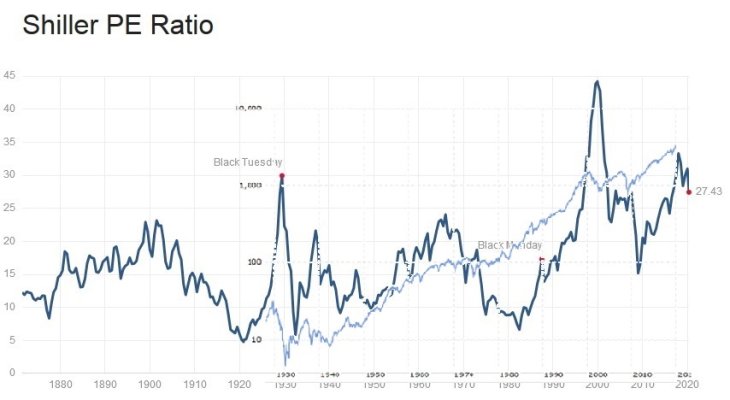

We had another neighborhood street happy hour last Friday. A recently retired corporate lawyer (and very success senior partner) told me he is completely out of the stock market for the first time in his life because of unrealistic forward PE estimates. His firm was in Delaware, so he provided legal advice primarily for companies listed on the NYSE.

Based on his 2008-2009 experience, he said corporate boardrooms in many sectors are likely in the panic mode right now, trying to raise capital in the short term to avoid bankruptcy filings by creditors, while not taking on too much debt and cripple earnings for too many years in the future. Since company executives and board members of publicly traded companies are heavy equity holders they have a personal interest to avoid restructuring under federal bankruptcy laws which can wipe out owners and replace them with the previous bondholders. At the same time, many of these companies have pulled annual earnings estimates because executives have little idea of what the future looks like, and are still trying to plan for different scenarios.

On a side note, he told me never to invest in a Chinese company (not that such risk was on my radar anyway) because they file onto the NYSE through shell companies, don't follow GAAP, and the Sarbanes-Oxley law cannot reach into China and imprison a CEO for cooking the books.

But what the hell does he know anyway?