Freedom56

Thinks s/he gets paid by the post

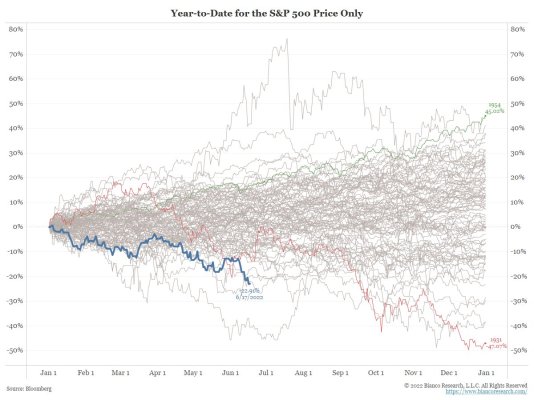

For those waiting to get into the market, continue to wait. 90% of all stocks in the S&P500 have fallen in 5 of the last 7 days. This has never happened before, ever. This is an unprecented amount of selling yet the market has not really even declined. I would think somewhere between 1500 and 2000 on the S&P500 would be a good place to start if you are out. If you are complelled to get in divide the amount of money you want to put in by 730 and put that much in every day for the next two years.

Back in March 2020, I was telling people to buy investment grade preferred stocks after they were battered down to levels where their yields were 9-11% and YTC at 35-40%, you stated that preferred stocks should be avoided until they dropped another 50%. Well that didn't happen and in fact those that bought not only earned 9-11 percent yields plus also 90-110% capital gains. I don't buy equities but barring a nuclear war, the S&P will have pretty strong support at the 2900 and then 2400 levels where the trailing PE multiples will be in line with bear markets of the past.